In the UK in 2014, The Independent Review of Retirement Income (IRRI) was commissioned to look at retirement incomes. Two recommendations from IRRI were:

“The use of deterministic projections of the returns on products should be banned.”

“They should be replaced with stochastic projections that take into account important real-world issues, such as sequence-of-returns risk (and) inflation.”

Quite a bit to digest. There is a broader discussion of these issues in a previous article written by David Bell.

What is deterministic forecasting?

In retirement projections, deterministic forecasting is a set of fixed assumptions around investment returns and inflation to produce one scenario to establish whether a retiree has sufficient financial capital.

An example of a deterministic forecast is the superannuation balances required to achieve a comfortable retirement as calculated by The Association of Superannuation Funds of Australia (ASFA). The ASFA Retirement Standard was developed to objectively outline the annual budget needed by the average Australian to fund a lifestyle in their post-work years, providing benchmarks for both a comfortable and modest standard of living.

ASFA details that:

“a comfortable retirement lifestyle enables an older, healthy retiree to be involved in a broad range of leisure and recreational activities and to have a good standard of living through the purchase of such things as: household goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment, and domestic and occasionally international holiday travel”.

As of March 2018, for a retired couple, the budget for a comfortable lifestyle was $60,264 per annum. Based on a rate of return of 6.0% per annum and inflation of 2.75% per annum, ASFA has determined that a sum of $640,000 is required for retirement. This method draws down capital over the period of withdrawal so that nothing is left at the end of an average life expectancy.

Stochastic modelling introduces variability and stress testing

A stochastic model considers different outcomes by allowing for variation in the inputs within the forecast.

For example, the Accurium Retirement Healthcheck is a projection tool that allows the assessment of retirement sustainability. It stress tests a retiree’s plans through 2,000 possible future scenarios. The investment return assumptions are provided by Willis Towers Watson and are generated using their Global Asset Model. This Model produces ‘random’ future sequences of possible investment returns for each asset class. These are generated so that ‘as a whole’ the simulations represent a full distribution for how ‘real world’ markets could perform in the future.

Stochastic modelling assists in making a scientific assessment of sequencing risk, which is the risk of experiencing poor investment returns at the wrong time. Stochastic modelling can't predict the nature of ‘Black Swan’ events. Is the chance of a significant crash 1% or 10%? These models can't estimate these odds, so the best that can be said is that these events don't happen very often.

Modelling a ‘comfortable’ retirement

It is an interesting exercise to model the ASFA example in the Healthcheck software for a two 66-year-olds in a couple couple who are eligible for the age pension.

Let's assume $640,000 in superannuation in a ‘balanced’ portfolio using the asset allocation constructed to align with the Morningstar Multisector Balanced Market Index (22% Australian shares, 25% international shares, 5% listed property, 33% fixed interest and 15% cash). Fees of 0.9% per annum are assumed. The default long-term asset class return assumptions within the Healthcheck produce a return of 5.3% per annum based on the asset allocation after the deduction of fees. Gross returns of 3.5% for 'cash' and 4.5% for fixed interest are assumed, which could be considered optimistic in the current environment. Nevertheless, the 5.3% per annum is lower than the ASFA assumption of 6.0% per annum.

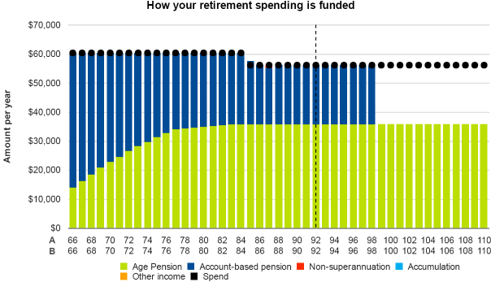

The Healthcheck also allows settings around the lifestyle of a retiree. ASFA produces budgets for those around 65-years-old and 85-years-old. For those around 85-years-old, the comfortable lifestyle budget is $56,295 per annum, which is approximately 7% lower than that for a 65-year-old. So in the Healthcheck, it has been assumed that expenses reduce to this level at age 85. ASFA also produces budgets for singles and the comfortable lifestyle budget is $42,764 for a single, which is approximately 29% lower than for a couple. Again, in the Healthcheck, it is assumed that expenses reduce to this level at the first death. Personal effects of $25,000 have been assumed for age pension calculations.

The chart below illustrates the misleading nature of a deterministic forecast. It shows that the retirees' money in their account-based pension (the blue bars) should not run out until they are 98-years-old. The dotted line shows where there is a 50% chance that at least one member of the couple will still be alive, and that's in 26 years’ time.

What if a greater range of outcomes is considered?

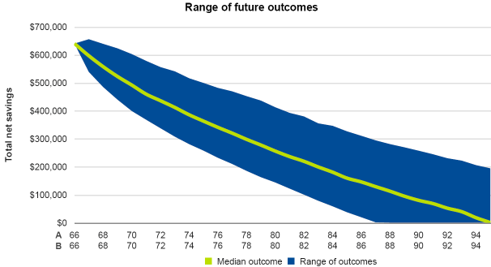

However, the stochastic modelling produced via the Healthcheck shows that in 64% of the 2,000 scenarios tested, the retirement lifestyle is sustainable. This means that the couple has a 36% chance of outliving their savings.

I’m not sure what readers think about a 36% failure rate, but I wouldn’t feel comfortable crossing a bridge if it had a 36% chance of collapsing!

The chart below details where variability has been allowed for. There is an 80% chance that the retiree’s future savings will fall within the blue shaded area. The bottom of the blue range represents a ‘worst case’ outcome at each age. There is a 10% chance of running out of money after 22 years. The top of the blue range represents a ‘best case’ outcome at each age. The green line represents the median of 2,000 scenarios.

When presenting the deterministic forecast, I don’t think anyone could reasonably imagine that there was a 10% chance of running of money after 22 years. The deterministic forecast illustrates that the retirees should be fine until they are aged 98, which is 32 years away.

So how much does a retiree need to be ‘safe and comfortable’ with 95% confidence?

Let’s assume that we want 95% confidence that the retiree would not run out of money. I am risk averse, so I still wouldn’t walk across a bridge if it had a 5% chance of collapsing. Nonetheless, it is better than walking across a bridge that has a 36% chance of collapsing.

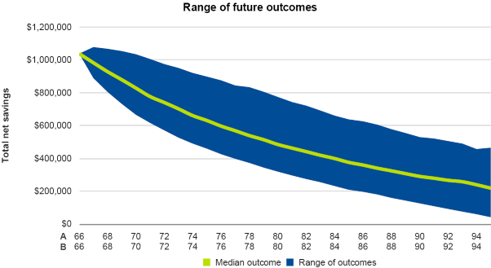

By reverse engineering within the Healthcheck software, based on the previously detailed assumptions, it is estimated that a retiree couple would need $1,036,000 to have only a 5% chance of running out of money. This is 62% greater than the amount estimated by ASFA. However, it is lower than that implied by some safe withdrawal rate articles that suggest drawdowns of not more than 4% ($1,506,600). This is due to the benefits of the age pension, but if social security laws change significantly in the future, as they have in recent times, then this would impact the results produced by the model.

The chart below is based on $1,036,000 in superannuation at retirement. There is a 10% chance of savings being approximately $40,000 in 29 years’ time and a 10% chance of being roughly $460,000.

There is no doubt that a deterministic forecast is easier to explain, easier to understand and still has its place. However, stochastic modelling, while more complicated, considers a vast range of possible scenarios and estimates the most significant financial risk for retirees, which is the likelihood of running out of money.

As David Bell succinctly notes in his article mentioned earlier:

“Many other industries develop complex products which are explained effectively to consumers … Too hard … cannot be an excuse.”

Patrick Malcolm is a Senior Partner and Financial Planner at GFM Wealth Advisory. He has attained the Certified Financial Planner® designation, completed a Master of Applied Finance and is also a SMSF Specialist Advisor™. This article is general information that does not consider the circumstances of any individual.