I have a very specific question that I would like one of your experts to answer. My question is about the difference in tax rules between managed funds and Listed Investment Companies and which is most appropriate inside or outside super. I read and understood the rules but I am still confused. There are products like Magellan Global, Platinum Global or Watermark Market Neutral Fund which have both a managed fund version and a LIC version. The managed fund version usually has stellar returns but higher tax would be payable; the LIC version usually has worse returns but would give lower tax and franking credits. Does that mean that managed funds are better in super and LIC are better outside of super? Thank you very much for your help. Kind regards, Laurent

Frank Casarotti, General Manager of Distribution at Magellan Asset Management, sets out the differences between these two investment structures. Magellan offers unlisted managed funds, listed 'Exchange Quoted Managed Funds' (EQMF) and a Listed Investment Company (LIC), and there is a video in our Sponsor Noticeboard further explaining the differences.

Reply from Magellan:

It’s difficult to comment on whether managed funds or LICs are more suitable inside or outside super. It really depends on the investor’s preferences (e.g. non-tax features of the product, cash distribution or dividend reinvestment plan (DRP), frequency of distributions, asset classes, franking credits or not, etc.).

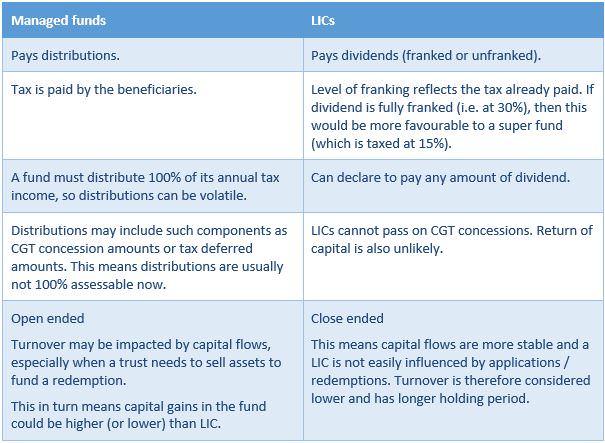

Here is a table highlighting the major differences.

Frank Casarotti is General Manager of Distribution at Magellan Asset Management. This is general information only and does not consider the circumstances of any investor.

If you'd like to read more about LICs and managed funds, check out these Cuffelinks articles.