I see new investors making the same mistakes again and again. New investors should focus on avoiding big mistakes, not on being brilliant. Here are 10 common mistakes of the uninitiated:

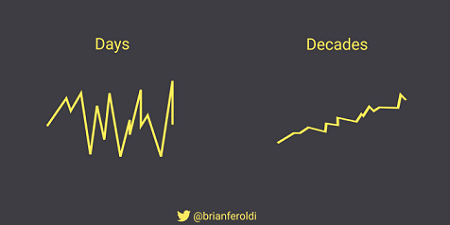

1: Short-term mentality

New investors are easily fooled by market randomness. Stock UP this week? “I’m a genius.” Stock DOWN this week? “Investing is impossible.” Experienced investors know that stock returns should be measured in years, not days.

2: Going 'all in' on one stock

New investors focus on the upside. They become convinced that they can’t lose and over-allocate to a single position. Experienced investors diversify, knowing that the future is uncertain and that no stock is guaranteed to succeed

3: Not doing any research

New investors buy stocks without doing enough research. Many don’t even know how to do the research. Without research, you don’t have conviction. Without conviction, you won’t have the strength to hold through the inevitable downturn.

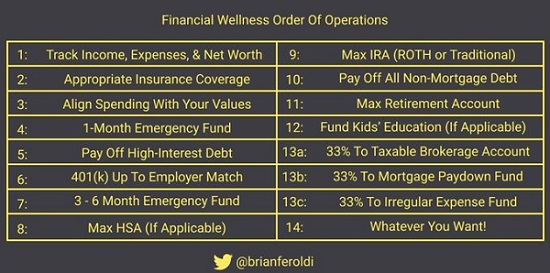

4: Not taking care of their personal finances

New investors think that buying stocks will fix their personal finances. They quickly learn that stocks are volatile and handling that volatility is hard. Experienced investors make their personal finances rock-solid first.

(Note for Australian readers: 401 (k), HSA and IRA are roughly equivalent to our superannuation accounts).

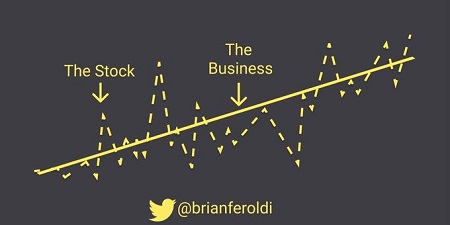

5: Watching the stock, not the business

New investors focus intensely on minute-by-minute price movements. Experience investors focus intensely on company earnings reports and their estimate of the company's intrinsic value.

6: Selling winners to buy losers

New investors sell their winners and double-down on their losers. Experienced investors know that the opposite strategy is much more effective.

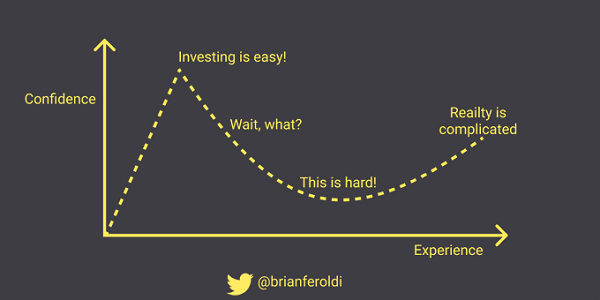

7: Overconfidence

New investors are filled with confidence. Experienced investors know that the more they learn, the more they realise they don’t know. (I followed the Dunning-Kruger effect).

8: Not having a process

New investors just start buying and selling whatever stocks are popular. Experienced investors focus intensely on their investment process and make use of an informed process:

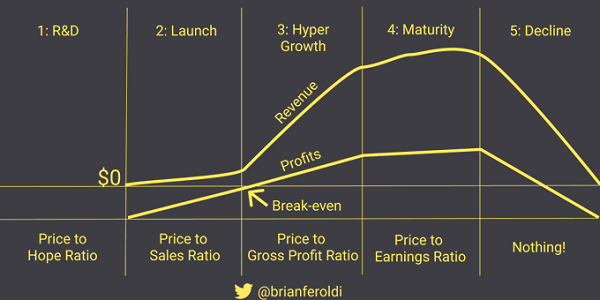

9: Overusing the P/E ratio

New investors use the P/E ratio to make valuation decisions. Experienced investors know the P/E ratio has huge flaws and it is only useful in phase 4

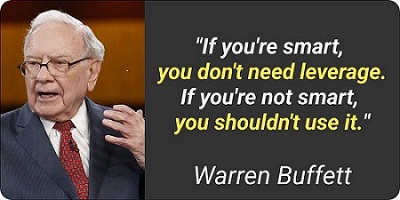

10: Using options, margin and leverage

New investors are in a rush to build wealth. They use options, margin, and leverage to juice their returns. Experienced investors know this is a recipe for disaster. Never forget Buffett's quote:

I personally have made every mistake on this list

This thread from 30 October 2020 shows how bad I was at investing when I first started:

When I started 'investing' in 2004, I had no idea what I was doing. I couldn't tell you anything about a balance sheet, income statement, management. To prove just how bad I was, I looked up the first stocks I bought in 2004-2007.

Here's how it went ... (stocks referenced are US companies).

Stock #1 - $STEM

I heard stem cells were going to be big, so I bought this penny stock. The only thing I knew was the ticker - that's it! I sold it for a 20% gain in a few months.

My feelings: Investing is easy!

Stock #2 - $DIGI

Another penny stock. I couldn't tell you ANYTHING about this company either. Bought for $1.40 and sold a month later a 5% loss.

My feelings: Investing is still easy! (currently about $0.10 share, down 90%).

Stock #3 - $ALT

Penny stock, I can't tell you anything about this company. Bought $1.01, sold a month later at cost.

My feelings: Investing might not be easy. ($ALT is unlisted today).

Stock #4 - $UAIR

Penny stock and a company I know! I can't lose! Bought for $1.13. Sold for $0.75 three days later! My first 'big loss'.

My feelings: Investing is getting harder

Stock #5 - $VODG

Penny stock bought for $0.18 (So cheap, how could I lose?). Sold for $0.20 one month later.

My feelings: Investing is easy again!

Stock #6 - $DDD

Another penny stock, a clinical-stage biotech at the time, not 3D Systems. Bought at $3.15. Sold three months later at $4.50

My feelings: Investing is so easy. Who are these suckers that buy 'high priced' stocks?

Stock #7 - $DDD again

Back to old reliable! Bought at $4.83 (higher than my 1st sale price). Bought again at $3.50 (what a bargain!). Sold for $1.30 (biggest loss to date!). Eventually becomes unlisted.

My feelings: Investing sucks sometimes! No more penny stocks for me - too risky!

Then I screened for stocks based solely on trailing dividend yield. Nothing else, so bring on the huge dividends.

Stock #8 - $CIF

12% dividend. How can I lose? Bought $3.21. Sold $3.11

My feelings: Dividends!

Stock #9 - $IMH

22% dividend yield. I really can't lose now! Bought $17.05 (expensive). Sold $17.60 three months later (luck). (Current price $1.40)

My feelings: Dividends!

Stock #10 - $PURE

Back to clinical-stage biopharma penny stock that's going to the moon! Bought $1.90, $2.30, $2.40, $2.10. Sold $4.65 & $3.13 (success!)

My feelings: I'm getting better at 'investing'!

Stock #11 - $CLM

What's it do? No clue. 20% dividend! Bought at $9.15. Sold one month later at $8.20.

My feelings: What aren't these dividend stocks working?

The good news

I then consumed every piece of financial content that I can get my hands on at this time. Rich Dad Poor Dad, The Millionaire Next Door, etc. I discover buying 'good' companies is the way to go.

I buy $EBAY, $GE, $BAC, $GOOG. I buy ETFs like $QQQ, $EEM.

Peter Schiff and Robert Kiyosaki convinced me that inflation is going to make the dollar worthless, so I buy $GLD, $SLV, $SLW and foreign stocks.

I still like dividends, so I buy $BP, $MO, $CVX, $PAYX.

I continue to read, read, read, read, read.

I start to buy more good companies like $NFLX, $AMZN, $GOOG.

I start to develop a long-term mindset. I start to read @morganhousel and learn about market history and psychology. I abandon my desire to own gold/silver/oil.

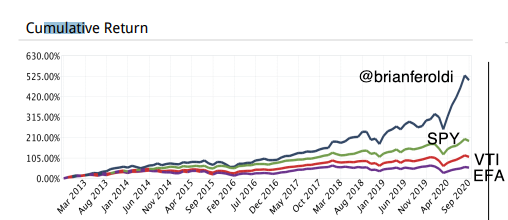

My results since:

It's OK to suck in the beginning. I sure did! Get some skin in the game, make mistakes, and learn from them.

Connect with other investors, and develop a system.

Most of all, develop a long-term mindset. Invest, don't trade. Let's all get better, together!

Brian Ferodi is a US author who tweets @brianferoldi and writes a free weekly newsletter available here. This article is general information and does not consider the circumstances of any investor. Publication here is not an endorsement of the investment strategies described.