[Consultancy EY has released its 2023 Global Wealth Management Research Report. It surveyed over 2,600 wealth management clients in 27 countries.]

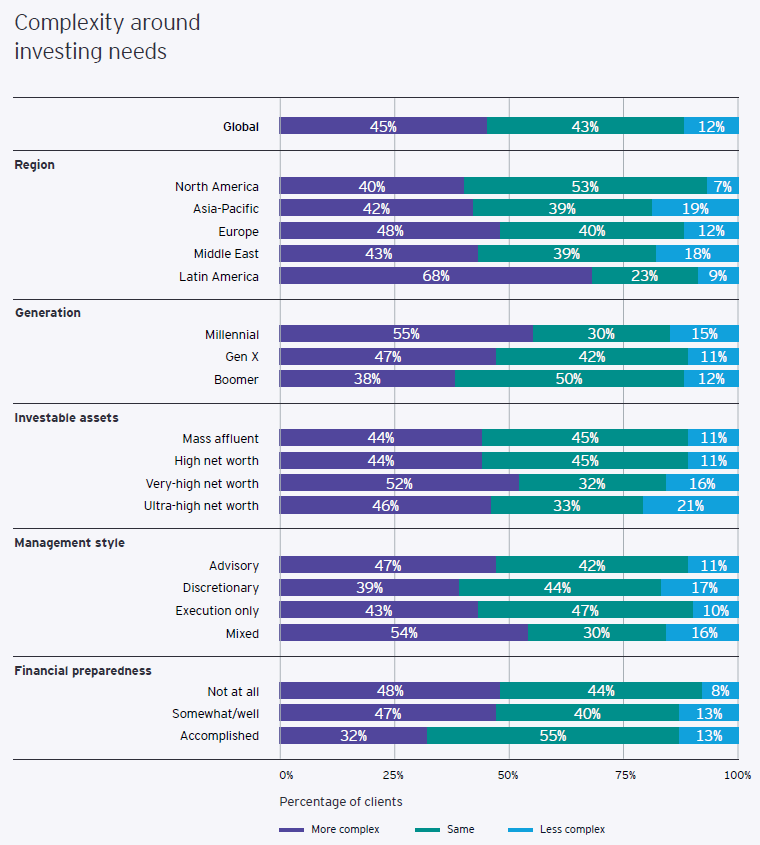

The research shows that volatility and complexity are having a profound impact on investors’ needs and behaviours. Clients of all types are seeking out additional advice and investment strategies. They’re hungry for support and expertise and are increasingly willing to work with new providers.

Market volatility is making wealth management harder

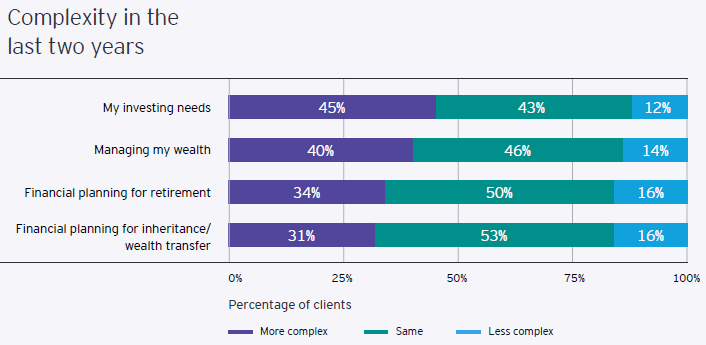

40% of clients think that managing their wealth has become more complex over the last two years, while only 14% say it has gotten easier.

This sense of complexity is not only in response to the political and economic shocks of recent months. It also reflects the rise of new investment products such as digital assets and the growing availability of online and hybrid offerings and the increasing complexity of the wealth management industry itself as FinTechs and other new entrants expand, and incumbents adapt their business models.

Among global clients who feel either unprepared or somewhat unprepared to meet their goals, a majority (57%) view market volatility as a reason for their lack of financial security. This rises to 69% among Boomers, who are more likely to have retired or are close to retirement.

More than a third of Australian clients (37%) think that managing their wealth has become more complex over the last two years, with 64% citing market volatility as a reason for their lack of financial preparedness.

And Australians appear more actively aware of declines in their portfolios than those in other markets, with the vast majority (97%) saying they change investment behaviour due to declines in portfolio value, significantly above the global average of 73%

Less emphasis on passing on wealth

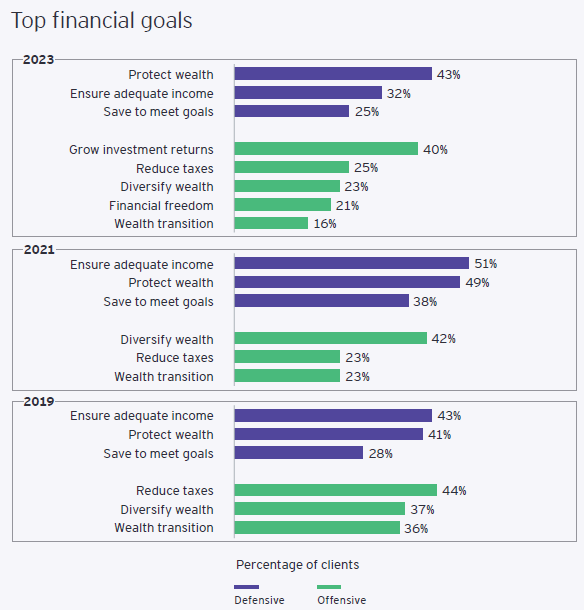

The volatility and uncertainty of recent years have reinforced the defensive focus of wealth management clients’ financial goals.

Investors’ three leading goals are now protecting against inflation, strengthening investment returns and ensuring financial security. Over the past two years, there has been a 30% decrease in the importance placed on purposeful financial legacy goals, such as transition of wealth to family and charity.

These are universal priorities, with limited variation between different age groups or levels of wealth. It’s also notable that clients’ need for protection and security is increasing their desire for expert advice on emerging threats to their portfolio — and on opportunities for recovery and growth.

Less satisfaction with newer asset classes

Overall levels of client satisfaction with traditional asset classes and strategies such as actively managed funds and passive investments are high, despite the impact of recent market volatility.

In contrast, clients are less satisfied with more innovative asset classes, including digital assets and alternative investments such as private equity or real estate.

Self-directed investors, those drawn to FinTechs by their ability to deliver specialized services at low cost, and investors with significant exposures to innovative asset classes, exhibit above-average appetite for more advice from their wealth management providers.

Appetite to work with multiple providers

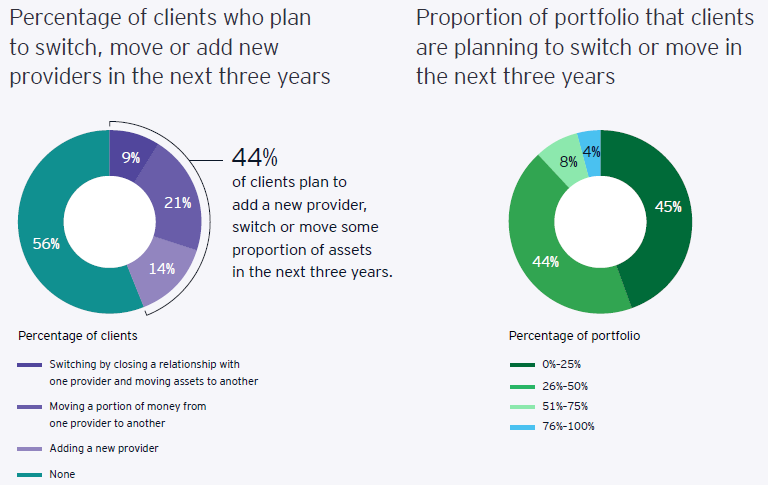

Despite their defensive goals, almost half of all global clients (44%) plan to add a new provider (14%), move money to another provider (21%) or switch altogether (9%) over the next three years. As in prior years, North American clients are less likely to make some kind of switch than average (25%), but when they do move, they are likelier to transfer more than half of their portfolio compared to other regions. It is remarkable that most clients are planning some sort of switching in Asia-Pacific (57%), the Middle East (59%) and Latin America (62%).

Overall, however, the dominant theme is not outright switching but an increasing desire to spread assets between multiple providers. The research shows an anticipated increase of 12% in the average number of providers that clients expect to work with over the next three years. Millennial investors are more than twice as likely to switch (73%) than Boomers (29%), with almost one in five expecting to add a new provider. They are also more likely to shift a larger slice of their assets.

In Australia, two in five clients (41%) plan to add a new provider, move money to another provider, or switch altogether in the next three years.

The proportion of Australian clients working with FinTechs to manage their wealth is expected to more than triple over the next three years – from 8% to 28% – attracted by the sector’s low charges, specialised digital experiences and low-friction switching. That growth is significantly ahead of the global average, which is expected to double from 9% to 18% over the same period.

Appetite for advice grows

The survey shows investors are hungry for advice and expertise from their advisor to interpret economic, market and political shocks. Almost half (46%) of Australian respondents indicated they are looking for more advice across investment services, which is similar to the global average (48%) but the lowest among Asia-Pacific countries where the average is 56%. Among Australian respondents, mass affluent clients signaled the clearest appetite for more advice on investment services at 57%.

The survey also found that investors have acted in similar proportions in response to market volatility, moving to active investments and seeking safety with increased allocation towards savings/deposits. Almost all Australian respondents said they change investment behaviour due to a decline in portfolio value, and almost half (48%) have moved assets into active investments in the past two years. Conversely, only 36% have taken a more conservative move towards savings and deposits.

The survey also found that half of Australian investors (51%) would seek additional financial advice, and 73% would review their financial plans in response to future volatility.

Most of the wealthy are 'maximisers'

This year, we added a behavioral science approach to the research in order to emphasize the importance of psychological factors in economic decision-making.

By measuring behavioral traits, wealth managers can glean powerful insights into client motivations and preferences that are otherwise hidden in traditional segmentation models. As providers continue to seek opportunities to improve acquisition, engagement and retention, behavioral-based segmentation will increasingly drive new paradigms of personalization in the industry.

To measure client decision styles, we constructed a scale based on theories and research from the fields of behavioral science and personality psychology. According to the Nobel prize-winning social scientist Herbert Simon, people tend to make decisions by either Maximizing or Satisficing (“sufficing” plus “satisfying”).

Maximizers exhaustively examine every available option before carefully choosing the highest utility choice. Satisficers tend to make decisions by choosing the first option that is “good enough” to meet their basic criteria.

The research found that 59% of wealth management clients worldwide are Maximizers, while 41% are Satisficers. Of particular interest highlighted in this report to providers, we found significant differences between how these two groups perceive complexity, their propensities to switch providers, and their preferences for engagement frequency.

The research found that Maximizers prefer monthly advice on their financial plans twice as much as Satisficers (28% vs. 14%). Additionally, Maximizers are 72% more likely to seek a new provider when faced with overload and 55% more likely to switch providers than Satisficers. Therefore, wealth managers should prioritize offering frequent advice to Maximizers and simplify their investment options and financial plans to reduce overload. Failure to do so could result in losing assets to another provider.

The full 2023 EY Global Wealth Management Research Report can be downloaded here. This article does not consider the circumstances of any person and is subject to the disclaimers in the full Report.