An intuitive but flawed understanding of passive investing would suggest that, out of 100 active portfolios, an index tracker will come in 50th place. In other words, half the active managers outperform, half underperform, and the benefit of indexing is that you’ll avoid the bottom half and get a roughly average result at very low cost.

2023 shows that’s not quite true, as we can see in the distribution of this year’s returns. In a Monte Carlo simulation, had 100 investors picked 50 equal-weighted stocks at random from the MSCI World Index at the start of the year, a remarkable 92 of those portfolios would have trailed the Index.

In reality, global equity funds did better than just picking stocks at random. Still, the Index managed to beat 73% of active managers—a feat only topped during the build-up to the tech bubble in the 1990s.

What happens next?

That was a clear victory for passive investors in 2023 over us and most of our active peers. But there’s a deeper implication: if you’re buying a passive fund to guarantee an average result, that’s not necessarily what it’ll deliver.

2023 was an outlier on the positive side, but if a passive strategy can deliver a 92nd percentile result, then an 8th percentile result is also possible. That kind of outcome isn’t just theoretical. A passive strategy lagged nearly all simulations as recently as 2009 (3rd percentile) and, before that, in 2000 (2nd percentile).

A passive approach, it turns out, is a distinct portfolio with its own risks and exposures. It moves up and down the performance rankings like any active manager, with one critical difference: how the portfolio is constructed. While we build portfolios based on shares that we believe offer the most attractive value, traditional market capitalisation weighted passive funds allocate strictly according to index weighting, paying no mind to value or risk.

Imagine an investment universe that consists of five equally valuable companies, but one is priced at twice its fair value and the other four are priced at half. While the value-conscious manager would look to avoid the overvalued stock altogether, the passive approach would allocate half its capital there.

By design, traditional index funds are naturally overexposed to the most overvalued parts of a market. It follows that the environment where a passive approach will rank highest versus peers is one where the most overvalued shares get even more overvalued.

Indeed, the more the valuation gap between overvalued and undervalued stocks widens, the more the passive strategy outperforms, the greater its allocation to the overvalued stocks, the more money it attracts to keep the cycle in motion—and the riskier it becomes.

The converse is also true: the environment where a passive approach will do worst is one where the most overvalued shares sell off hardest (e.g. 2000) or the most overlooked shares recover most strongly (e.g. 2009).

As a barometer of current market conditions, this year’s 92nd percentile performance from the Index is a fascinating tell—one that chimes with our work on aggregate valuation gaps as well as our bottom-up research.

The Magnificent Seven versus the rest

And 2023 isn’t alone. Though 2022 was a break from the recent pattern, US index-tracking strategies have now beaten the combined wisdom of active investors for 8 out of the last 10 years. The scope and length of that remarkable run now eclipses even that of the dotcom boom.

Never before has following the crowd made so much money. Nor, in our estimation, so little sense. But just look at the opportunities the crowd has left for those of us willing to take a different view.

We could wax lyrical about the glaring difference in value between Korean banks priced at 4 times earnings, versus Apple at 28 times, despite diverging fundamentals—Apple is increasingly at risk of bans in China, while Korean banks could double their dividends.

Or how the thick margin of safety at Intel, backed by listed stakes and real saleable assets, compares to the slim margin for error at Nvidia, trading at 13 times next year’s projected revenue. That revenue that could be competed away over time, while Intel’s semiconductor “fabs” in the US are increasingly valuable as the east and the west drift further apart.

We could effuse about the quality of Nintendo’s innovation engine, and marvel at Mr Market’s willingness to extrapolate dominance for the Magnificent Seven while putting little value on Nintendo’s exceptional intellectual property.

But those deep dives would only cover a fraction of the portfolio, which risks diluting the message on how distorted the overall opportunity set has become.

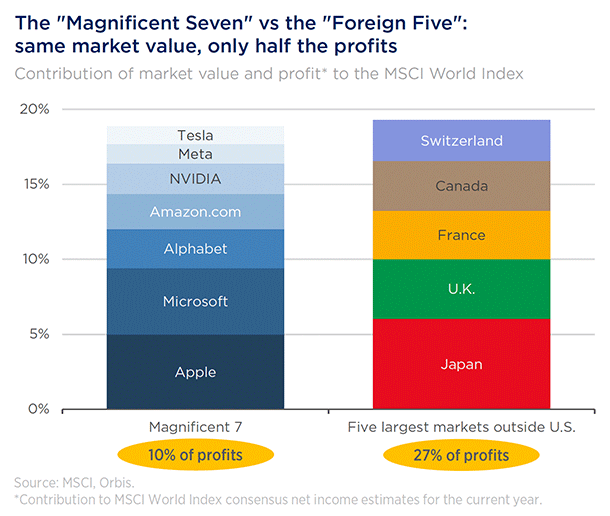

Not since the inception of the first Orbis Funds in 1990 has one country’s benchmark weight punched so far above its share of global GDP (then Japan, now the US). Nor since our sister company Allan Gray’s creation in 1973 have a handful of shares commanded such a large proportion of the market. Today, the Magnificent Seven stocks command as much market value as the “Foreign Five”, the largest developed stockmarkets outside the US by market value, yet the Seven contribute less than half the profits of those stockmarkets.

1 This is the asset-weighted net-of-fee return of all share classes in the Strategy. This return may differ from the return of any individual share class.

This is an extract from Orbis Global Equity’s December Quarterly Commentary.

Eric Marais is an Investment Specialist at Orbis Investments, a sponsor of Firstlinks. This report contains general information only and not personal financial or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person.

For more articles and papers from Orbis, please click here.