Independent Investment Research (IIR) has released its December Quarter 2016 review of the LIC sector, sometimes called Listed Managed Investments (LMI). A summary of the performance of the 34 LICs included in the Report is presented below. The full paper with more detailed coverage is available here. As this full review is of the previous quarter, investors should check latest prices which may have moved significantly.

Overall equities performance

For the December 2016 quarter, the S&P/ASX200 was up by 5.2% following the US market rally after Trump’s election. Large cap equities, and especially resources stocks, contributed most to this performance. Small caps, down 2.5% for the quarter, still managed an overall gain for the year of 13.2%. For the 12 months to December 2016, the S&P/ASX200 was up 11.8%.

LIC performance

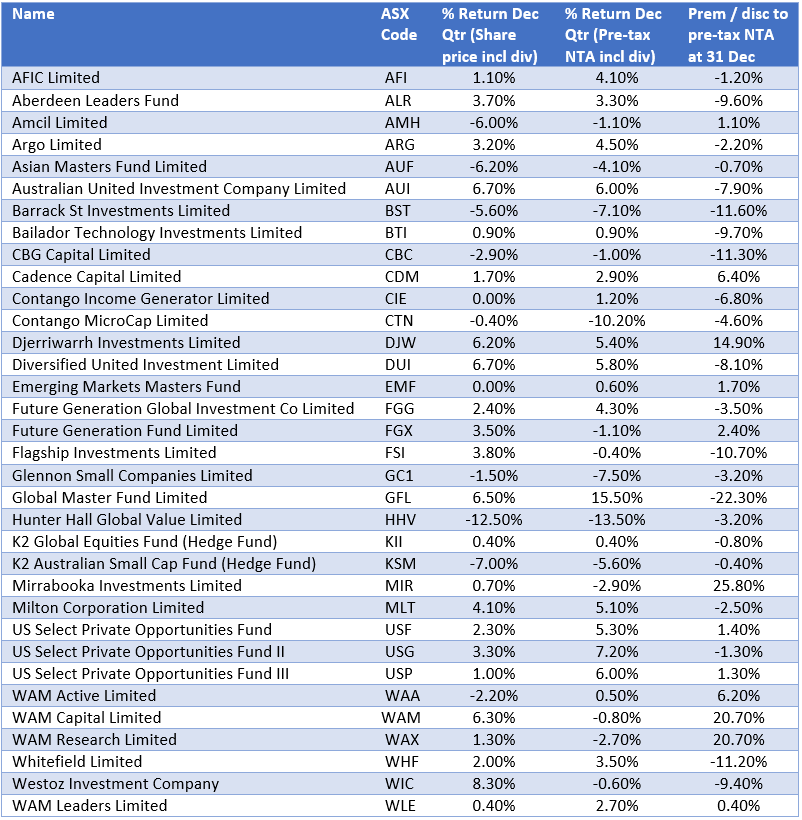

IIR’s analysis uses two different measures. The first is total returns (share price gain or loss plus dividends) which represents the actual return received by shareholders from their investment. The second is pre-tax NTA plus dividends, which is better for evaluating manager performance.

Using this second metric, the best performing fund for the December quarter was Global Master Fund (ASX:GFL) with a 15.5% increase in portfolio value due to a strong share price performance of its core holding, Berkshire Hathaway. As the overall market performed well, so too did the majority of LICs included in the Review. However, some small cap LICs had negative returns.

If using the first metric, Westoz (ASX:WIC) was the best performer for the quarter with an 8.1% total return in share price and dividends due to its resources focus. This reduced the discount to pre-tax NTA from 16.8% at 30 September 2016 to 9.4% at 31 December 2016.

Premiums and discounts

As at 31 December 2016, 12 of the 34 LICs covered were trading at a premium to pre-tax NTA. The largest of these was Mirrabooka Investments (ASX:MIR) at 25.8%, followed by WAM Capital (ASX:WAM) and WAM Research (ASX:WAX), each at 20.7%.

At the other end of the scale, Global Master Fund (ASX:GFL) was trading at the largest discount to pre-tax NTA at 22.3%, widening from 15.8% as at 30 September 2016. Over the past three years, GFL’s discount has averaged 14.4%.

The table below shows the quarterly performance for each of the 34 funds as measured by both metrics mentioned above, along with their premium/discount to pre-tax NTA:

Leisa Bell is Assistant Editor at Cuffelinks.