The recently-announced additional tax on superannuation account balances above $3 million may be reasonable in intent but the proposed methodology appears rushed and will lead to more complexity and poor outcomes. Even if a reduction in concessions above a certain account balance figure (say $3 million, providing it is indexed) is supported, as I do, both the principles AND the mechanics should be right.

While the proposed high-level principle might be fine, some of the mechanics are definitely not.

Financing an ageing population

First, some context. With all the agitating about the cost of superannuation concessions, it is useful to remind ourselves of the purpose of superannuation. The equity issues are real and should be addressed.

Treasury’s Consultation Paper regarding the Objective of Superannuation (20 February 2023) proposes that:

“The objective of superannuation is to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way.”

This is a reasonable primary objective. In addition, superannuation has another purpose, which at a national level is to assist Australia in financing its ageing population. Superannuation concessions should be understood in this context.

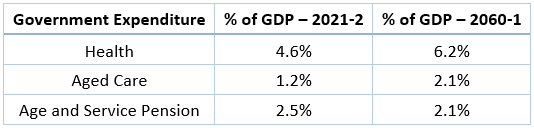

Key areas in financing an ageing population are Health, Aged Care, and Social Security/Age Pension, and the capacity of the workforce to fund government expenditure.

Based on the 2021 Intergenerational Report (IGR), forecast changes in Government expenditure are as follows:

Superannuation, strongly encouraged by appropriate concessional treatment, is playing a valuable macro role, and the real aggregate cost of superannuation concessions should be interpreted in this light. As superannuation continues to mature, the reduction in age pension costs (as a % of GDP) is a welcome development.

Notwithstanding this macro view, the need to address equity and fairness issues in super remains.

Ramifications of an additional tax on high-balance earnings

The proposed mechanics include the use of an ‘ATO calculation’ basis for determining earnings corresponding to account balances in excess of $3 million. Not only is this a purpose for which it was never intended, it is far too simplistic. They appear rushed and not properly thought through, and with unintended consequences.

There has been substantial commentary on many of the key issues in recent weeks, such as:

- the calculation basis for ‘earnings’ on balances in excess of $3 million

- the lack of indexation

- the tax on unrealised capital gains

- the absence of the usual Capital Gains Tax (CGT) discount mechanism and hence CGT discount inconsistencies depending on asset ownership structure

- cashflow and liquidity issues with illiquid assets

- treatment of Defined Benefit schemes (subject to consultation), etc.

I agree with many of the criticisms and will limit my comments here to minimise duplication.

Indexation of the $3 million amount

The lack of indexing appears to be a conscious decision. It could be argued that this decision constitutes intergenerational inequity (Millennials/Gen X versus Boomers). On the other hand, you can argue that it’s a deliberate attempt to reduce concessions progressively over the next 30 years. Ultimately, it will affect the top decile (10%) of account balances by 2050 (based on Financial Services Council forecasts).

What is not clear is how an indexation regime for the Transfer Balance Cap (TBC, currently $1.7 million, and potentially $1.9 million from 1 July 2023) interacts with a non-indexation regime for the additional 15% tax. It is feasible with high inflation indexing of the TBC that it will reach $3 million within, say, seven to 10 years.

Tax on unrealised gains

The tax on unrealised gains (accruals-based taxation) appears to violate generally accepted tax principles that CGT applies on realisation. All OECD countries that tax capital gains do so on realisation (Source: Harding, M. (2013) ‘Taxation of dividend interest and capital gain income’) although it is understood that Denmark may be the first to introduce accrual taxation on capital gains later this year.

The tax on unrealised gains (in respect of balances exceeding $3 million) also means unequal treatment in terms of discounting for capital gains (50% personal, and one-third for super). This will add further weight to asset accumulation outside super beyond the $3 million mark, providing a member meets a Condition of Release.

It is not only the unrealised versus realised calculation, but an additional 15% tax on gains (super) versus 50% discounted (outside super). This may be what the Government wants, and is preferred compared to a hard cap regime which forces money out of super.

Will 15% CGT accrual payments over the years be applied as offsets to the ultimate amount of capital gains and CGT on realisation? Or will it be simply additional to the CGT payable on ultimate asset realisation? It’s shaping up as the latter, but it’s not clear from the announcement and the record-keeping is starting to sound daunting.

Large balances in public (non-SMSF) funds are potentially worse off

Large account balances are certainly more prevalent with SMSFs but far from restricted to them. And the issues for members with large account balances in APRA-regulated funds are potentially more significant than for SMSFs, due to their lesser control over the timing of realisation of capital gains.

Reliable and contemporary data on account balance sizes is difficult to access. The Government estimates that the proposed changes will impact about 0.5% or circa 80,000 superannuation fund members. Based on numbers in ASFA’s research paper ‘Developments in Account Balances – March 2022’, and an earlier ASFA publication ‘Superannuation and High Account Balances’ (April 2015), it is reasonable to assume that around a third of those with balances exceeding $2 million to $2.5 million are in funds other than SMSFs and a somewhat lesser portion for balances exceeding $3 million, say 20-25%.

This would translate to about 15,000 - 20,000 members in APRA-regulated funds.

The issue for such members is that included in the calculation of unit prices is a provision for unrealised capital gains (typically 10% for funds in the accumulation phase).

If such a member is in accumulation phase, and the 15% tax on unrealised gains for the amount of the account balance in excess of $3 million is added to the existing provision, then the effective tax on unrealised gains (either provisioned or actual) is 23.5%, calculated as [1-(.85 x .9)]. In this case, and from a tax on capital gains perspective only, it may be preferable to generate capital gains outside super and access the 50% CGT discount.

This is especially the case if allowing for the prospective Stage 3 tax cuts which will mean a 30% tax rate for incomes between $45,000 and $200,000.

Time to consider the implications

Ideally, there will be a lot more consultation in the enabling legislation. There is time with changes not proposed until 2025-6 so no urgent action appears warranted.

Although there are real and worrying issues, the proposed changes are significantly better than the potential ‘hard cap’ approaches which were contemplated. These would have had major disruptive impacts but perhaps that was just part of the ‘softening up’ process.

For those who can satisfy a Condition of Release, shifting ownership of assets currently in superannuation in excess of $3 million to some other ownership regime (e.g. personal or Family Trust) is worth considering, at least from a taxation perspective, although that should not be the sole or even primary determinant of investment strategies. This may be even more the case with the proposed Stage III tax cuts.

Perhaps this is exactly what the Government wants to achieve without the political backlash associated with hard caps.

Difficult issues apply for SMSFs with a significant portion of relatively illiquid assets, including property with LRBAs, with the impact of annual assessment of tax on unrealised gains, cashflow issues and avoiding selling real assets into depressed markets over the next few years.

Some members may also contemplate whether to make ‘downsizer’ contributions into superannuation, or to ‘upsize’ the family home, with its associated tax advantages, and potentially in conjunction with a home equity release arrangement for generating retirement income.

As always, there are a range of issues to consider including the family home not being income-producing, a concentrated asset and so not great for diversification.

The best solution will always depend on personal circumstances. This all emphasises the need for quality financial advice in coming years.

Given these obvious tax issues and distortions, it is surprising that there hasn’t been a greater outcry, with little sympathy for complaints from the ‘wealthy’.

The warning sign is that if the Government starts making moves on unrealised gains, and effectively diluting the discounting on capital gains, will there be other areas similarly targeted in the future?

Andrew Gale is an actuary, public policy expert in financial services, a Non-Executive Director and a former Chairman of the SMSF Association. The views expressed in this article are focussed on public policy and not financial advice, are personal views, and are not made on behalf of any organisation. This article is not financial or tax advice and it does not consider the individual financial circumstances of any person. No reliance should be placed on this article for personal decisions.