In the spirit of recognising the many different ways in which you can pick stocks, I wrote an article two years ago about using a basic momentum strategy. I will update this article annually (last year’s is here). The premise is as follows: academic researchers found that the portfolios of recent stock market outperformers subsequently outperformed portfolios of recent underperformers. A long/short equity strategy constructed this way should generate a positive return. We applied this theory to the Australian marketplace and found a volatile but high-performing strategy. So how did it perform in the past financial year?

2015-16 performance

A brief refresher on the strategy, noting it is paper-based and theoretical:

- At the start of each financial year I go long an equally weighted portfolio of the previous financial year’s top 10 performing stocks on the ASX 200

- I also short an equally weighted portfolio of the previous financial year’s worst 10 performing stocks on the ASX 200

- I hold this portfolio for the subsequent financial year (12 months).

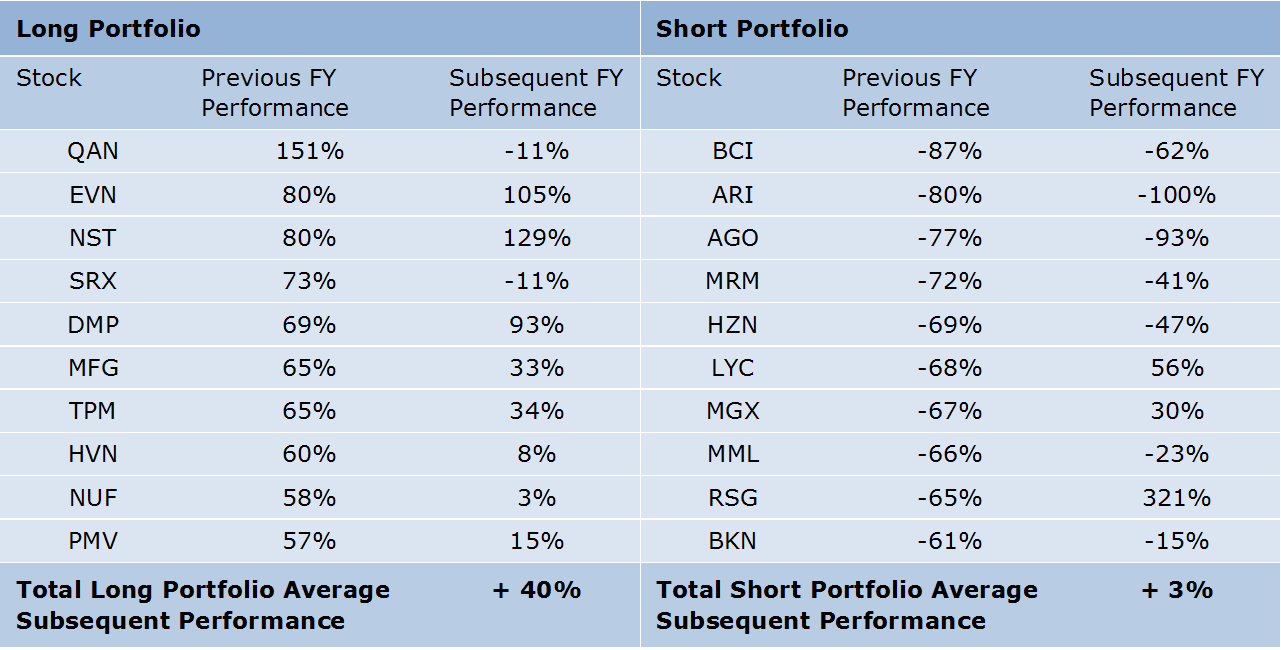

The table below lists stocks I would have held, long and short, purchased from the end of the 2014/15 financial year. It is based on their performance over the past 12 months, along with their subsequent performance.

If I subtract my short performance (+3%) from my long performance (+40%), I have a total paper portfolio performance of 37%. However, it would definitely have been a rollercoaster year if you closely followed each stock (imagine being short RSG as it rallied 321%).

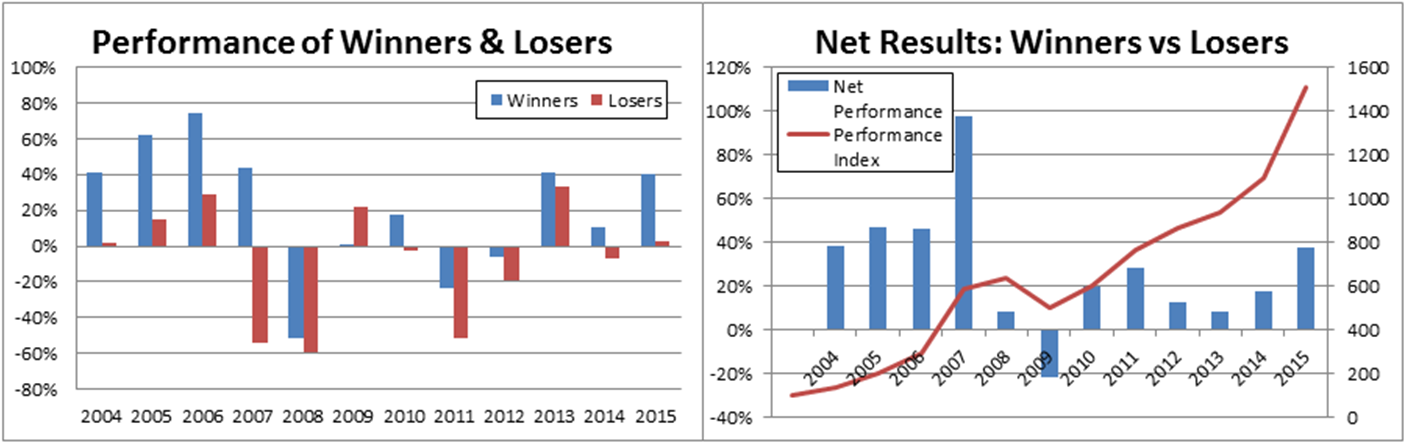

The past financial year was good for this strategy, above its long-term average. The chart below presents the updated track record (now 12 years).

Source: Thanks to Acadian Asset Management (Australia) for the data.

The performance numbers above only focus on the active return piece and leave out cash returns, stock borrowing fees and transaction costs (in theory, if I am long and short the same dollar amount of stocks I have 100% of my portfolio size earning cash returns). Stock borrow fees can be high for stocks that have performed poorly and this would dilute the strategy’s returns.

This article annoys some people

Each year I write this article, it seems to annoy people. The comment below is typical:

“Looking at any strategy without considering its actual cost and the ability to implement suggests to the reader that there are larger gains to be made than would exist in practice. Could all of the stocks actually have been borrowed, and what was the cost of borrow? Would any of the (very large) individual short positions (or even the entire short portfolio) pose a problem during a counter-trend short covering rally?” – Jerome Lander

This has always been a paper portfolio and never recommended as an investment strategy. It originates from academia and historically academics have failed to incorporate transactional expenses (though this is changing). And yes, the strategy relies on you not looking at your portfolio during the year because the ride is volatile.

So what’s the point?

The article illustrates a behavioural bias that exists in financial markets. Cuffelinks often has references to behavioural biases but rarely are these biases presented in a worked example that leaves you scratching your head and asking, ‘Is this possible?’. If markets were perfectly efficient, then simple rules-based strategies like holding past winners and selling short past losers would not generate outperformance.

Additionally, this article is an annual reminder that there are many different ways to pick stocks. Some are based on company analysis, some are technical, and some are behavioural. You need to pick the approaches you believe you can execute well, understand the strengths and weaknesses of your approach, and the environments where it will work. Cuffelinks publishes many articles on fundamental investing but less on technical approaches which account for behavioural biases.

Finally, it is relevant to reflect on what biases may be embedded in your own investment strategy. When I reflect on the winners versus losers anomaly, I find myself wondering if I am not open enough to the possibility that stocks and markets can experience a significant event that leads to consecutive years of outsized performance (positive or negative). If I have a mindset that I have missed this opportunity or that everything will bounce back (mean revert) then I have potentially hard-wired myself to not being open to important developments at a company, sector or market level which may have longer-lasting effects. I might feel I have missed an investment opportunity because it has already had a run, when in fact it may still have significant further upside.

You can have the best valuation model but if it is not populated with well-considered, unbiased inputs then it may not be successful.

David Bell is Chief Investment Officer at Mine Wealth and Wellbeing. He is also working towards a PhD at University of NSW. This article is general information and does not consider the circumstances of any individual.