SMSF trustees aren't simply hard-working people with the knowledge and means to take control of their financial future. Their ranks are full of Machiavellian schemers who stoke property price booms and plot ‘unfair’ ways to use the super tax concessions.

So say some of the more sensational and misinformed media coverage of the last 12 months.

In the face of such regular hysteria, we thought it would be worthwhile taking a sober look at whether SMSFs are meeting their primary purpose – to provide their members with a sustainable income in retirement.

Fortunately, the results of our SMSF Retirement Insights research paper reveal that those who take responsibility for managing their superannuation are more likely to enjoy a comfortable retirement.

Reason to be confident about retirement

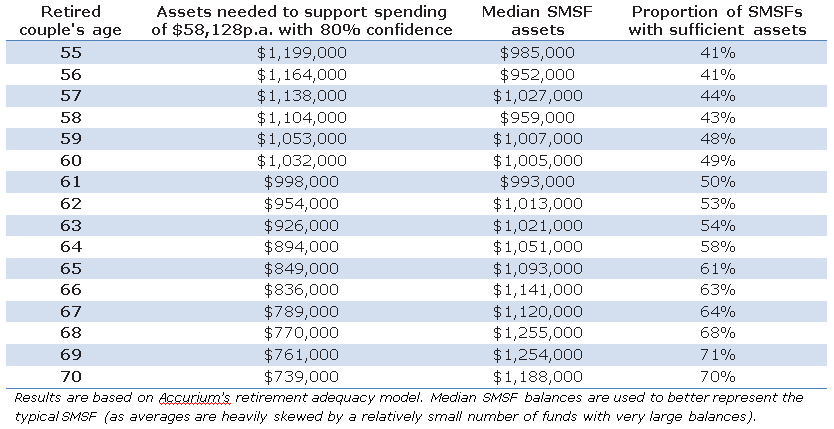

Our research estimated the savings needed by a couple in their SMSF to fund a comfortable retirement for life. The ASFA Retirement Standard (as at 1 October 2014) suggests that a couple would need to spend around $58,128 each year throughout retirement to enjoy a comfortable lifestyle.

Given the considerable risks inherent in providing sustainable retirement income from a lump sum of savings, these risks must be allowed for when modelling retirement. Rather than make simple projections based on fixed assumptions, our research modelled 1,000 different possible return sequences to identify what level of savings is required to provide a high likelihood of success. The scenarios allowed for a large variability of investment returns, inflation and lifespans for retirees. Spending was assumed to increase each year with inflation and the couples’ SMSFs were assumed to hold a broadly balanced investment portfolio. Our calculations also allowed for trustees’ entitlements to the age pension when eligible and any tax obligations that arose.

The results give an estimate of the level of savings needed to sustain the ASFA comfortable level of spending for life with 80% confidence. We then compared the required level of savings with the actual fund balances in two-member SMSFs in Accurium’s database of over 60,000 SMSFs.

Our results show that the majority of SMSF couples have sufficient savings to be able to afford the ASFA comfortable spending level if retiring at age 62 or older. The table below shows the savings needed when retiring at different ages and how these compare to actual SMSF balances:

Aspirational SMSFs need to be careful about retirement

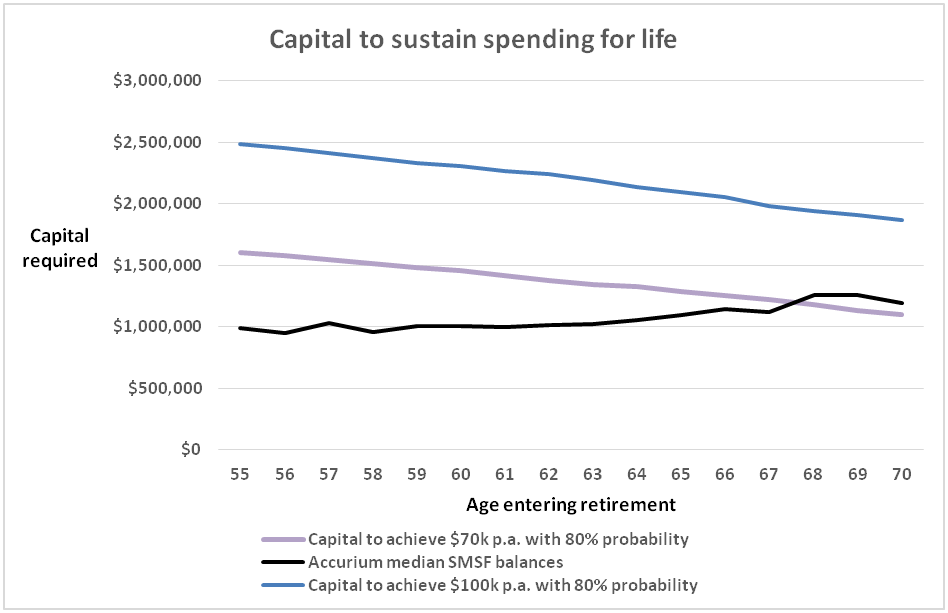

Given that $58,128 per annum is below the average full-time Australian working wage, it is worthwhile asking whether wealthy SMSF trustees might aspire to a higher standard of living in retirement. A 2012 survey of Financial Needs and Concerns of SMSF Members asked trustees ‘what level of income they required to live comfortably in retirement’. Over 50% of respondents said they required an income of $70,000 per annum or more and 25% said that they need at least $100,000 per annum.

To see how well placed SMSFs are to support these higher aspirations we calculated the amounts required in savings to confidently sustain these levels of spending throughout retirement. We compared these calculations to the fund balances in our database with the following results:

Our analysis indicates that, based only on the median SMSF balances, typical SMSF couples cannot afford to retire on $70,000 per annum until age 68. The median balances in our database are never sufficient to confidently sustain a $100,000 per annum spend throughout retirement. That said, perhaps some trustees’ do have realistic expectations as around a quarter of 65 year old couples do have sufficient assets in their SMSFs to support a budget of $100,000 per annum.

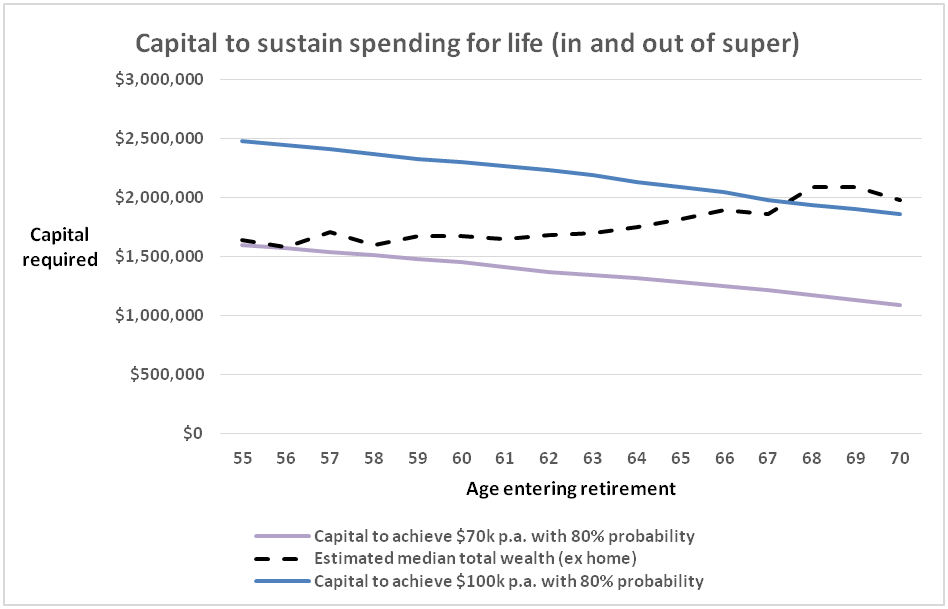

Savings outside super

Of course, savings held in superannuation only tell part of the story. Many SMSF trustees hold significant savings outside of their funds, indeed Investment Trends’ 2014 SMSF Trustees Survey suggested that on average only 60% of trustees’ total wealth (excluding their home) is held in their SMSF. Based on this information, we estimated the median total wealth of SMSF trustee couples at each age and compared this to the amounts needed to sustain higher spending levels in retirement. The results (shown below) paint a much rosier picture with the typical couple likely to be able to afford $70,000 per annum even when retiring as early as age 55. However, the estimated median total wealth is not sufficient to be confident of affording the more generous $100,000 per annum retirement budget until age 68.

Modelling retirement risks

The figures above make a number of assumptions about typical SMSF trustee couples, for example, that they are the same age. The figures start to form a guide around the level of savings that retirees need, in order to confidently support their desired lifestyle throughout retirement. However, all of their individual circumstances also need to be taken into account including the actual age of each spouse, their investment mix and cash flow plans. Modelling should allow for the key risks facing retirees – market, inflation and longevity risks. We believe that this can only be done effectively using stochastic or probabilistic modelling that looks at a wide range of possible future scenarios.

Risk in retirement goes much further than asset allocation. Retirees need to understand and be comfortable with the level of risk they are taking with their retirement spending plans. Our research assumes SMSF trustees would prefer an 80% probability of their assets lasting for life. Some retirees may be willing to accept different levels of risk and modelling should allow for this.

The full paper ‘Accurium SMSF Retirement Insights’ is available for download at www.accurium.com.au.

Doug McBirnie is a Consulting Actuary at Accurium. ?This information is factual and is not intended to be financial product advice or legal advice and should not be relied upon as such. ?You should seek appropriate professional advice before making any financial decisions.