When a fintech lists on a stock exchange early in its life, it’s the first public look under the bonnet. Startup business owners face a timing dilemma. If they list early, they can cash in on their efforts, selling equity or raising their salaries for working in a listed company. But they forsake the potential for greater gains if the business is more successful at a later listing.

For example, the wealth platform provider, netwealth (ASX:NWL), was a recent highly-successful listing, but it was founded in 1999, spending nearly two decades developing and investing in its technology. In selling only 30% of its shares, prior owners retain upside which the market has already delivered. Another success story is Canva, still privately owned despite a recent off-market capital raising giving it a value over $1 billion. The owners have not yet been tempted by the big payday.

Let’s examine the former Acorns Australia, rebadged as Raiz Invest, that listed on the ASX (under the code RZI) on 21 June 2018 after adopting the US idea and technology for Acorns from the US as recently as 2015. The listing price was $1.80 and at time of writing, the share price is $1.00 on low volume despite the initial offer being oversubscribed. It shows that valuing startups is little more than a coin toss.

This review looks at Raiz in two ways: an investment platform and a company to invest in.

What does Raiz do?

Raiz calls itself a ‘micro investing platform’ rather than a ‘roboadvisor’. The original Acorns had the clever idea of encouraging people to “Invest spare change automatically from everyday purchases into a diversified portfolio.” It targeted younger people with a smart app, allowing rounding-up of small purchases such as putting 50 cents into the account each time a $3.50 coffee is purchased. The small transactions grow into an investment portfolio over time based on dollar cost averaging.

These amounts are called ‘Round-Ups’ but it also offers ‘Recurring’ (a regular savings or investment plan) and ‘Lump Sum’ options. The money is invested into one of six diversified portfolios of Exchange Traded Funds (ETFs) selected by the customer.

Raiz is not a fund manager, as it focusses more on the utility of its app. Its costs are more driven by the five or six direct debits a month on average for each customer with full financial reporting rather than funds management expenses. This automation of savings in the ‘background of life’ is its claim to fame.

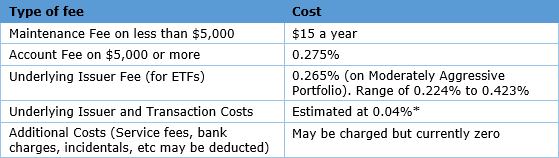

What is the cost of investing with Raiz?

There are many online investing platforms, but unlike in the US market where fees are as low as 0.15% (plus cheap ETFs), Australian offers generally compete on marketing and convenience features rather than cost. The leading funds from institutional competitors are often cheaper.

Our study of Spaceship compared it with the HostPlus Balanced Indexed Fund, with the large institution significantly cheaper despite the popular disruption image of fintechs.

How does Raiz stack up on cost?

Source: Raiz Product Disclosure Statement, updated 10 April 2018. *Raiz has the right to charge higher transaction costs. Fees are per annum. Raiz applies a buy/sell spread “equal to or less than the smaller of the market bid/offer spread or 0.5%”.

The cost of investing with Raiz depends on the client balance and fund selected, and Raiz provided these estimates in its Prospectus (including the cost of the underlying ETFs):

- On $1,000, in Aggressive Portfolio, 1.827% p.a.

- On $50,000 or more, in Aggressive Portfolio, (0.275%+0.287%+0.04%), 0.602% p.a.

On low balances, the $1.25 a month fee ($15 a year) is obviously a large percentage, making up 1.5% on $1,000. With a minimum investment of only $5, Raiz is allowing entry at all levels, but no platform is worth using for tiny amounts.

In its Prospectus, Raiz advised that it earns 9% of its revenue from charging the buy/sell spread when there is no need to trade on netted transactions. However, all competitors have varying bid/offer spreads so a fair comparison should consider these costs. Most managed funds pay them into the fund rather than into the revenue of the company.

Comparison with alternatives

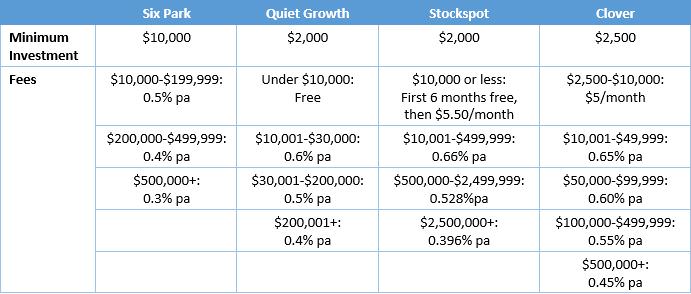

1. Online digital investment platforms. There are many roboadvice offers now in Australia, although the ‘advice’ part is little more than a few questions about age, risk appetite and financial resources. Portfolios are selected based on the responses, but it barely qualifies as financial advice. For example, many younger investors should be paying off credit card debt. It is better described as ‘digital investing’.

The cost of roboadvice from Stockspot, Clover, Six Park and Quiet Growth varies depending on balances and portfolio. Spaceship recently launched a cheaper non-super option. Taking a comparison point of $50,000, and including 0.25% for the cost of ETFs for the four others, the cost would be (see fee table below):

- Raiz Invest (as above): 0.602% pa

- Six Park: 0.75% pa

- Quiet Growth: 0.75% pa + GST

- Stockspot: 0.91% pa

- Clover: 0.85% pa + GST

Notes: Fees exclude the cost of the ETFs, usually around 0.25%. Brokerage on ETFs is usually covered by fees but bid/offer spreads are charged. Clover and Quiet Growth fees exclude GST.

2. Industry funds (only relevant to superannuation). The cheapest with a management fee of 0.02% pa is the HostPlus Balanced Index Fund, but there are fixed fees of $78 a year. Many other industry funds have balanced options with active management and full functionality including call centres and general advice for around 0.6% pa. The additional weekly administration fee of around $1.50 or annual cost of $78 is material for small balances.

3. Retail managed funds and platforms. Again, there are significant variations depending on fund and balance, but a favourable factor is the lack of fixed fees. For example, the non-super FirstChoice Wholesale platform from Colonial First State offers balanced funds for as low as 0.65% pa with no additional administration fee and a minimum account balance of $1,000.

4. Direct investing. The cheapest equity ETF in Australia is the BetaShares Australia 200 ETF with a management cost of 0.07% pa. For a comparison with diversified portfolios such the Raiz range, Vanguard has a range of ETFs from Conservative to High Growth allocations for 0.27% pa. As these ETFs are listed on the ASX, investment also requires the payment of brokerage and the bid/offer spread.

Asset allocation

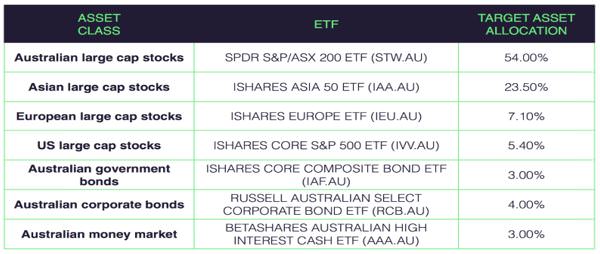

The underlying ETFs used by Raiz are listed on the ASX and weighting depends on the type of portfolio. The ASX codes for the ETFs are STW, IAA, IEU, IVV, RARI, ETHI, IAF, RCB and AAA. For example, the Target Asset Allocation for the Aggressive Portfolio is:

Over half the portfolio is invested in Australian large caps, an index dominated by banks, BHP, Rio, Telstra and the two big grocers. Surprisingly given the strength of the US market and home domicile of many major tech companies, the US large cap weighting is only 5.4% while Asia is 23.5% and Europe 7.1%, with total offshore allocation of 36%.

In the Conservative Portfolio, 30% goes into Australian government bonds, 23% corporate bonds and 24.5% cash. That’s 77.5% into low-yielding fixed interest, which might not be an appropriate portfolio for the young investors targeted by the marketing.

What about Raiz as a business?

Let’s switch from Raiz as a ‘spare change’ investment platform to the Raiz business itself.

Nearly every startup business like Raiz has a common characteristic. It’s not possible to value them using a normal discounted cash flow model, because there’s no profit. The first requirement is simply to buy into the dream. These businesses invariably lose money in their early stages (or for many years as in the case of Amazon, Tesla and Uber). It’s anyone’s educated guess how much the business is worth depending on assessment of potential.

Here is some background on the business side:

- Raiz listed on the ASX on 21 June 2018 based on a Prospectus lodged with ASIC on 9 May 2018. It raised $15.1 million valuing the company at $119 million at a listing price of $1.80. It issued a business update on listing which showed 160,000 active accounts with funds under management of $200 million. For a young mobile micro investing platform launched in 2016, this is a strong result, the best market penetration in Australia for this segment. There are 66.2 million shares on issue (and 6.4 million share options, mainly held by management), and at the latest price of $1, the market value is down to 44% since listing.

- The average customer balance is only $1,234, a level where the fixed fees translate into high percentage costs (as shown above, 1.827% on $1,000). In fact, although $1.25 a month does not sound like much, Raiz makes most of this revenue from this Maintenance Fee.

- 70% of customers are aged 18-35, the millennial segment, 87% are 18-44 and 63% are male.

- In FY2017, the Company had ‘Receipts from customers’ of $990,000 and ‘Payments to suppliers and employees’ of over $3 million. The net loss was $2.4 million and it expects to make a net loss of about $2 million in FY2018.

- The Chief Executive Officer and Managing Director is George Lucas. At the completion of the float, he owned 9.89% of the company or 6.5 million shares valued at $11.7 million (locked up for two years from listing). He received a one-off cash bonus from the float proceeds of $1 million (and a further $1 million was paid to other key employees). Mr Lucas’s base salary will be $500,000 plus 9.5% superannuation with bonus potential up to 100% of base salary. He also holds 1 million options exercisable at $1.80.

In my opinion, this is not overly excessive for the achievements to date in the wealth management industry. It’s not easy to establish a business and burn through millions of dollars a year before leading a float. Many will feel $1 million plus $11.7 million of shares is rich for three years of work, but the value of the shares is already down by a paper $5 million and the share price could be much less (or much more) in two years.

- The other uses of the $15 million float proceeds besides the $2 million for staff were:

- $4 million for ‘regulatory requirements’

- $5 million for international expansion

- $2 million for advertising and rebranding (from Acorns)

- $2 million for working capital and offer costs of $1.45 million.

Where does revenue come from?

There were four main areas of revenue at the time of the Prospectus:

71% of revenue: the $1.25 Maintenance Fee, which is highly dependent on number of small, active accounts.

8% of revenue: the 0.275% Account Fee, expected to become first as balances rise.

9% of revenue: netting revenue from the buy/sell spread on ETFs. The spread is collected even when no brokerage is paid because transactions are netted.

12% of revenue: targeted advertising and ‘Raiz Rewards’ through smartphones or emails.

The advertising revenue and the Raiz Rewards scheme is a major difference to roboadvice offers, as anyone who has registered with Raiz will know. They plan to “leverage our data to improve personalisation and relevance of the adverts or new products”. This feature might appeal to the younger audience but many less tolerant baby boomers will want to switch off the product promotions arriving regularly into the inbox.

Robustness and technology

An often-unstated aspect of saving with a startup is that if the venture is not successful, or it pivots to another activity, it may be closed with the money returned to clients. While the savings may not be lost (assets are usually held by a custodian), it may trigger a ‘tax event’ such as a capital gains tax liability at an unwanted time. Two roboadvice businesses which have closed in the last year include OwnersAdvisory and BigFuture, and more will follow.

Raiz has generated sufficient funds and users to give confidence of its sustainability, and without going into detail on the robustness and security of its technology, here is where it is sourced:

“Raiz Invest Australia now holds an exclusive, perpetual and irrevocable right and licence (granted by Acorns US) to use and further develop the Raiz technology platform originally provided by Acorns US. The original software includes the whole software stack from the front end applications that run on smartphones and web browsers to the backend software that runs the registry, administration, operations and funds management features.” (from the Raiz Prospectus).

Conclusions on investing in the company and saving on the platform

As an investment valued and underwritten by market experts (the Lead Manager and Underwriter was Bell Potter) only a few weeks ago at $1.80, it’s now 44% cheaper at $1. It was oversubscribed (a friend asked for $50,000 and was allocated $8,000) suggesting the support was more a stag than genuine long-term investing. CEO George Lucas has bought 90,000 shares at prices between $1.25 and $1.39 since the listing.

The business has an impressive 160,000 active users and 470,000 signups, and a high profile in the market. It is expanding into superannuation and Asia.

I make no attempt to value a company like this. A move into profit depends on higher balances and fees from investors, and rollout of the advertising model. I am not in the target market and have no interest in investing 50 cents each time I buy a coffee, nor do I want my bank account filled with tiny debits to engage me better. But that’s irrelevant for this company. At this stage, it’s worth what anyone will pay for it based on an assessment of the potential to increase its four sources of revenue.

What about the platform?

Raiz is a good way to introduce novice investors to regular savings, compounding, market fluctuations and education on investing. It has a user-friendly app with features that show how balances may change based on different market exposures and savings. It’s not suitable for a person who starts with $100 and does not top up, as the $15 annual fee will erode the balance. It allows smaller balances than most roboadvisors and the $15 is reasonable provided the full functionality is used. It’s a competitive product for someone with say $5,000 to $10,000 using the ‘round up’ feature to build a small portfolio at a cost around 0.6%.

While the asset allocation will not matter much for small portfolios, investors with large balances should be satisfied with the ETFs chosen for equity and bond exposures. The Aggressive Portfolio is heavily weighted to large Australian companies and non-US global, and the Conservative Portfolio will deliver a low yield. The portfolios are not offering an asset allocation I would choose but every investor is different.

The market positioning is as a micro investing platform rather than a place where substantial amounts are invested, although it has launched a superannuation version. Investors can replicate a portfolio for the cost of the ETFs, with suitable allowance for the brokerage cost. Buying ETFs direct would not be cost efficient for small amounts (minimum market brokerage of $10 is 1% on $1,000) but worth considering for trades of say $10,000 or more. It’s likely that many of Raiz’s customers are not comfortable transacting with a broker and may not even know what an ETF is. For significantly larger balances, a direct holding of ETFs would be cheaper. However, Raiz is a platform with features like tax reporting which a simple broking account might not provide.

Looking longer term, two thoughts dominate. On the plus side, the innovative idea appeals to a large audience (although not a wealthy one) at a competitive customer cost. While the barriers to entry are low, it is not easy to create the market profile that Acorns and now Raiz has achieved. On the negative side, there are many competitive threats, such as ETF providers starting brokerage-free platforms as they have in the US, making direct access to ETFs a compelling alternative.

Graham Hand is Managing Editor of Cuffelinks and has no business relationship with Raiz and holds no shares in RZI. This article is based on information believed to be accurate but no warranty is provided, and it does not consider the circumstances of any person. If any of my calculations or facts are incorrect, please advise me ([email protected]) and I will update the article.