Few issues in retirement planning have received more attention in recent years than life expectancy and longevity. Most people can expect to live to 90 or 100 years, which could mean 30 years in retirement, financed by either a meagre government pension or personal resources.

It’s understandable that people do not worry about retirement savings while in their 20s and 30s, and even into their 40s with children and mortgages to worry about. But research on Australian retirement by three academics, Julie Agnew, Hazel Bateman and Susan Thorp, leads to the following conclusion:

We find that more than half of Australians in their 50s and 60s have not planned key aspects of retirement. A small minority have detailed and advanced plans. In addition, expectations around these issues and actual realisations may not be well matched.

Work, Money, Lifestyle: Plans of Australian retirees, JASSA Finsia Journal of Applied Finance, 2013

A minority choose their own retirement date

The survey asked 920 Australians aged between 50 and 74 years about their knowledge, values and plans around retirement age. The majority of not-yet-retired had done virtually no planning for the transition to retirement, perhaps because they expected to decide for themselves when they would stop paid work. However, of those who were already retired, only 40% said they decided their own retirement date, while 60% were either forced to retire or encouraged out of the workforce, as shown in Figure 1.

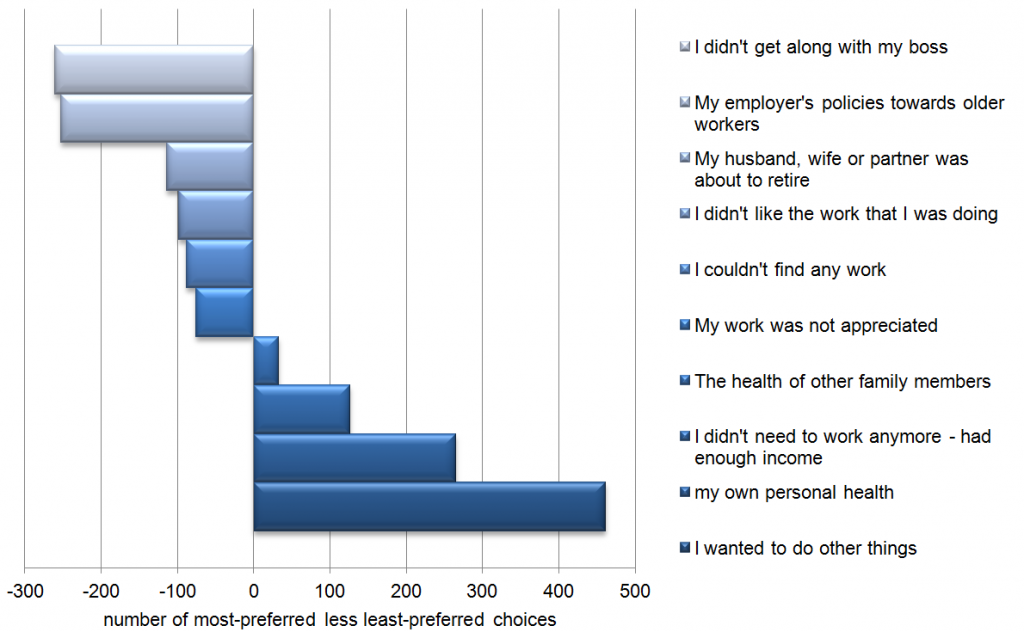

Figure 1: Relative ranking of reasons for retirement by already-retired people

(The bar lengths are determined by counting the number of times people ranked the reason as ‘most important’ and then deducting the times when it was ranked ‘least important’. Survey respondents were shown sets of statements listing the reasons for retirement and were asked to choose the one that most applied to them and the one that least applied to them).

As Figure 1 shows, the most important reason to retire was ‘I wanted to do other things’, but factors beyond the retirees’ control, including personal health and unwelcome work environment, were major factors in retirement. As the authors state, “The likelihood that events outside one’s control determine retirement timing makes advanced financial preparation more critical.”

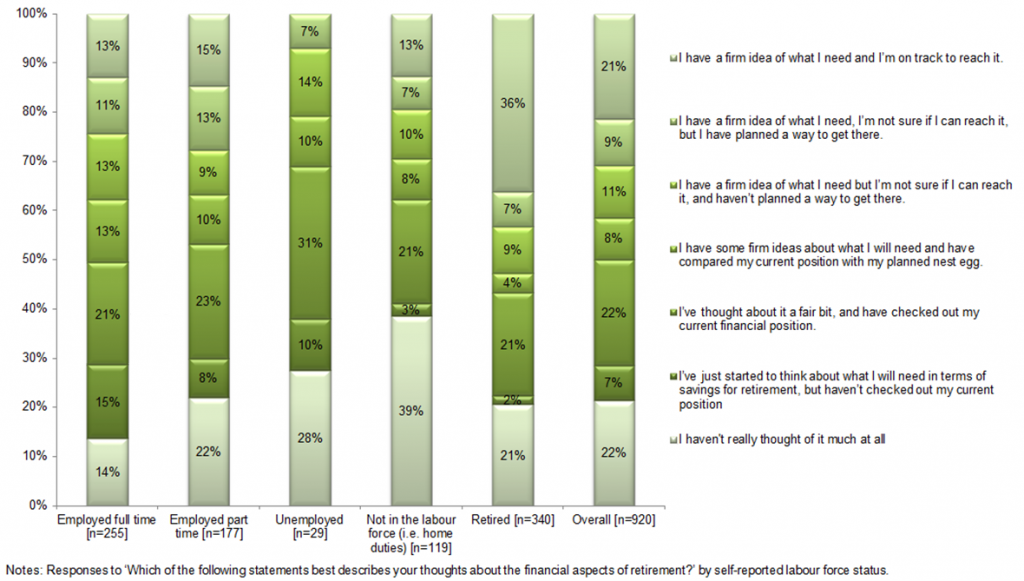

Figure 2: Financial planning by labour force status, % of sample

Only 48% of Australians aged 50 to 65 years have attempted to work out how much money they will need for retirement. About one in three has a firm plan on how they will reach their retirement needs. It’s not surprising then that about half of pre-retirees expect their standard of living to decline in retirement.

Activities and lifestyle

The survey also revealed that about 40% of pre-retirees had given little thought to what they might do in retirement. For those who made plans, travel and leisure activities were priorities. Those who had already retired reported carer responsibilities and volunteering had been more important than anticipated. Of those who had returned to work, most said it was for work enjoyment rather than needing the money.

So while there is generally a lack of planning for retirement, Australians are looking forward to more travel and leisure. Let’s hope they've got the money to enjoy those retirement years, because there will be far more years than most of them expect.

Graham Hand is Editor of Cuffelinks and has worked in the finance industry for 38 years.