In the Cuffelinks’ reader survey regarding the pros and cons of a bank royal commission (RC), the majority (70%) said they opposed a RC, although there was less agreement on the reasons for the opposition among a diverse range of strong opinions.

Common among supporters were issues surrounding executive salaries and bonuses, the failings of regulators, and fraud and unconscionable conduct.

Those who opposed tended to agree with the arguments put forward in the related article, 10 reasons not to hold bank royal commission, especially time and cost, doubts about what it would achieve, lack of firm terms of reference and a view that banking regulators should be allowed to do their job.

Results summary

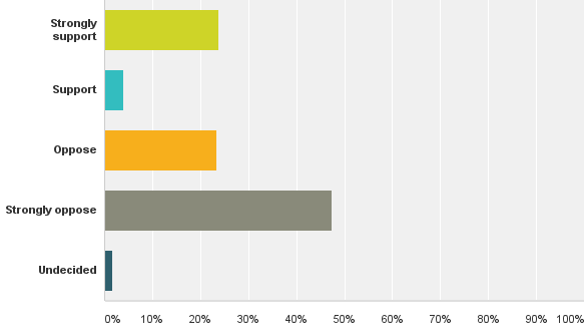

Question 1: Do you support or oppose holding a royal commission into the banking and financial services industry?

Among the more than 250 responses, the percentage split was around 70/30 against. This would indicate that while the wider public shows strong support for a RC, people that are more engaged with their investments and perhaps even linked to the industry in some way, cannot see a RC making the difference everyone wants it to.

Can our politicians put politics aside and act on the industry’s shortcomings without the hoo-ha of a RC? It’s a challenging question. Comments for Question 1 can be found here.

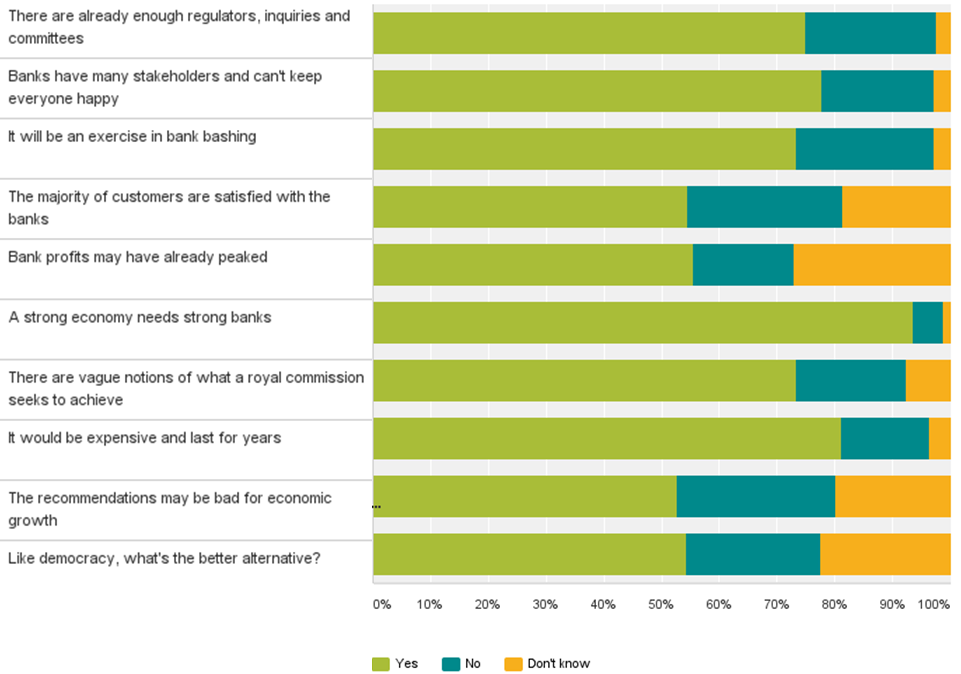

Question 2: Do you agree with the points made in Graham Hand's article?

Most of those who took the survey agreed with or were convinced by Graham’s arguments, although four of the points were supported by only a little over half the respondents: issues of customer satisfaction, bank profit levels, benefits of RC recommendations, and alternatives to a RC. Clearly the most agreed upon point was that, for our economy to be strong, we need a strong banking system.

Comments for Question 2 can be found here.

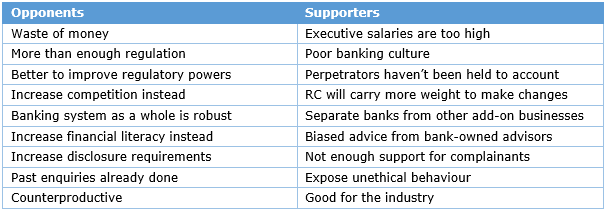

Question 3: Please add any other comments.

Summarising all of the comments is difficult given the wide variety of opinion and many people draw on their personal experiences. Even so, some of the recurring phrases (from each camp) went a little something like:

Comments for Question 3 can be found here. Thank you to all our respondents, including the many who disagreed with Graham's original article. We await future developments with interest.

Leisa Bell is Assistant Editor at Cuffelinks. No responsibility is accepted for the comments by any of our readers and they are presented in the spirit of an open conversation.