Just as enhancing a meal with spices can cause indigestion and heartburn, adding asset classes to an investment portfolio beyond traditional core stocks and bonds can induce an uncomfortable reaction. To the degree our individual risk tolerance allows, however, the addition of diversifying asset classes can offer more rewarding long-term investment outcomes when compared to less-diversified portfolios.

Of equal importance, and of equal cause for heartburn, is holding on to those less familiar asset classes through periods of volatility. Yet, being able to stomach both potential causes of discomfort - adding the diversifying assets in the first place and then holding onto them - offers investors the potential to reap the benefits of diversification over the long run. The crucial ingredient to a diversifying strategy’s success is to find the diversifying mix an investor is comfortable with over the long term.

How much diversification is enough?

The most common objective of individual investors' portfolios is to maximise after-tax net-of-inflation (or real) returns, so that those returns provide money for expenditures when needed. The most crucial aspects of diversification are that:

- diversification is long-term. Over shorter horizons, particularly in volatile markets, we must remember the long-term value proposition of diversification.

- diversification is not an all-or-nothing choice. We can put diversifying asset classes into the current portfolio mix to the extent we are capable of tolerating the inevitable short-term discomfort.

- finding the right allocation to diversifying asset classes helps avoid the costly but common practice of rotating into and out of diversifying strategies at the wrong times.

The asset mixes of a diversified portfolio

The Asset Allocation Interactive (AAI) tool on the Research Affiliates website can assist advisers and their clients in visualising the benefits of greater diversification in their current portfolio mix. AAI uses a common risk-and-return framework to identify efficient (from a return per unit of risk perspective) portfolios, which are well diversified for a range of target volatilities.

The following scatter plot from AAI shows the long-term real risk and return expectations in AUD (based on data as at 31 August 2018) for 27 global asset classes and four portfolios along the efficient frontier (shown below in the four black dots).

Portfolio and asset class expected 10 year returns as of 8/31/2018

Click for more detail. Note: The term 'Linkers' refers to inflation protected bonds. Source: Research Affiliates, LLC, Asset Allocation Interactive Tool. Please see disclosure.

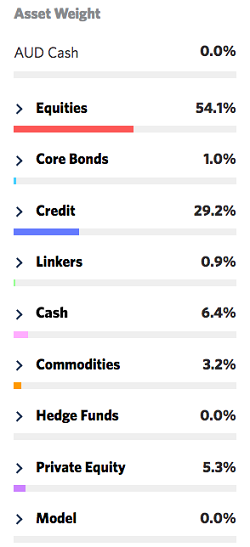

For illustration, look more closely at the 8% volatility portfolio. Over 72% of the portfolio consists of asset classes outside of developed-market equities and bonds. The equity allocation of 54% is invested 31% in emerging market equities. This outcome is driven by today’s valuation levels (as of August 31, 2018), which call for an efficiently diversified portfolio to step even further out of the mainstream than would otherwise be the case, given the better bargains that exist elsewhere in the capital markets. Note that the Credit category includes investment grade, high yield and Emerging Market bonds.

The 8% volatility efficient portfolio asset allocation as of 31 August 2018

Note: The term 'Linkers' refers to inflation protected bonds. Source: Research Affiliates, LLC, Asset Allocation Interactive Tool. Please see disclosure at end of article.

Diversification is not an all-or-nothing choice

To some, the 8%-volatility efficient portfolio may seem too alien and uncomfortable. We get it. Even though the rational side of our brain knows we should hold diversified portfolios, the discomfort of unfamiliar assets can lead us to gravitate toward a more familiar mix, such as a 60/40 allocation. The behavioural finance literature (e.g. French, Kenneth, and James Poterba. 1991. “Investor Diversification and International Equity Markets.” American Economic Review, vol. 81, no. 2: 222–226) shows that investors are naturally predisposed to tilt their portfolios toward the stocks and bonds of their own country. Referred to as home bias, this tendency is often fueled by a preference for the familiar and an aversion to the unknown.

Our behavioural biases go even further. Investors can easily feel more regret when losing money in foreign markets than they do when underperforming in their home markets. For this reason, diversification is unfortunately sometimes referred to as ‘regret maximisation'. So it’s no surprise the predominant risk in most investors’ portfolios is mainstream equity risk, and that the average asset allocations of financial advisers, wealth managers, and public plans are heavily weighted to mainstream stocks and bonds.

Yes, the urge to invest within the friendly confines of home is both strong and natural. But this doesn’t mean we should sacrifice global diversification altogether. We can still harness the potential of diversifiers if we first accept that building and holding a diversified portfolio is not an all-or-nothing choice. We can successfully engage in the pursuit of diversification by building asset mixes that marry individual preferences or tolerances with forays into an expanded opportunity set. Even if diversifying assets compose a small portion of our overall portfolio, any nudge in this direction puts us on a path toward better long-term outcomes gained by achieving the potential benefits of diversification.

Tracking error, or the volatility of relative returns between a portfolio and its benchmark, represents the risk taken by an investor who strays from the benchmark. Most investors don’t think of their portfolio relative to an investment benchmark per se, but often benchmark their returns against their friends, family, or the market index. By keeping tolerance to discomfort in check, we can increase the likelihood of willingly holding the portfolio over a longer horizon.

Conclusion

A consistent diet of spicy food has been linked to health benefits, including a longer life span. For those who want these benefits, but are especially averse to the painful flames, do not despair. Simple remedies abound for those who want to ramp up their tolerance for spicy food. Ultimately, how much heat to ingest is a personal choice, the same is true when it comes to investing.

There are benefits for our investment health of finding the right level of asset class diversification. Beyond the obvious practical implications for customising client portfolios, the AAI tool can illustrate the trade-offs of greater portfolio diversification. This visual means of communication may be helpful in extending the baseline tolerance level, especially in times of short-term underperformance which is likely be beneficial in the long run.

Extending the adviser-client dialogue by illustrating the likely risk and return trajectories of a spectrum of diversified portfolios is a simple yet crucial method. The opportunity to encourage trust through greater understanding, while reiterating a few enduring principles such as the long-term value proposition of diversification, can help us steer investors to better long-term outcomes.

Jim Masturzo, CFA, is Senior Vice President, Head of Asset Allocation and Jonathan Treussard, PhD, is Director, Head of Product Management at Research Affiliates LLC. Research Affiliates will be hosting symposiums in Australia on 13 (Melbourne) and 14 (Sydney) November 2018. Financial professionals can learn more details, and request an invitation here.

Disclosure

The figures are from the Research Affiliates Asset Allocation Interactive tool. All data presented herein are estimates and are based on simulated portfolios and do not reflect the performance of any product or strategy. Past performance is not indicative of future results. Please reference the important legal disclosures found at www.researchaffiliates.com which are fully incorporated herein.