Over the course of 2018, the focus on peer relative comparison of superannuation fund investment returns has increased, fuelled by the usual end of financial year comparisons, and this year compounded by the Productivity Commission and Royal Commission reviews.

While it is right for fund returns to come under close scrutiny - after all, the impact of a lower return on a member's balance over the long term is significant - there are many aspects of these comparisons that are deeply flawed.

1. Excessive focus on the short term

Anyone who builds a multi-sector investment portfolio knows that they are designed to deliver over the long term. The focus should be on five years or more for most 'growth' or 'balanced' funds in the performance surveys, and even better seven or 10 years. The media and the survey providers grab on one year is largely meaningless.

2. Ignorance of investment objectives

The stated investment objective of most balanced superannuation funds is usually stated as a 'CPI plus' return over a specified time frame. For example, a 75% growth asset fund would typically have an objective of CPI + 3.5% over five years.

It was notable that during the Royal Commission hearings, the focus was almost exclusively on peer relative performance measures rather than performance against the investment objective. The Commission examined which funds had outperformed others, and more often than not industry funds versus retail funds. Yet even the bottom quartile fund in the SuperRatings survey has delivered 7.8% pa over five years and 5.7% pa over 10 years to June 2018 (the latter is lower as it still includes the impact of the GFC), against an investment objective of around 5.5% (based on CPI + 3.5%). The fact that almost all funds achieved their stated investment objective, even including the GFC, has been completely ignored. These funds have achieved what they had promised to deliver to members over the long term.

3. Major differences in asset allocation within same category

For reasons of practicality, comparison surveys include funds with a wide range of growth-defensive mixes in each bracket. For example, for the most-watched growth-oriented survey categories, SuperRatings covers 60-76% growth assets, while Chant West has a range of 61-80%. This is a very wide range. During rising equity markets, a fund with 60-70% growth assets will of course perform worse than funds in the 70-80% range.

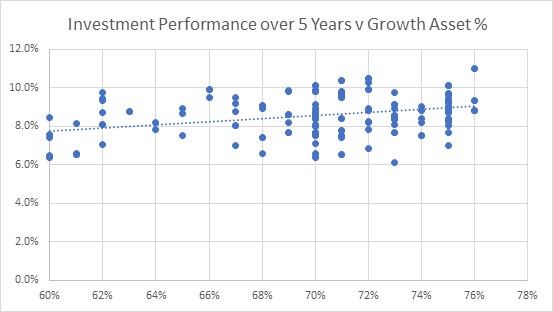

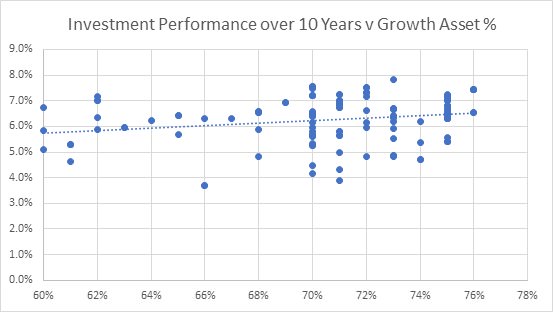

A trend line of fund returns against growth asset levels suggests that a 10% increase in growth assets (from 65% to 75%) produced a 1% higher return over five years, and a 0.5% higher return over 10 years. This is enough to move a fund from 1st quartile to 3rd quartile over both time periods, a massive difference in performance ranking.

In this age of quantitative analysis, survey providers should provide a regression fit showing the best fit line for the results, which then allows a comparison of an individual fund's performance at the comparable growth asset allocation, as shown in the chart below. Funds could then be compared against what they should have been expected to return. A fund above the trend line has outperformed at its level of growth assets, and equivalently for those funds below the trend. This would then focus attention on funds relative to their own growth asset positioning.

After all, a fund with 76% growth assets could make bad decisions and underperform relative to what it should achieve, just as a fund with 65% growth assets can. The higher equity exposure should not disguise the real result.

A resultant impact of the focus on peer relative performance is that funds have started to push themselves towards the top end of the survey brackets, so there is a cluster of funds with growth asset allocations towards the top end of the bracket (as can be seen in the above charts, for the SuperRatings survey).

Of course, targeting higher return also comes with higher risk. This is not necessarily driven by what is the best investment structure for their members, but by the desire to outperform competitors.

4. The growth versus defensive asset definition game

The assessment is made even more cloudy because there is no industry-wide standard for defining growth and defensive assets. While some assets are easily defined as 100% growth (listed equities, private equity) or 100% defensive (cash, sovereign and investment grade corporate bonds, inflation-linked bonds), there are many assets that exhibit both growth and defensive qualities, such as unlisted property and infrastructure assets, high yield bonds, alternatives.

Rather than having a standard accepted definition, funds are allowed to make their own choice. Inevitably, some funds have been aggressive in saying some growth assets are defensive, allowing them to load up on other growth assets to the point where they should not be in the survey bracket they are allocated.

Guidance for allocating between growth and defensive

Applying some simple metrics such as the ones below would provide guidance for how to allocate assets on the growth-defensive range, especially for unlisted assets:

- Volatility (standard deviation) of the asset class (higher volatility = higher growth allocation)

- Correlation of the asset class returns with listed equities (higher correlation = higher growth allocation)

- The largest historical drawdown of the asset class over the last 30 years (bigger drawdown = higher growth allocation)

- The breakdown of the asset class return into its capital and income components (greater % in capital return = higher growth allocation, and vice versa) and

- The level of leverage of underlying investments within a fund (higher leverage = higher growth allocation).

Rightly or wrongly, survey providers have argued it is not their role to dictate to funds on this question. While that in itself is debateable – some leadership on this issue would actually be in their interests - what is needed is an industry-wide agreement (preferably sponsored by an industry body) on some parameters to decide the correct growth-defensive allocation.

As some unlisted property and infrastructure funds include a variety of types of assets, this could include requiring investment managers to provide an assessment of growth-defensive qualities of their own funds. For example, an unlisted property manager could assess each property on its capital and income components, historical volatility and the like, and conclude its fund on average should be classified as 50% growth and 50% defensive. A superannuation fund would then use these metrics to calculate a fund-wide breakdown of its product (as the sum product of the asset allocation and the growth % allocation).

While it may be too much expect the media to focus on long-term returns (both absolute and relative to peers) and performance against investment objectives, these relatively easy measures would markedly improve peer relative performance comparisons, and provide a more like-with-like comparison of fund returns. It would also remove the gaming currently prevalent in the system, and focus attention on the real story – generating a return net of fees and taxes that will meet the retirement needs of members.

Phil Graham is an independent investment committee member. Until recently he was Deputy Chief Investment Officer with Mercer.