Yeh, no, yeh. Like, you know, whatever. Bro, that other super was so last year. OMG, check out the shop @SpaceshipAU. #theseguysarecool #supertechnology #newinvesting.

Anyone who follows superannuation must be living in outer space not to have heard about Spaceship. It is superannuation for millennials, or ‘our generation’, with technology investments at its core. It aspires to become the Amazon of super, offering lower prices as it redesigns an entire industry. It is ‘Australia’s fastest growing startup’ and winner of the Best Startup at the #FinTechAwards 2017. And the difference between Spaceship and the incumbents is “the amount of thought given to the details”.

Spaceship recently said it had almost reached $100 million under management, an incredible amount for a startup. On 1 June 2017, The Australian Financial Review reported that the value of Spaceship based on a $19.5 million issue of convertible notes was $70 million, backed by a who’s who of local and international venture capitalists. Over 20,000 people have registered with them.

At the risk of being the old fart rather than a blast from a rocket ship, this baby boomer’s analysis of Spaceship will be as objective and dispassionate as possible. But passion, enthusiasm and marketing are at Spaceship’s core, and it is difficult not to have personal biases.

I admit I had no idea who Ariana Grande was until a nutter walked into her Manchester concert, I can barely sit in the same room when MasterChef or The Voice are on television, I do not wear my underpants down below my bum crack and I prefer test cricket to Twenty20.

But I run an online business, I invest in fintech companies, I smash my avocado, I visit fintech hubs like Stone & Chalk, I attend fintech pitches, my new iPhone is amazing and I expect to live forever. I love much of the techie stuff.

So here are the boring details of the Spaceship #assetallocation, #stockselection and #feesandexpenses and then we will uncover the secret sauce, the #customerexperience.

#assetallocation

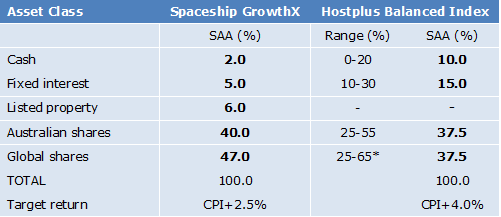

Spaceship offers one investment option, called GrowthX, with investments “where the world is going, not where it’s been”. Spaceship’s asset allocation is compared below with an industry super fund, Hostplus Balanced Index. Although it has a typical strategic asset allocation (SAA), this fund is chosen because both funds use index exposure and this Hostplus fund has the lowest public offer superannuation fund fees in Australia (as far as I am aware). Such incumbent funds are the ones from which Spaceship needs to grab clients. Cuffelinks has no arrangements with either fund.

Spaceship GrowthX v Hostplus Balanced Index Fund, Strategic Asset Allocation

Source: Spaceship and Hostplus Product Disclosure Statements, 2017.

*Range is 25% to 55% plus 0% to 10% in emerging markets.

What conclusions can be drawn?

- Spaceship has a larger allocation to global shares to accommodate its technology focus, but in the breakdown of its portfolio (see below), the technology allocation in the overall portfolio is 34%. For a fund which pitches its technology emphasis, a one-third allocation is barely true to label, although it is overweight compared with most balanced funds. With 40% in Australian shares, Spaceship will have a decent exposure to the old-world shares like banks, mining companies and retailers.

- Both target returns are after fees, and despite the claim of a growth focus, Spaceship’s return target is a modest CPI+2.5%. As we will see later, Spaceship is more expensive so it has a significant performance drag to overcome.

- Even a balanced fund like this from Hostplus has a 75% growth allocation, and in theory could have as little as 10% in defensive, although this is unlikely.

Many in Spaceship’s target market are already working in the technology industry. Some advisers would argue their superannuation should be a hedge against the loss of a job or decline in value of the equity in their own company or employer.

#stockselection

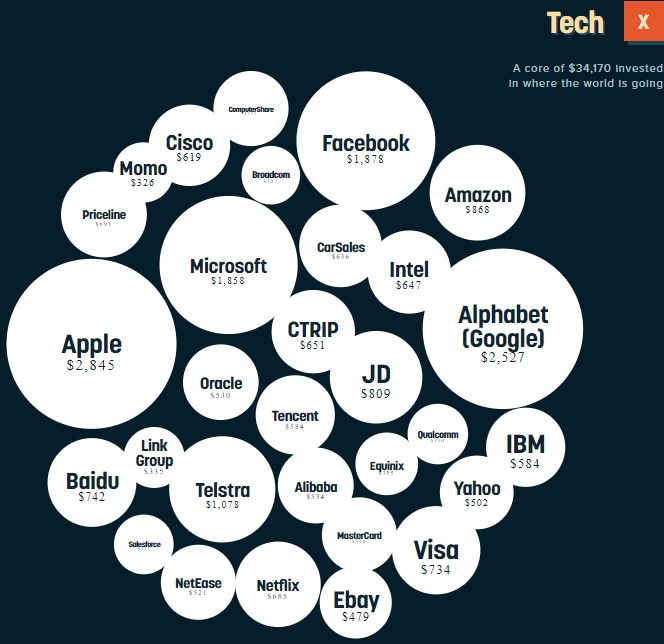

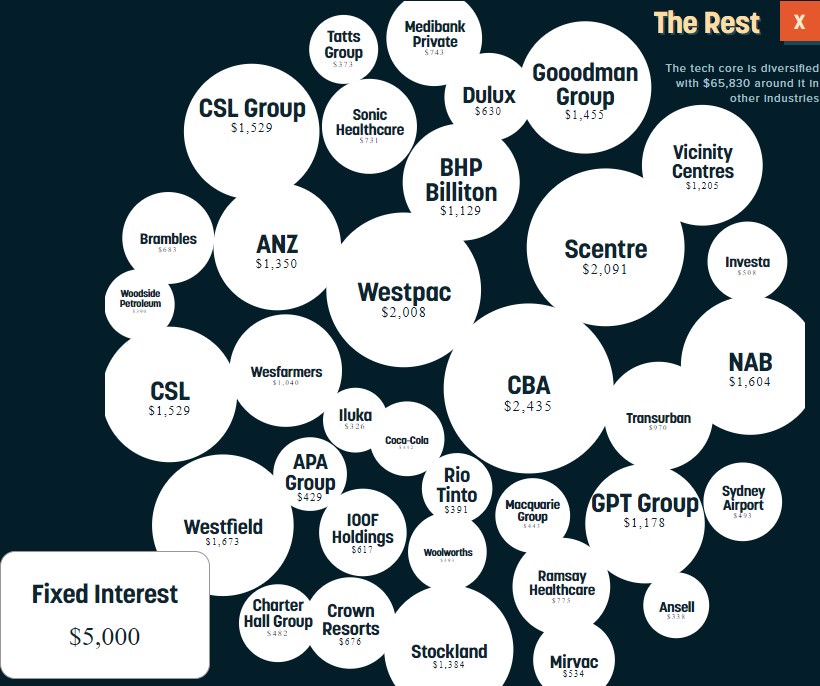

The diagrams below show how $100,000 placed with Spaceship is invested, company by company. “Know exactly what you own,” the website says. Spaceship prides itself on investing transparently.

Why is it crazy to send it to someone, somewhere. Isn’t Spaceship someone, somewhere?

Source: Spaceship website. Representative portfolio as at 21 April 2017.

On the Spaceship website, under the ‘Info’ tab, there is a page headed, ‘Investment Portfolio’. It says: “We believe you should know where your Super is invested. It’s time to start becoming more informed about your Super.”

Take a closer look at the portfolio, and three questions surface:

First, does the Australian portfolio ('The Rest') look familiar? The big banks, the large property groups, BHP, Rio, CSL, Wesfarmers. Are the allocations the Australian S&P/ASX300 index weights?

Second, the investments in the diagrams add up to about $60,000, meaning $40,000 is invested in other companies. What else is in the portfolio?

Third, if they are managing a small portfolio and disclosing the stocks, as implied by the diagram, who is doing the stock selection and how are they managing the implementation costs on many small holdings?

Answer: there is no stock selection. Spaceship is investing in index funds or ETFs. As far as I can see, the website and the PDS fail to mention this.

How is the index exposure achieved? In a document called the Reference Guide, there is this:

“The exposure will be obtained through a mix of index funds and exchange-traded funds (ETFs) (directly or through a Depository Interest) which seek to replicate, as closely as possible, the price and yield performance of a reference index in different ways.”

And then under a list of risks, is this:

“Swap counterparty risk: the risk that the counterparty to the True Index swap may not be able to pay for the potential underperformance (i.e. short-fall) between index performance and net asset value of a fund.”

True Index is a product of Macquarie Bank, used by many other wholesale and retail investors and an explanation of the fund is linked here. There is swap risk to a counterparty, Macquarie Financial Holdings Pty Limited. There is not enough space here to reproduce the relevant terms of the PDS, except this on Termination Risk:

“If True Indexing ceases, investors will no longer receive the Index return and may also be required to pay higher management fees.”

Investors then become “exposed to the risk of the underlying investments”. On the ‘underlying investments’, Macquarie says True Indexing seeks to achieve index returns by investing in shares and derivatives (including options, futures, warrants and forwards). There is nothing inappropriate about this way of constructing an index, but it's different to most other index funds. On a direct investment with Macquarie in the Macquarie True Index Linked Australian Share Fund, the management fee is 0.103%, with no administration fee, exit fee or other expenses.

Index funds and ETFs have experienced massive growth in recent years, but that is overwhelmingly due to the low cost, and not all index funds and ETFs are the same. While Spaceship mentions the True Index funds, there is no detail on the exact funds used and the ETFs, and True Index does not cover all sectors.

So I rang Spaceship to find out which index funds are used. I was told that information was not available to the public. When I said that does not meet the ‘transparency' and ‘know what you own’ beliefs espoused by Spaceship, I was told, “If people knew the funds, they could invest directly in them.”

I was told to put my request in writing, which I did, asking exactly which funds and ETFs are used and who issues them. I am still waiting for a reply.

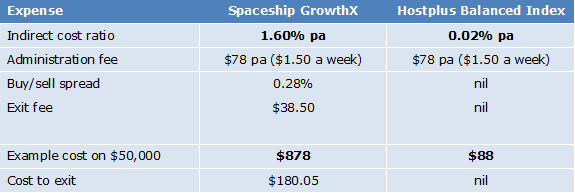

#feesandexpenses

There are two ways a disrupter can steal significant market share from incumbents in superannuation: cost and customer experience. The performance undertaking is nothing more than an aspiration that will only play out over a long-term cycle, perhaps 10 years or more.

Spaceship GrowthX v Hostplus Balanced Index Fund, fees and expenses

Source: Spaceship and Hostplus Product Disclosure Statements, 2017.

Where is the Amazon of super? At this point the rubber fails to hit the road, or in the case of Spaceship, the rocket stalls. It is very expensive, with multiple fee levels. It is aimed at millennials with little in super, but the fixed cost of $78 on $10,000 is 0.78% pa. Are their clients checking the overall costs versus the fees on the funds they are leaving?

While the cost implications of the fixed fee are similar for many super funds, including Hostplus, there are other funds with no fixed administration fees. For example, Colonial First State offers balanced funds for as low as 0.65% with no additional administration fee and a minimum investment of $1,500.

(For an example of a tool which compares fees across a range of retail and industry funds, and explains the fees, see Virgin Money’s comparison page).

Quoting from the Spaceship PDS, page 3:

“For example, total annual fees and costs of 2% of your fund balance, rather than 1%, could reduce your final return by up to 20% over a 30-year period (for example, reduce it from $100,000 to $80,000).”

Exactly. And the difference in fees on Spaceship compared with competitors is more than 1%. Putting aside buy/sell spreads and ignoring exit fees, a young person with $10,000 in Spaceship would have an annual fee of 1.6% plus 0.78%, or 2.58% pa.

If this were my millennial daughter making an investment, I would tell her to wait until they do something with their fee structure, even if it is an amazing customer experience.

So what is the customer experience?

#customerexperience (or as the techies say, CX)

A successful disrupter or tech company does not need to be cheaper than others to be successful. The iPhone is expensive but it is such a great device supported by the best ecosystem that people queue overnight to buy it. The first CX with a new iPhone is amazing. It becomes the centre of our lives, the first and last thing we check every day. Same with Tesla. Not cheap, but great CX.

But this is superannuation, yawn. You cannot touch it until you are older than Granny. Most people want a house, house, house before they care about super. Even if they think they can never afford a home in Sydney, they will not want to save where they cannot touch the money until 40 years hence. Life is about experiences, holidays, gap years and yes, smashed avocado.

Wait, that is old thinking. Nobody has succeeded in engaging young people with super due to these baby boomer beliefs. And that is the very point of Spaceship’s success. They have redefined CX in super and thousands are flocking to them.

The online application process is pared back to the minimum required and is relatively easy, although identification based on the tax file number has become reasonably common in the industry, with no ‘wet signature’ required. There is disagreement in wealth management about whether this is sufficient identification and compliance, but Spaceship has taken a user-friendly rather than legalistic approach.

The process then finds the applicant’s existing super, giving a choice from which fund to transfer money. There appears to be no way to make a new contribution as it only allows for rollover. Then this box appears:

I found this confusing. If every transaction is a rollover, there should be only two choices: roll over the entire balance, or roll over a portion of the balance.

Soon after application, an email arrives with the subject, ‘Spaceship: Forward to Your Employer’. The content says,

“Attached is your Employer Superannuation Guarantee Contributions form. Your employer needs this to make contributions to your Spaceship Super account. You can forward this email directly to your employer.”

Anyone who applies to invest into Spaceship is asked to instruct their employer to direct all future SGC payments to Spaceship. It is likely that many of Spaceship’s young clients are coming from default options at industry funds, and these are usually cheaper, with an average ICR across the industry of about 0.6%. How many investors know they will add at least 1% to their investment cost, which as Spaceship says in its own PDS, could result in 20% less over 30 years? And Spaceship does not currently offer life insurance, which the customer may be leaving behind (although Spaceship warns about this).

The Welcome Letter makes its target market clear: “You probably won't be retiring for decades and your portfolio should reflect that.” Stay away, boomer.

What about their other communications, such as their regular newsletters? There is good engagement material about winning awards, drink sessions to meet other clients and speakers at breakfast events. This regular email is more frequent than from other super funds.

But what insights do they give into how to manage superannuation? How is this from the CEO of Spaceship on 23 June 2017:

“Regulatory update: The Government will introduce a $500,000 lifetime cap for non-concessional contributions. The lifetime cap will limit the extent to which the superannuation system can be used for tax minimisation and estate planning.”

This update was given at a critical time, one week before the end of the financial year, when many people were planning last-minute contributions. It is incorrect. This proposal in the 2016 Budget was replaced by the $1.6 million Transfer Balance Cap and Total Superannuation Balance. Big difference, and a major reform change. Superannuation rules are complex and most people struggle to recall the detail but this was a significant oversight. I immediately wrote to Spaceship advising of the error, and as far as I know, no correction has been issued.

(Update: subsequent to the publication of this article, Spaceship issued a correction in its weekly email).

Other Spaceship communications contain spelling errors that I could nit-pick about, but there’s something else that matters far more ...

What about a transaction and performance report?

Assume you were designing a new super fund from the ground up. An essential requirement from the start should be to show the client how their fund is performing and what transactions have been made. Surely every super fund should provide details of investments, fees, withdrawals, unit prices and fund performance in an online statement.

In the personal dashboard for its users, after the login page, Spaceship provides an ‘approximate account balance’. There is no list of transactions or unit prices. The client does not know the impact of fees or market movements on the balance. When asked about this basic transaction feature, Spaceship responded by email:

“This is not currently a feature of the web portal. We're working on adding it in, in the future. If you like I can send you an account statement that will show the net gain/loss of your portfolio since it has been in Spaceship?”

A copy of a piece of paper? Didn’t expect that on a spaceship.

A friend opened an account with Spaceship in February 2017 but did not fund it until May 2017 with $100 to test the experience. His current balance is $72 as Spaceship backdated the weekly fee to February.

Why Spaceship is popular with millennials

The success of Spaceship is not about anything described above: not the fees, the product, the asset allocation or the customer experience. It is the marketing.

Spaceship is backed by one of Atlassian’s founders, Mike Cannon-Brookes, and other high-profile executives in technology companies. Cannon-Brookes is arguably Australia’s most successful fintech entrepreneur, which makes him a huge influencer. His success draws a crowd. His @mcannonbrookes Twitter account has made 8,000 tweets to 22,000 followers. Thousands of people listen when he writes about and praises a product. They forward and like the Facebook posts and spread the word quickly among like-minded people.

The CEO of Spaceship, Paul Bennetts, is a successful fintech entrepreneur and an Advisor to Daniel Petre’s Airtree, a leading Australian venture capital company with holdings in successes such as Canva and Prospa. Clearly, Paul knows his way around social media and marketing in a VC world.

Spaceship hosts events, creates a community, shares trendy content on its blog called ‘The Dish’ and does engagement with younger people better than incumbents. It talks their language to drive lead generation.

Speaking to two millennials who work in investment management demonstrated why Spaceship has attracted so much attention. One said that judging from her Facebook feed, it would be easy to think that Spaceship is the only super fund available. Incredible! The other told me she was bombarded with Facebook ads for Spaceship, and her friends regularly forward articles to her.

A third millennial told me, “I was a little disappointed that what feels like a young team didn't make sustainability of investments (contended a concept though it may be) a priority.” That's because they use broad indexes, they do not select stocks.

What do other market professionals say?

Spaceship has received more publicity than any other superannuation, roboadvice or digital advice fintech, and let us focus on three commentators.

Michael Rice of actuarial firm Rice Warner told The Australian Financial Review:

"It doesn't sound like a good proposition to me. Spaceship appears to be charging more and taking on more risk with a lower objective of projected returns than a MySuper product.” He later added in a more general context: “The fee levels on many of these products are outrageous. We don't need greater control but we do need some rules to stop poor value products being marketed to gullible people."

Jordan Eliseo, Chief Economist at ABC Bullion, jumped to Spaceship’s defence, writing in The Australian: “That comment regarding the gullibility of young Australians is almost offensive.”

But not all the millennials are convinced. Chris Brycki of Stockspot told Business Insider:

“They get full marks for the use of flashy marketing and celebrity endorsers to distract people from the underlying financial product being sold. Look under the covers and you won’t find a tested process behind their investment strategy (to buy tech stocks), and no track record to support their high fees. Just clever marketing.”

Will Spaceship succeed financially over the long term?

I meet regularly with fintech startups and attend pitch fests, and there are some great ideas in with the rubbish. Most of them will not survive long enough to become commercial, and they hope a large business will buy them before the money runs out. Check the ASIC registers of many startups, and they show regular rounds of funding as costs exceed revenues. Many are a punt on a dream or solving a problem that does not exist. Forbes Magazine claims 90% of startups fail, but clearly, there are spectacular successes among the survivors.

I do not know whether Spaceship will be a winner, beyond the success they have already achieved. I am not in their target market, but I cannot see serious disruption in this model.

In my view, the current offer is not strong enough to match the competition. It is expensive, and despite the impressive design backgrounds of their staff, the sign-up process and communications are not engaging or exciting. There are unexpected shortcomings. They are not transparent about their investments, refusing to reveal in which index funds and ETFs they invest. It is hard to believe there is no online report of transactions, fees charged or unit prices.

Spaceship illustrates a common startup Catch-22. They do not have the critical mass of say a billion dollars which allows competitive pricing, and the fees will restrict the build-up of the critical mass.

The other factor is whether their returns will justify the costs. This article is not the place for a full analysis of the potential of technology stocks, but the NASDAQ index of technology stocks has already had a great run in recent years. The index has fallen about 5% in the last month at the time when many Spaceship clients have been onboarding.

NASDAQ index from 1985 to 4 July 2017

Source: Yahoo Finance

If millennials are checking their balances regularly, they will be impatient and will be expecting success. There are many wonderful technology companies, but consider this analysis of the so-called FANMAG (Facebook, Apple, Netflix, Microsoft, Amazon, Google) stocks from the US firm that originated the smart beta concept, Research Affiliates:

“Consider the FANMAG stocks. Based on a few common metrics, this group collectively exhibits steep valuations. On a weighted-average basis, the group currently trades at a price-to-earnings multiple of 56 times, more than twice that of the S&P 500. In aggregate, the six are currently trading at a price-to-sales multiple of 6.9 times, a 67% premium to the market. Finally, with all but two generating no dividends, the group is now delivering a weighted dividend yield of 0.85%, 56% lower than the S&P 500. Are these lofty valuations justifiable? That is, can we expect popular expensive stocks to reliably deliver excess returns in the long run?

A look at the historical evidence over the last 60 years suggests poor odds of the popular pricey stocks outperforming in the long run, even if they are shares of large, growing, and profitable companies.”

There is no doubt the FANMAGs are great companies, and they have driven US equity markets to all-time highs. Anyone who wants to invest in an index or smart beta fund that is dominated by these companies can use an ASX-listed technology ETF for a fraction of the cost, such as NDQ (issued by BetaShares, management fee 0.48%) or TECH (issued by ETFS, management fee 0.45%).

This will not be the first or last battle in an intergenerational, intergalactic war for superannuation, with millennial rivals like Zuper and Grow Super on the horizon. This rebel Spaceship aspires to become the (New) Emperor, but it has stalled on the launch pad. It will need to improve its offer significantly and the most likely outcome is The (Old) Empire Strikes Back.

Footnote added 24 August 2017

The Australian newspaper reported this week:

"Millennial superannuation fund Spaceship has removed all references to Atlassian CEO Mike Cannon-Brookes from its marketing, as two of its co-founders were reportedly pushed out of the venture. The Australian understands the tech-focused super fund, which had used Atlassian co-founder and one of Australia’s wealthiest entrepreneurs Mike Cannon-Brookes heavily in its social media and website marketing, was asked to remove his image.

Spaceship’s website previously featured quotes from Mr Cannon-Brookes and splashed his face across advertising on Facebook and Twitter, imploring millennials to “invest your super where Mike Cannon-Brookes invests his super”. Spaceship has since rebranded its marketing to remove all references to Mr Cannon-Brookes."

Footnote added 5 October 2017

Spaceship announced on 2 October 2017 changes to its product pricing and asset allocation. The fees on GrowthX will lower from 1.60% to 0.99%, and the allocation to technology stocks will increase from 34% to 50%.

Graham Hand is Managing Editor of Cuffelinks. If any company mentioned in this article, including Spaceship, wishes to correct or comment on any matter, Cuffelinks will publish the response.