Last week, Graham Hand’s article ‘Should your equity manager hold lots of cash?’ included a one-question poll for readers to air their thoughts on equity managers having large allocations to cash in times of uncertainty. Graham’s concluding paragraph read:

In summary, each investor should know how much cash is held by the funds they choose in sector-specific allocations, as the overall cash exposure in a portfolio may differ significantly from expected. When an equity fund manager has a maximum cash allocation of 5%, at least the investor knows where they stand. My preference is for an equity manager to remain fully invested and I will manage my exposure to markets through my overall asset allocation.

Thank you to the 400+ readers who responded, giving us a healthy sample size.

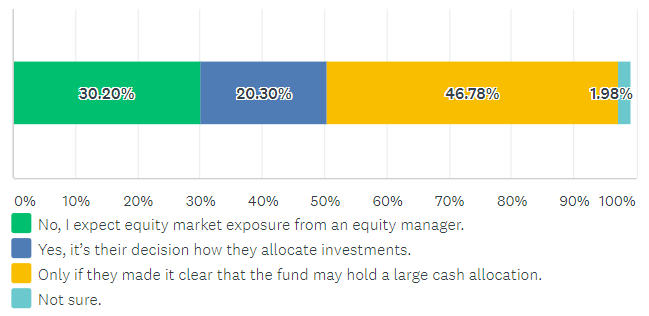

We found that two-thirds of our readers are not as bothered by equity managers holding large cash allocation as Graham was. However, almost half of all respondents said it is only acceptable if the manager has made their intentions clear in advance.

Results and comments are replicated below.

Question: Are you happy that your equity manager sometimes makes large cash allocations?

Comments

- Provided PDS informs the investor that up to x% can be allocated to cash, I am comfortable. Usually a so-called value mgr. adopts this stance

- Cash may have poor returns, but how else can the fund manager take advantage of opportunities during market corrections (which will likely occur), if they don't hold a cash reserve? Ideally, that manager is active in the management of the cash, allowing it to rise and fall with changes in market valuations. When the market is deemed expensive, cash will rise, and vice versa.

- If execution capability to move in and out of safer/riskier asset classes is faster than I could as an adviser then I actually appreciate a more open mandate within clear parameters

- If you have built a portfolio of sector specialist managed funds then your control over asset allocation is heavily dependent on the ability of each fund manager to stick with their mandate.

- Noting a growing fund outperforms. Can down-weight poor stocks by buying others and has new cash to invest in pullback opportunities.

- Protection of my capital outweighs performance.

- Net return is the bottom line, how a manager achieves this their problem. Why keep a dog and bark yourself?

- I have put SOME of our funds with managers who make it clear they can (and will) go to cash in some circumstances. Hopefully, they will see a correction coming before I can. I control most of our funds. Hedging my bets sow to speak!

- I dont need to pay a professional 1.25% to lose money for me, i can lose it quite happily by myself.

- When I invest in a manager, I expect that they will stick to their mandate - such as "Australian small-medium cap growth equities". Clearly, they need some modest amount of cash for transactions. I generally invest in active managers rather than index followers. To get good value out of being an active manager, they need to have cash available when the market dips to buy stocks that are then worthwhile. I want them to recognise that, and not necessarily be fully invested when the available investment selections are mediocre. To select active managers that I trust, I look at how they have performed in markets over time, not just what they say.

- Need some cash for costs, redemptions, transactions etc

- I regard it as an important risk-management tool for a long only fund. I prefer that a fund manager goes to cash rather than experience a 50% drawdown

- The maximum cash equity should be stated in the product disclosure document. Cash should be held short term only.

- Mainly to preserve capital depending on market conditions.

- I am happy for them to hold significant cash reserves up to the maximum amount allowed in their published investment policy, if they expect excellent buying opportunities to arise in the near future.

- unless I otherwise like a fund that has internal road asset allocation. Then I consciously consider that as part of my cash and reduce my cash holdings accordingly to compensate.

- I can hold cash to deploy if need be myself thanks! It’s fund managers being too scared at times to back themselves! Very disappointing when it happens!

- Preservation of capital important

- i can manage my cash (asset) allocation.

- Holding large amounts of cash is not a good strategy, inflation will see to that so stick it work, ie put it into the banks, WES, WOW, AFI even WAM but contrary to Fund managers mantra don't time the market ,got news for you that is what I do and it WORKS, you need patience though. Fund managers have to disperse the funds within a short time frame, that is recipe for disaster IE LSF and WGB) there that's just plucking a few in a manner of minutes. They call themselves fund managers I won't be using them!!

- I am my own equity manager! It is my money

- That is what you pay a manager for. Otherwise just use an Index.

- I do not want to force a manager to reinvest the very instant that they sell an asset. If they need a little more time, that is fine PROVIDED I KNOW their policy.

- Do not have one

- Cash rates are so low ... you have to decide if u want higher risk versus cash yield

- as long as the decision is the best interpretation of the clients risk profile and investment strategy

- I am assuming that they are making decisions to get the best return and I have chosen them to do this. I do it myself with my portfolio.

- For my strategy / exposure I WANT the manager to stay in cash if they have good reason to do so. I actively choose products on this basis.

- I’m paying active managers for their insights, including when to move more money to cash

- At the moment my share investments are following the Morningstar model income portfolio, except for the fact that I'm holding one third of my portfolio in cash. I'm about to invest 33% of that cash into four different funds, Aus Gold, US equities (un-hedged), Bonds and Cash!

- I like Jack Bogle's idea, buy an index fund and hold it forever. Actively managed funds will probably suffering reversion to the mean, less fees and commissions, thus giving a much lower long term result.

- And Yes they should make it clear that they have this right

- You have to clearly read the IP and the SAA to establish what you are buying. If you want full investment to equities fine as you can buy/sell the MIS to reflect your view but if not then do you really want your Manager always fully invested even when it's bleeding obvious what is about to happen or what about in a liquidity crisis, do you want to throw good money after bad.

- I want my funds working hard for me. Not sitting in cash and getting low returns.

- This is simplistic definition of "exposure", many managers hold higher beta portfolios and may hold the cash as offset. Key questions are do they have the skill? Is risk allocation reasonably sized? Are incentives appropriate? I am personally dubious about their skillset but measuring "exposure" is more complex than dollar weighting.

- Cash may be required to significantly increase certain positions in future which implies the manager is confident of predicting a market pull back with consequent 'bargain' opportunities emerging. I'd have to be convinced on their track record for that one but if that confidence seems justified and they have told me in advance about large cash allocations for bargain hunting purposes, then yes, I would accept such cash holdings as part of the strategy.

- I expect anywhere up to 15% cash holding depending on managers assessment of over v undervalued markets, but only as an option value. Most likely 5-10%. When everyone is greedy it should be high, when everyone is scared it should be low.

- Having cash to buy into the market is important and so some flexibility is required.

- I employ my equity manager to deliver appropriate returns (equity-like) taking appropriate risk. I am happy for them to decide the best allocation of cash to meet these two objectives at any point in the cycle.

- I rarely have "not sure" on surveys, but in this case, it all depends. If the FM is being prudent based on market events, then some flexibility is often desirable

- I am extremely frustrated when equity manages like Magellan do this. I pay fund managers to invest in the asset class they are in, not in cash or other products.

- I'm paying you to invest in equities. If I want cash, I'll buy that myself.

- I choose a credit manager (CCI) to have freedom of allocation as specified in their PDS & work around that for allocating to other asset classes

- I’ll decide how much cash to hold, and allocate funds to equity managers for equity investments

- The value they provide is generating superior returns over a medium/long term than those generally achieved by an individual. Otherwise, they are of questionable use. So, if that means parking cash when they see fit, so be it.

- I believe it is my Fund Managers obligation to achieve good returns for me. If my Fund Manager foresees difficult times ahead I believe it is my best interest that he preserves my recent gains and goes to cash for a period.

- Who needs an equity manager?

- Equity fund managers need to allocate to cash when buying/selling, when application money’s come in. They also handle some of the market timing issues that many investors don’t want to deal with. Check the asset allocation framework before investing. If you want pure equity exposure then use an ETF or direct equity portfolio.

- And only if it's because their stock pickers can't identify companies with relative upside at current market pricing. They can keep a cash reserve to buy when they find stocks they want. I don't want a manager taking a macro view of where the share market is trading. That's done elsewhere in my portfolio.

- Difficult question to answer, but I expect a manager to adjust to his current view on the market. If I was not happy then I have the choice to move.

- our fund manager Forager has recently acknowledged poor returns partly due to holding large cash reserves

- One would hope that an Equity Manager has more insight into potential market moves than me, but in the last three years it appears that I have been better at picking up sharp declines before they did. Hence I have my money where I control its ultimate allocation.

- Cash allocation should only be for emergency needs, no more than 5 to 10% of total investments, also depends on the investors AGE.

- And only if they do so for a relatively short period of time before allocating back into equities

- I have never used a manager and the only cash I have is for living

- No, because I would hold cash myself or invest in a bond ETF.

- This is an individual decision, after discussions with your equity manager

- I expect a manager to allocate cash for the best outcome they see possible. IF that includes CASH due to VALUATION or other RISK then so be it. I DO NOT WANT a manager at the top of the market to be fully invested if they believe the market is expensive and opportunities are minimal.

- While I want my asset managers to invest in the asset classes "as advertised", a temporary cash allocation is slightly different. If the manager has a well founded belief that their particular asset class is going to decline and lose money, I do not think that they should be forced to be 100% invested. A retreat to cash would seem the sensible option.

- To your point, I question those managers charging a performance fee to outperform and equity benchmark and do so by holding cash during falling markets. The performance fee should be aligned to generating alpha rather than rewarding managers for asset allocation timing.

- One expensive lesson I learned was when I bought a LIC that was trading at a sizeable premium due to outperformance. After I foolishly bought, the manager went to max cash taking the premium out of the share price. Lesson learned.

- Inappropriately high cash allocations reduce returns in bull markets, but provide some peace of mind in downturns. Many investors are not interested/informed/nimble enough to quickly adjust their asset allocations as markets move. The question is: does the average investor know more than a professional investor? Having said that, I do agree that if a fund manager has consistently high cash allocations then their MER should drop to reflect that fact.

- True to label is important, but I do want a manager who is prepared to de-risk when valuations are toppy. I am happy to live with underperformance as long as communication is clear.

- What's a large allocation? I get twitchy if more than 15% is held in cash for extended periods, say, more than 6 months unless it is very clear a bull cycle is in its last paroxysms.

- If they declare their position upfront & reasons why and it suits a particular investors needs, all good. For me right now, I'm long equity, mostly private and have spare cash to pounce if the opportunity presents.

- Managers should invest in line with their stated investment allocations - "true to Label"

- Of course they should. The idea is to make and then preserve money. It’s pretty stupid to follow the market down “just because”.

- Any major change should be referred to, and discussed with client first and not be made without client's approval.

- It really depends on who has the better asset allocation skill - the equity fund manager or the asset owner

Leisa Bell is Assistant Editors at Firstlinks.