(As many of our readers go straight to the website for articles, this piece on GameStop repeats information included in the editorial).

Regardless of the many theories floating about on the impact of the extraordinary events around GameStop (GME) trading, there is one market fact: you never know who is on the other side of your trade. The Reddit tribe is portraying a victory against a few hedge funds as the little guy gaining revenge over Wall Street, but many of the 'suits' are enjoying the ride.

Young Reddit users fighting the establishment seem to believe that everyone chatting on their sites is on the side of the good guys. But anyone can sign up and start posting comments, and professional traders and hedge funds make a living drawing information from many sources. They not only monitor what is said on these sites, but they post comments that suit their own market positions. For many years, ASIC and other regulators have warned about brokers using social media to influence the market, recognising that experienced traders are inside the tent. They can 'pump' up the price with their words and actions, and once the frenzy starts, 'dump' their shares into the hands of newbies.

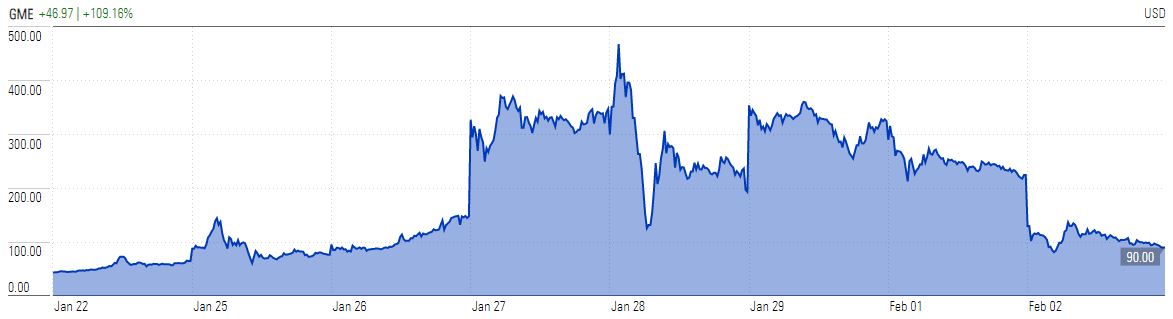

It's doubtful whether there are enough individuals with 'diamond hands' to hold out against hedge funds and other professionals in concerted attacks, and control their own destiny. In the parlance of subreddit group r/wallstreetbets, diamond hands are where investors are hard and committed enough to sustain a position despite the potential risks and losses. The opposite are 'paper hands', where holders are weaker and fold early. GameStop shares have already fallen from US$500 to below US$100, and while a few hedge funds have suffered, it is guesswork knowing who has won and lost overall. The memes come out as the Reddit group implores members to be diamonds.

Many large players on Wall Street have already benefitted from the rise in the price of GameStop. For example, Fidelity and BlackRock each own more than 10% of GME shares. The owners of Reddit and Robinhood (which undertook a multi-billion dollar equity raising) have seen the value of their businesses rise as millions of new users subscribe to their services. The r/wallstreetbets group had 2.8 million members at the start of this saga and it is now close to 10 million.

Many fund managers, both longs and shorts, jumped aboard the trading to take advantage of the volatility and GameStop pushing towards US$500 then down to below US$100. And the likes of Goldman Sachs are mandated to manage a public offer of Robinhood with spectacular fees attached. While we can categorise the young Reddit members as a sub-group of renegades fighting the system, and some hedge funds were indeed caught out, Wall Street in general is far from defeated.

Reading the Reddit posts, a lot of individual users seem to think this is a game, with people saying GME is going to US$1,000. Apparently, holding the stock of a struggling retailer is a way to finance their education or buy their parents a car. Well, investing is not that easy and this was always going to end badly for many.

Source: Morningstar Direct

The popular view that Robinhood is democratising investing by making trading free overlooks the fact that someone has to pay for it. Robinhood makes most of its revenue on 'payment for order flow' (PFOF) where trades are directed to market makers not immediately to exchanges. These professional traders make money from knowing the order flow, so the Robinhood users are helping the very people on Wall Street they think they are punishing. Citadel Securities, Wolverine Securities and Two Sigma hedge funds exploit the retail trades while Reddit users jump on social media claiming they just fooled the big guys.

In fact, many fund managers on Wall Street don't even like hedge funds, especially those who have been victims of short selling attacks on shares they own. While there's a strong case that selling a stock that is overvalued is as legitimate a way to make money as buying an undervalued stock, some tactics used by hedge funds are less defensible, such as when they write reports specifically to drive prices down. Hedge funds certainly have their enemies, and there's little sympathy evident in our interview with a prominent CIO.

And finally, many pension funds globally, including super funds in Australia, are themselves investors in hedge funds. Our own Future Fund is a major allocator. It is possible that the Reddit conspirators caused losses in hedge funds managing the retirement savings of their parents.

The Peridot Capital Management newsletter quotes another example of a stock targetted by the Reddit army, AMC, a struggling movie theatre chain, and how the rise in share price benefitted a large holder:

"Silver Lake Partners, a large, well known private equity firm held $600 million of AMC convertible debt due in 2024, which was in a dicey spot with the convert price well into the double digits. Well, they acted fast last week, converting the debt into 44 million shares of equity as the stock surged into the high teens, and selling every single share the same day the stock peaked. That’s right, they go from being one of the largest AMC worrying creditors to being completely out at nice profit in a matter of days. Note to Redditers: that’s how you ring the register!"

So yes, it was a clever attack at a vulnerable part of the market, where closing short positions involved buying shares which exacerbated the price rise, and forced index funds to buy shares. But the media characterising it as the revenge of the 99% on the 1% or akin to 'Occupy Wall Street' are not thinking about who is on the other side of the trade. And let's face it, the motivation of most Reddit users is to make money, not campaign for equality. They are not parents struggling to put food on the table and pay the rent, and cheap access to call options is not what the 99% was crusading for.

There are legitimate comparisons to the disenfranchised who voted for Donald Trump, as nobody was punished for the excesses of the GFC and central bank liquidity has pushed the stockmarket to record levels while others suffer from slow economic growth and unemployment. Those with assets have increased their wealth while wages have stagnated. It is inequitable. Cheap money, free trading apps and social media have opened the door for a coordinated attack which has surprised professionals, and many are enjoying seeing parts of Wall Street suffer.

Either way, let's record this moment in financial history where the shares in a struggling video retailer rose from US$3 to over US$500 in a year without any improvement in the fundamentals of the company. Here's a screenshot from Robinhood on 28 January 2021 of five days of GameStop prices.

We will never know who won and who lost as GME shares fell over 80% in the following week, but we do know the hedge funds will be better prepared in the next short attack, even if the risks of shorting have increased.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor.