Looking at month-to-month outcomes, October 2014 could be filed away as another month of reasonably normal returns. However if you lived through it day-to-day, there was lots of volatility and events, including somewhat of a ‘mini-panic’. Perhaps it’s better to ignore the detail! However, markets are dynamic and learning opportunities should not be ignored. A recent business trip to the US gave me a chance to reflect, leaving as many questions as answers.

Reasons for the mini-panic were not new

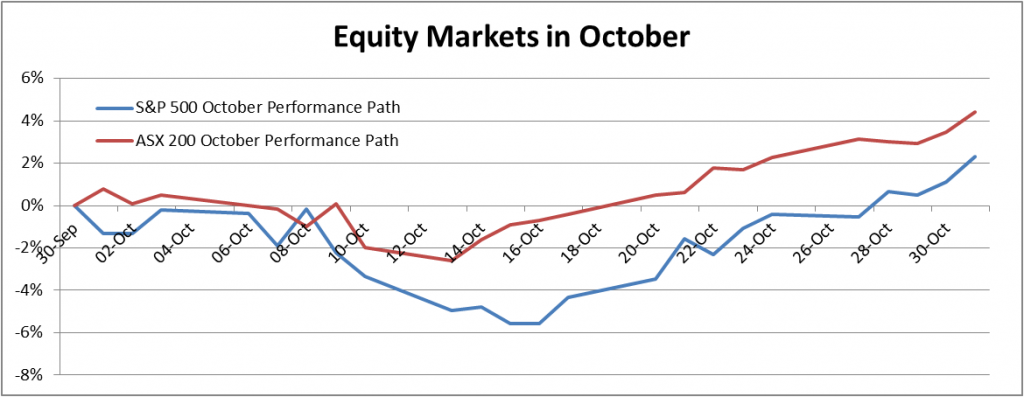

The performance path for October 2014 for US and Australian equities is presented below.

Source: Bloomberg

It looks like October was a non-event in Australia (falling only 2% by mid-month), but recall that Australian stocks were already close to 7% off their highs heading into October.

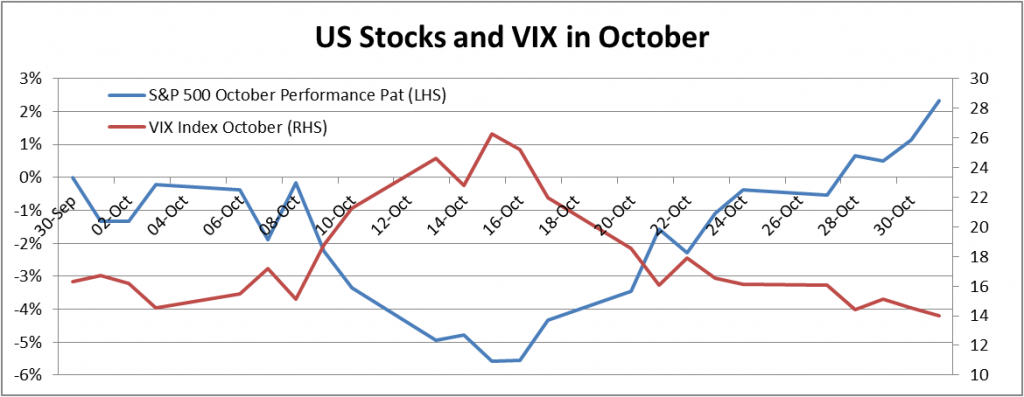

There were no real new reasons for the mini-panic during the first half of October. I title it a ‘mini-panic’ as the VIX index (a measure of implied market volatility, commonly known as the ‘fear index’) rose sharply before subsiding. The threat of Ebola, global security issues, strong USD, concerns of a European triple dip recession, further weakening in China, market over-valuation, inevitable rate rises in the US … the market was well aware of these issues. So what started the October mini-panic? When it comes to market triggers, we often don’t know. It can be as simple as a couple of larger market participants selling down and this spooks others into action.

Source: Bloomberg

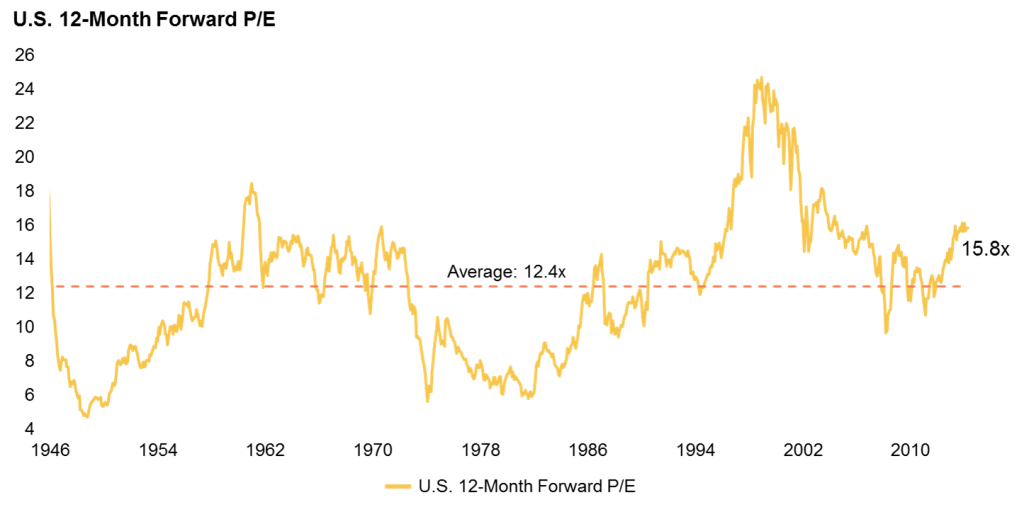

Overvalued equity markets but interest rates are so low

On many measures equity markets are overvalued. In the US in particular, profit margins are at abnormally high levels, so any reversion to this component makes US companies appear even more overvalued. The chart below is one of many valuations of the US equity market.

Source: Morgan Stanley Investment Management Global Multi-Asset Team analysis.

When valuations are stretched it feels like minor falls can turn into major market corrections. But while interest rates remain at extraordinarily low levels, it is difficult for equities to fall significantly as investors are reluctant to accept the alternative of zero return guaranteed. October proved the same when sharemarket falls in the first half of the month were accompanied by falls in bond yields (suggesting lower interest rates for longer) which attracted investors back to equities. These are uncomfortable times for asset allocators who focus on fundamentals.

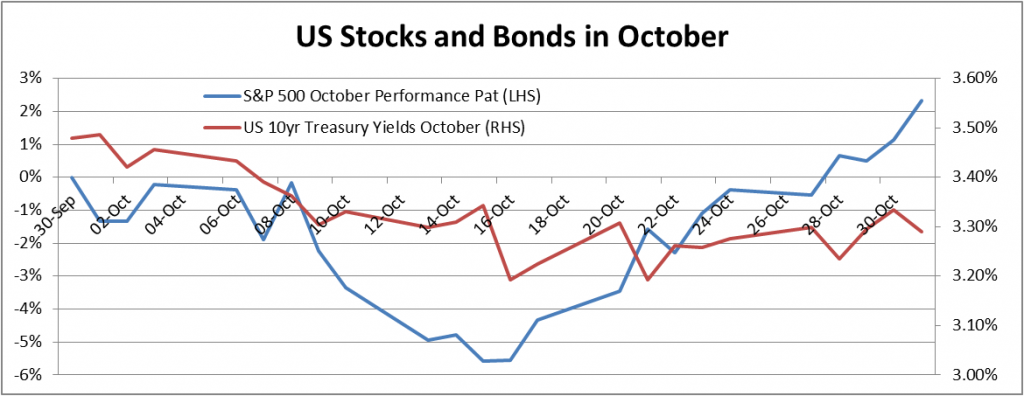

Bonds provided diversification during the mini-panic

Like many market observers I constantly worry that at some point bond yields will sell-off and this will cause a sell-off in equities at the same time. This structural break in the historical correlation between equities and bonds would create a difficult environment for investors (such an event has occurred in the past). Traditional diversification will have failed. However October proved not to be this case: equities fell and bond yields rallied and so the status quo was preserved. I can rationalise this: while short term interest rates are very low in the US, bond yields are a fair bit higher (so the yield curve is reasonably steep). This leaves room for bond yields to rally reflecting a market view, not that interest rates will fall, but that interest rates will be lower for longer. The rationalisation in my mind is that the risk of traditional diversification failing is more nuanced: while the yield curve is steep, and if the negative catalyst is an economic growth concern, then the traditional relationship (diversification) between equities and bond yields may well still continue. If the curve is more flat or the catalyst is rising interest rates then the traditional relationship will be challenged.

Source: Bloomberg

Hedge funds struggled but don’t write them off

Hedge funds struggled in October. There were some idiosyncratic events (two large trades common to many managers experienced adverse events – AbbVie’s takeover of Shire and a ruling on Fannie Mae/Freddie Mac preference shares) were just an unfortunate coincidence with October’s events. But months like October (a mini-panic and then a strong recovery) are difficult for hedge fund managers because many cut risk in response to market falls and rises in volatility. So hedge funds locked in some of their mid-month losses whereas traditional long-only equity fund managers recovered all of their losses. That said I wouldn’t write off hedge funds. Such an approach to risk management has the potential to protect them in an extremely difficult environment.

Market structure has changed: watch your liquidity

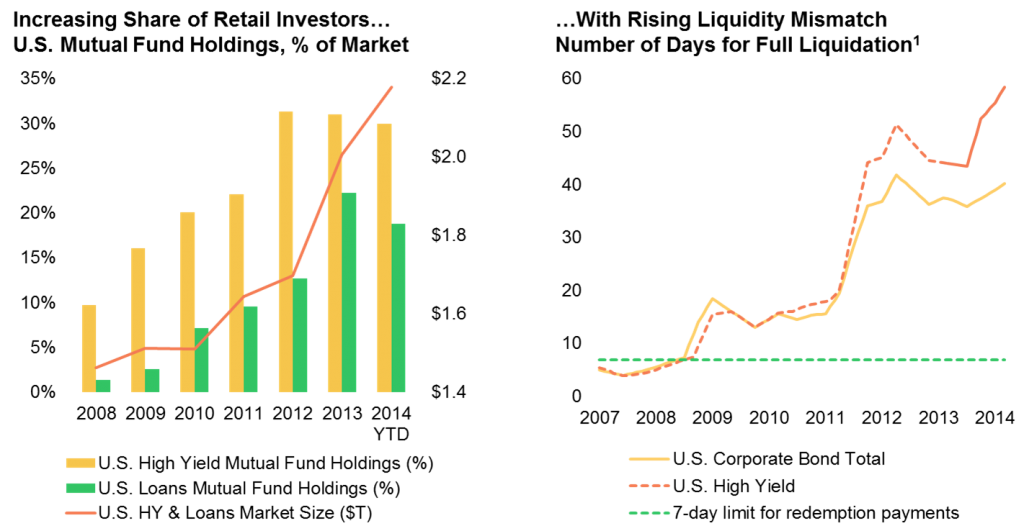

The structure of the market (the mixture of market participants) constantly changes. It is an area which requires ongoing monitoring. One of the big themes has been the reduction in bank proprietary capital. Deprived of capital banks now carry less inventory. This means that when you go to transact in a security like a high yield bond, the bank is less likely to exchange with you directly (on their own balance sheet) and more likely to be an arranger of a sale by finding another interested counterparty. This can negatively affect liquidity.

For example, there has been a massive inflow of capital into high yield bond funds and ETF’s by retail investors, as shown in the first graph below, presumably chasing the higher yields on offer. The underlying funds offer daily liquidity. So the potential availability of liquidity is lower and the potential demand for liquidity is higher. This doesn’t sound appealing to me. Redemption expenses could be higher and there is an increased potential for larger market events. However October didn’t test this change in market structure: because high yield bonds are fixed rate and interest rates rallied, high yield bonds performed reasonably and outflows were not substantial. In my assessment a good risk manager would mark their high yield exposure as less liquid and having a larger negative skew to its return distribution.

Source: EPFR; IMF; Bloomberg LP; Morgan Stanley Investment Management Global Multi-Asset Team analysis.

Markets like October provide useful lessons

While October 2014 market behaviour proved to be a mini-panic which was quickly recovered, it created useful insights. Thinking through the issues, working out the appropriate balance between return and risk, and watching for emerging risks and regime changes are what makes the job of a portfolio manager so fascinating.

David Bell is Chief Investment Officer at AUSCOAL Super. This article is for general educational purposes and is not personal financial advice.