Housing market sentiment has eased from record highs and confidence has ticked down further as house price rises start to slow. Construction costs are now seen as the biggest constraint on new housing developments, and there is a lack of stock for buyers of established property. NAB has revised its dwelling price forecast – 23% in calendar 2021 and 5% in calendar 2022 – as the impact of low rates and strong income support begin to fade.

Survey highlights

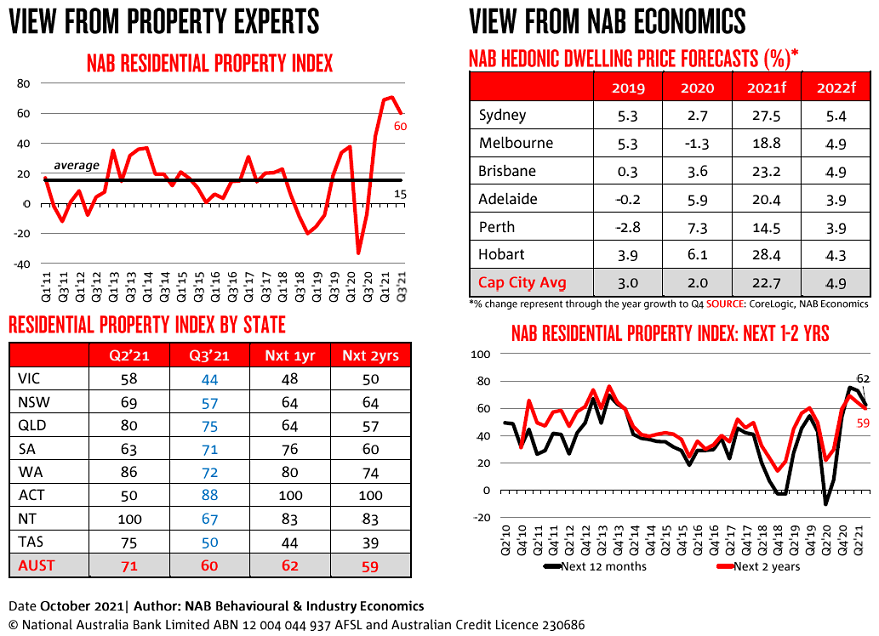

The NAB Residential Property Index dipped to +60 pts in Q3 from a survey high +71 pts in Q2, as shown in the chart below. With market data showing house price rises slowing, sales easing, and building approvals falling, the survey is also pointing to a market that has passed its peak.

Sentiment softened in most parts of the country (and still lowest in VIC), and confidence fell again (but still above average). With the survey expectation for house prices in the next 12 months to outpace rents, gross yields should fall before leveling out in two years’ time as prices and rents rise at a similar pace – though some states (WA, the NT and ACT) may see yields rise.

In established markets, property professionals identified a lack of stock as the biggest constraint facing buyers in all states. The survey also found that though foreign buyers are still bit players in local housing markets, a significant net number of property professionals now expect their market share to rise in the next 12 months, especially in new residential markets.

NAB’s view on dwelling prices

The housing market has remained remarkably resilient despite the ongoing lockdowns in the two largest capitals as well as a sharp slowing in population growth over the past year.

The market has been well supported by lower interest rates, the Federal Government's HomeBuilder programme, as well as a range of state government incentives. Contributing to the strength seen in housing has also been the better-than-expected performance of the labour market despite the significant disruptions to the economy.

That said, house price growth has slowed recently (though it remains strong), activity has slowed (with time on market increasing and new listings normalising) and approvals for both construction and lending finance pulling back. Auction clearance rates have seen more mixed results, falling notably in Melbourne on the current lockdown but having since recovered – with all markets now at high levels. Rents have also begun to recover.

In terms of forecasts, we have revised them up slightly in both 2021 and 2022. We expect a similar pattern of growth across all capitals from here, with the pace of growth slowing in the last quarter of 2021 before slowing further in 2022. Given the outcomes in the year to date, we expect Sydney and Hobart to finish 2021 around 28% higher, Brisbane and Adelaide also in the 20%+ range and Melbourne slightly softer. Perth sees the slowest but still strong growth at almost 15%.

Alongside the rebound in economic activity, we see a solid bounce in the labour market, with hours worked and participation coming back fairly quickly. A near-term read on the unemployment rate remains difficult, with the timing of participation and employment gains likely to skew the headline measure but for now we see unemployment peaking at around 4.9%.

Importantly for the housing sector, policy makers are alert to a build-up of macroprudential risks amidst very low interest rates and the sharp rise in house prices. In early October the interest rate serviceability buffer was widened by 0.5% to 3.0% above the loan’s interest rate. The impact of this will be to reduce the debt capacity of the typical borrower by 5% and the assessment for now is that this will not see a large impact on lending or the property market.

However, macroprudential policies are rarely used in isolation and we remain alert to the possibility of further measures around the turn of the year, likely in the form of high DTI or LVR speed limits.

Get all the insights in the NAB Residential Property Survey (Q3 2021).

With the housing market losing steam, market confidence among property professionals also fell further. In Q3, the 12-month confidence measure fell for the second consecutive quarter to +62 pts (+73 pts in Q2) and the 24-month measure to +59 pts (+64 pts in Q2) – though both measures continue to trend well above average.

House price expectations

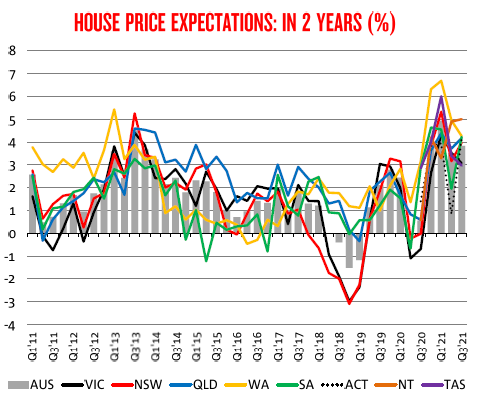

Despite recent data pointing to a continuation of strong (albeit moderating) house price growth across the country in Q3, the average survey expectation for house price growth over the next year is basically unchanged.

On average, survey respondents expect national house prices to rise by a still solid 4.3% over the next 12 months (previously 4.2%), but at a slightly faster 3.8% in 2 years’ time (previously 3.5%).

New developments

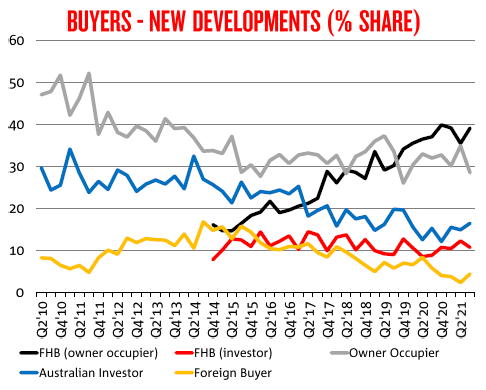

First Home Buyers (FHBs) continued to be the most active participants in new housing markets in the September quarter, accounting for 1 in 2 (49.8%) of all sales (47.8% in Q2). FHB owner occupiers accounted for 39.1% of total sales (35.5% in Q2), and FHB investors 10.7% (12.3% in Q2).

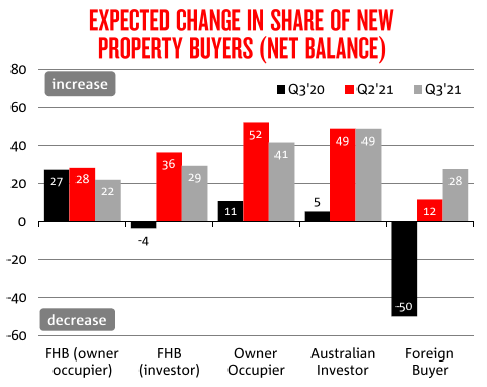

Property professionals were asked whether the share of new property buyers in the market would rise or fall in the next 12 months in each buyer segment. In net terms, the number who said it would increase outweighed those who said it would fall in all buyer groups led by resident investors (+49%) and owner occupiers net of FHBs (+41%). Noticeably more property professionals (+28%) also said they expect the share of foreign buyers to increase than decrease in the next 12 months – a big reversal from expectations at the same time last year when significantly more expected their number to decrease then increase (-50%).

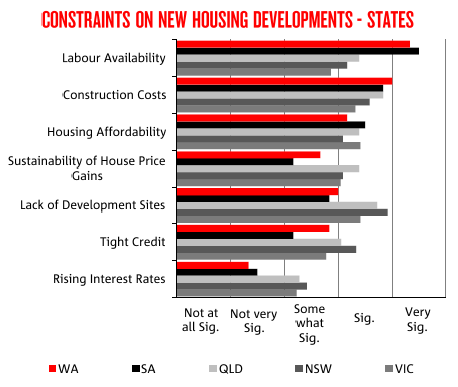

New housing market constraints

With strong building demand and shortages of building materials causing building costs to increase rapidly, construction costs overtook lack of development sites as the biggest impediment for new housing development in the country during Q3. A lack of development sites was the next biggest impediment to new developments nationally.

The negative impact of housing affordability on new housing development climbed for the third straight quarter, with property professionals in SA, VIC and QLD highlighting this issue as a bigger impediment than in other states.

With official cash rates widely tipped to remain on hold for some time, the impact from rising interest rates continued to moderate. The impact on new housing development arising from tight credit also fell to its lowest level since mid-2015, though it was still seen as a ‘significant’ impediment to new housing development by property professionals in NSW and QLD.

Established property

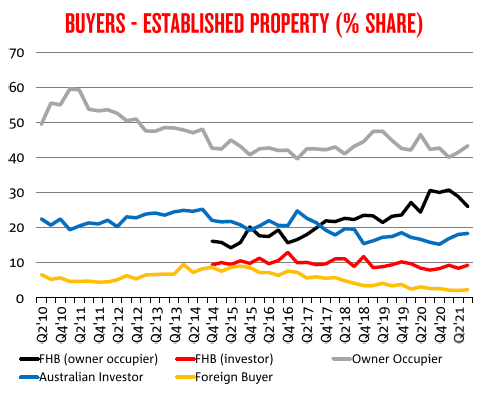

In established housing markets, buying activity continues to be dominated by resident owner occupiers (net of FHBs), In Q3, the overall market share of these buyers increased for the second straight quarter to 43.3% (from 41.5% in the previous quarter) but remains below the survey average (46.4%).

The overall share of FHBs in established housing markets however dipped for the second straight quarter to 35.2% (37.2% in Q2) but continues to trend above the survey average (31.5%). Overall, FHBs were most active in WA (36.9% and VIC (36.7%, and least active in SA (29.9%).

In net terms, more property professionals expect market share among buyer types to increase than decrease in the next 12 months. Expectations were strongest for domestic investors (+55%) and resident owner occupiers (+52%), followed by FHB investors (+33%) and FHB owner occupiers (+25%). Overall, the number of property professionals who expect the proportion of foreign buyers to increase (+5%) was mildly positive, representing a significant turnaround from the same time last year (-38%).

Established housing market constraints

Recent CoreLogic reports indicate that the number of newly advertised properties remains extremely low, with every capital city recording a below average amount of advertised supply, despite a recent ramping up in new listings.

With house price is also still rising solidly, property professionals said the next biggest impact on buyers came from house price levels, with the impact biggest in NSW and smallest in WA. Employment security was also cited as a ‘significant’ constraint, led by VIC and NSW where hours worked in the September quarter were most impacted by lockdowns and restrictions.

With interest rates widely expected to remain low in the near future, property professionals did not see rising interest rates unduly impacting buyers of established property. They also said that access to credit was impacting buyers less than at any time since mid-2015.

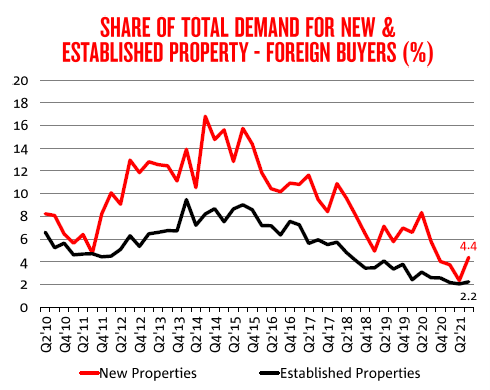

Foreign buyers

Foreign buyers in Australian housing markets where a little more prevalent in Q3 but buying activity from this group is still well down from the peak levels during the middle years of the 2010s. During the September quarter, property professionals estimate the overall share of total sales to foreign buyers lifted to 4.4% in new property markets (their highest share since Q3 2020 and up from a survey low 2.3% in the previous quarter), and to 2.2% in established housing markets (also up from a survey low 2.0% in the previous quarter).

Alan Oster is Group Chief Economist and Head of NAB Group Economics. Co-authored by Dean Pearson, Head of Economics; Robert De lure, Associate Director of Economics; and Brien McDonald, Associate Director of Economics.

About the survey

- The NAB quarterly Australian residential property survey was first launched in Q1 2011. The survey was expanded from NAB’s quarterly Australian commercial property survey which was launched in April 2010.

- Given the large number of respondents who are also directly exposed to the residential market NAB expanded the survey questionnaire to focus more extensively on the Australian residential market.

- The large external panel of respondents consists of real estate agents/managers, property developers, asset/fund managers and owners/investors.

- Around 370 panellists participated in the Q3 2021 survey.

- This article is an edited version of the full report.