You wanted shares to buy last year but didn’t get around to it, then prices rose and so you were waiting until prices fell, but now that they have fallen you are worried they will fall further.

I have good news and bad news for you. The bad news is as a 'Nervous Investor', you will never find a perfect time to invest, when everyone agrees markets are going to go up. The good news is I think I can help.

Let's look at why retail investors often underperform, what assets are available and five tips on what to do.

Why retail investors underperform professionals

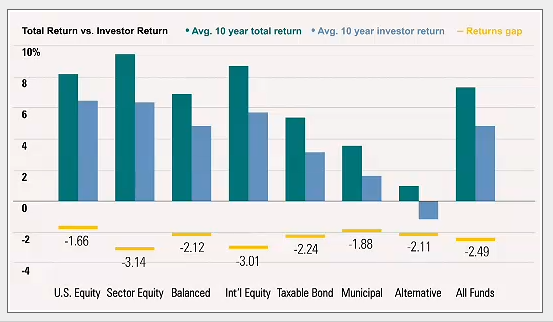

Morningstar regularly publishes studies showing retail investors underperform by around 2% (and others think the gap is larger):

Figure 1: Returns gap

Source: Morningstar

The main factor is behaviour. When markets wobble, investors tend to sell or sit on their cash. When markets have been performing well, investors tend to invest their cash. From a risk perspective, this might seem reasonable to the Nervous Investor – buy when risks seem low and sell when risks seem high. But, from a return perspective, it is exactly the wrong strategy: buy high, and then sell low.

Your brain is actively working against you. The average Nervous Investor makes poor investment decisions in the heat of the moment.

Getting perspective is difficult, especially if you rely on newspapers, financial TV or stock brokers. The first two are in the entertainment business and so creating an exciting story trumps any obligation to give you a realistic perspective. Stockbrokers make money from turnover, so convincing you to buy one day and sell a few weeks later trumps the obligation to give you long-term advice.

Some of the many biases include:

- Loss aversion: The hurt from losses is more than the joy from gains. For a Nervous Investor, this might mean being overly conservative rather than taking calculated (and diversified) risks.

- Confirmation bias: searching out facts supporting our view rather than challenging it. For a Nervous Investor, it means looking for reasons to invest later. And, as the internet is a big place, I’m sure you’ll find someone who agrees with you.

- Planning fallacy: our tendency to underestimate the time, costs, and risks of future actions and overestimate the benefits. For the Nervous Investor, this means “I’ll invest later after I learn the entire financial system and all its risks”. But life gets in the way.

- Choice paralysis: too many choices overload. For the Nervous Investor, this is a never-ending excuse – you just need to research the choices more.

- Bias blind spot: we can see everyone else’s biases but not our own.

To overcome these biases, create a plan and stick to it.

One of the most dangerous biases is judging a past decision by the outcome instead of the quality of the decision at the time it was made, given what was known. Humans are constantly rewriting history, such as these two staples of investment prediction:

- “Last year was much easier, all you needed to know was [insert theme that is known now but wasn’t 12 months ago] – this year will be more difficult.”

- “Last year was all about [insert growth / value / quality / momentum]. This year will be a stock pickers market.”

The reality is, investing is never riskless and there are always reasons for markets to fall or to rise.

Typical assets, and how they usually perform

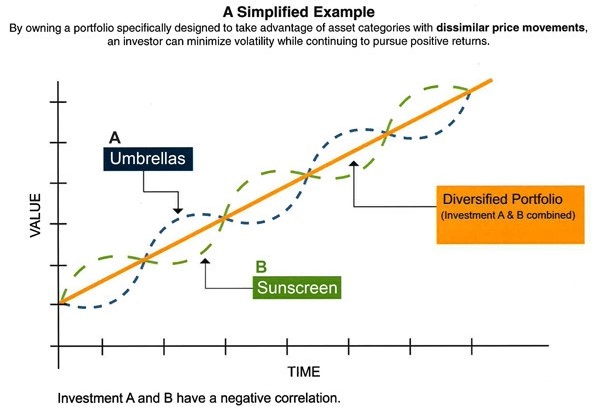

First, you want to diversify to smooth your returns. Consider the apocryphal portfolio owning an umbrella seller and a sunscreen seller. Some days one does well, other days the other does well. An investment in only one gives a volatile return, an investment in both smooths the return:

Figure 2: How diversification works

The four traditional asset classes are:

1. Cash/term deposits: the big advantage of cash is the value doesn’t fall in times of stress. The disadvantages are that cash gives a poor return relative to other assets, and in times of trouble, central banks cut interest rates which flow through income immediately. If you are relying on interest payments for living expenses, then this can create problems at the worst possible point of the economic cycle. While you can mitigate somewhat by term deposits, you then lose the liquidity of cash. The danger is you own too much.

2. Government bonds: The big advantage of government bonds is in times of stress the value often (but not always, depending on the type of crisis) rises. This provides diversification and income when you want it most. The main downside is the value of the bond does change, and so bonds are riskier than cash. Over the long term, bonds perform better than cash, but not as well as stocks.

3. Corporate bonds: Corporate bonds provide a higher interest rate than government bonds. The downside is there is a much larger chance the company you are investing in goes broke, which manifests itself as a poorer level of diversification. This makes the returns for corporate debt more similar to stock market returns – meaning for the Nervous Investor corporate debt is less useful.

4. Stocks: Stocks are the most volatile – in boom times they return the most, in bust times lose the most. Over the long term they return the most. As a Nervous Investor you want to have a diversified weighting to stocks over the long term, but keep this exposure to a level you feel comfortable with.

Five areas of focus for the Nervous Investor

1. Asset allocation

Get your strategy right and then stick to it. Write it down. Put it somewhere safe and refer to it before you make any investments. As a Nervous Investor, don’t let your emotions rule.

Diversify. Diversify. Diversify. Useful for ordinary investors, doubly so for a Nervous Investor.

2. Regret minimisation

Realise every investor is wrong at some stage. Your goal as an investor is not to make zero mistakes, it is to make sure mistakes don’t ruin your overall portfolio.

First, evaluate the fear versus greed trade-off. If you really want to be the person at the BBQ talking about how much you made on the stock market, then you must take risks. And some years you will have big losses. For many Nervous Investors, this is unrealistic. Abandon your dreams of being the hare and embrace the role of the tortoise.

Second, don’t invest all at once. Make a plan, and for some this will mean gradually investing over a few months, for others, it will mean gradually investing over a few years. You will be alternatively kicking yourself for not investing earlier and then berating yourself for not waiting for the market to fall. Accept that now and move on.

3. Self-evaluation

Do you have the knowledge to make investment decisions? If not, get a professional to do it. If you “just need to read up on a few more things”, then get a professional to do it for you in the meantime, in case it takes you a few years longer than you expect.

Do you have the temperament to make investment timing decisions? If not, get a professional to do it. You need to stick to your plan as a Nervous Investor, and if you are unsure of your ability, leave it to the professionals.

4. Self-control

Rebalance regularly. As a Nervous Investor, this will be a painful process because it will entail selling assets that are doing well and buying assets that have done poorly. Do it anyway. For many investors, near the end of the tax year is a good time.

Don’t watch every market tick. Once your plan is set up and running, turn off the live prices and financial news. As a Nervous Investor, they are going to pander to your worst instincts.

5. Analysis paralysis

As a Nervous Investor, you are probably already a few years overdue to do something. A longer-term plan might take years to be fully invested if that is what you feel comfortable with. But start now and don’t keep making excuses.

Tim Fuller is a Certified Financial Planner and Head of Operations at Nucleus Wealth. This article is for general information only and does not consider the circumstances of any individual.