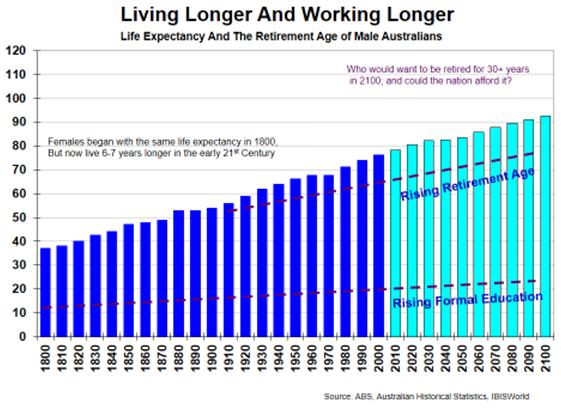

We live a lot longer these days, thanks to better diets, modern medicine and health services, less accidents (OH&S) and other developments. The first chart traces this increased longevity over several centuries and on to the end of this 21st century.

Life expectancy has more than doubled from the 38 years early in the 19th century, and may rise a further one-third by 2100 to be close to 100 years of age on average.

Interestingly, the amount of paid work in a man’s lifetime has never varied over many centuries: always 75-80,000 hours. All that has changed is that this amount of work is spread over 50 years, not the 25 years of the early 1800s. In essence, we work half the number of hours in a year. Further, we tend to begin our working lives with part-time or casual work, and finish that way: it makes for a more tapered start and finish. Much more civilised.

So retiring comes later and later in life, and given that most jobs are now cerebral rather than physical, the only way to wear the brain out is to stop using it!

Indeed, retiring closer to 80 years of age in 2100 will probably be the norm. Already, 65 is too young for more and more people.

In case we think work is very different for females, it is becoming less different. The total amount of paid and unpaid (household) work has been the same for both genders anyway for centuries at 125-130,000 hours; but now - due to more education, more equality and flexibility in the workforce, and the outsourcing of household functions – the female ratio of paid to unpaid work is favouring the former.

Apart from longevity, modern economies have underpinned the eventual retirement of its members in several ways: pensions, other forms of social security and superannuation.

Australia is one of the world’s leaders in the last mentioned along with Singapore and a few others. Our scheme, begun under the Keating Government in 1993, now sits at 9% of wages and rising to 12% in the 2020s. A level of 15% would be even better – enabling life-long super-contributors to retire for the rest of their life, however long – on a half or more of their final annual wage.

In today’s money terms that would be over $70,000 per household (and keeping pace with inflation), plus any other sources of income they had. A comfortable retirement.

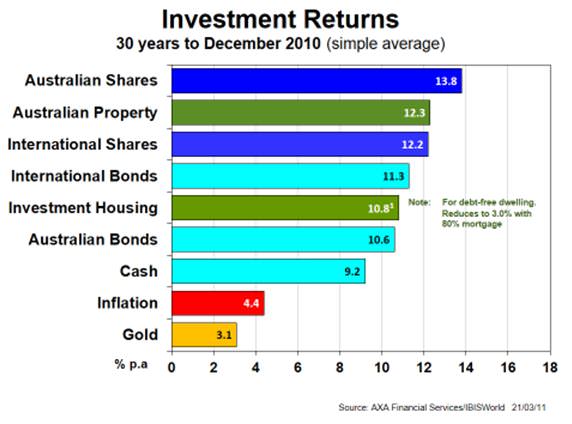

But where to put one’s nest egg to safeguard such a dignified and independent retirement? History provides a useful guide. The chart below shows the return on various asset classes over a 30 year period to 2010.

However, the decade to decade changes are significant in the pecking order of returns.

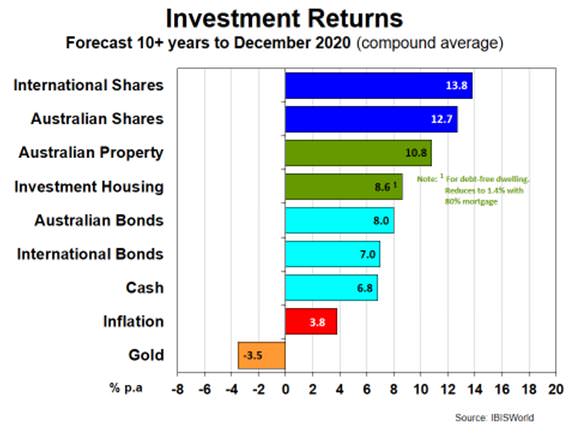

In the 10 years to 2010, gold topped the performance ladder for the first time in living memory; aided and abetted, of course, by the GFC. After all, these days, gold should be seen as a panic-metal or security blanket rather than having a currency-backing role which it lost in 1971 under the US Nixon Administration. So gold went from the worst performing asset to the best in the first decade of this new century. IBISWorld thinks the performance ladder will change again in the 10 years to 2020. The next chart is their current best guess.

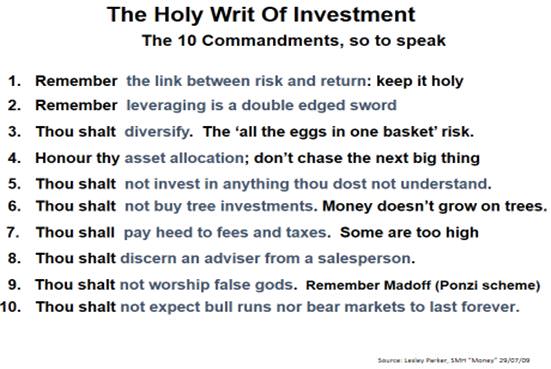

All this is a salutary reminder that investment is a tricky business. The year to year changes are just as volatile, if not more so, leading to the wisdom of having a ‘balanced portfolio’ and avoiding having ‘all one’s eggs in one basket’. This rule has been broken often in recent years and decades, leading to less and less sympathy from friends, relatives and the public at large for those that ‘lost everything’ through their own ignorance, stupidity or greed.

But perhaps the last word is best provided by Lesley Parker who published the following advice in the Sydney Morning Herald almost four years ago. Good sense then, and still is today.

Phil Ruthven is Founder and Chairman of IBISWorld, Australia’s best-known business information corporation, and he is also a director of other companies, advisory boards and charitable organisations.