Dear Readers

My personal thanks for your interest in Cuffelinks. As we approach 20,000 subscribers and almost two million pageviews, I am using the Cuffelinks contact list to reach as many of our readers as possible, for a win-win cause.

This exception to our usual newsletter format highlights three recent milestones for my charitable venture, the Third Link Growth Fund, which invests in Australian equities via other fund managers (it’s a ‘fund-of-funds’).

I started Third Link in 2008 with a unique idea. What if I established a fund where all the fees received for managing the investments, net of some tiny expenses, were donated to charities. After a long career in wealth management, I felt I had an ability to select good fund managers who could outperform over time. If I could convince the managers and administrators to provide their services for free for a worthy cause, everyone could win.

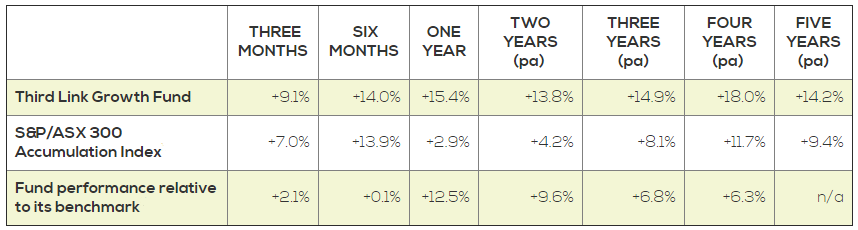

The results speak for themselves. Over the last four years (we used a different structure and benchmark in the first few years), the Fund has delivered 18% per annum and outperformed the S&P/ASX 300 Accumulation Index by 6.3% per annum.

The above figures are to 31 July 2016, after fees. Of course, this is not an indication of future returns.

There are three milestones I want to mention.

First, the Fund’s assets recently exceeded $100 million. Many of you may think this is a relatively modest amount for a fund with strong long-term performance. You’re right! Other funds employ sales staff and marketing resources to promote their businesses to financial advisers and the media, but Third Link does not employ anyone. Neither myself nor my fellow director, Ashley Owen, receive any payments from the Fund. We want as much money to go to charities as possible. We do not pay commissions or salaries to brokers, advisers or sales staff, and this means we have no distribution channels or support other than word-of-mouth and a bit of media.

Second, we recently passed $5 million in donations to charities, which are listed here. Despite our low profile, I’m proud that we now generate over $100,000 each month to support children and young adults under the Third Link THRIVE programme.

Third, we have just launched our new website, with more information presented in a fresher and more useful way. Please visit thirdlink.com.au and learn more.

When I started Third Link, I said the Fund would close to new investors at $150 million. Today, I confirm I will honour this undertaking. With this amount, Third Link will have about $2 million to give to charities each year. Also, many of the fund managers have given me a specific allocation and I feel more confident we can continue to perform with this amount.

And here’s a little secret. It is often cheaper to access these top fund managers via Third Link than directly to the managers, as they also waive their performance fees. My thanks to all the fund managers and service providers for their generosity in offering their skills without payment.

I have no idea how long it will take to raise the final $50 million. Inflows have improved since this recent report by Zenith Investment Partners, a leading independent investment researcher. Managing Partner David Wright, said:

“The Third Link Growth Fund has provided investors with exceptional returns as an Australian equity large cap fund since its conversion to a single asset class fund in February 2012. The Fund’s four-year annual performance to 30 June 2016 of 16.90% p.a. ranks it in the top quartile of the Australian Equity Large cap sector (which consists of 119 funds) easily outperforming the S&P/ASX 300 Accumulation Index return of 11.08% p.a. and median manager return of 11.54% p.a.

The Fund has generated this excellent outperformance with significantly lower volatility (9.91% p.a.) than the benchmark (11.93% p.a.) and the median manager in the category of 11.92% p.a. This and the fact the Fund has a history of monthly excess returns in falling markets of 94.12% also demonstrates its capital protection qualities.”

If you would like to invest, please see the Product Disclosure Statement here. At this point, most funds say something about not repeating past performance, and of course, I cannot give any guarantees. But I believe the money is in the hands of some of the best fund managers I know.

Thanks, Chris Cuffe