(Update on 15 March 2020. The numbers in Roger's article were up-to-date on Wednesday 11 March 2020. While we will not rewrite the article, it is noteworthy that Italy had a spike in new virus cases and deaths at the end of the week, and the US (especially Donald Trump) is finally reacting seriously by declaring a national emergency. As Roger observes, developments in the US in the coming weeks will be a major factor in how markets perform. We now know coronavirus will have lasting impacts on the way business and society operates in future).

With the data changing daily, the only things moving faster than the spread of coronavirus are the financial markets. In this exclusive note for Firstlinks, we explore the possible paths the stock market might take in the next few weeks and months, noting short-term predictions are a very high-risk venture.

This too shall pass

Indeed, on the subject of short-term predictions, it’s worth sharing the 19th-century retelling of a Persian fable by both the English poet Edward FitzGerald and US President Abraham Lincoln.

When an Eastern sage was desired by his sultan to inscribe on a ring the sentiment which, amidst the perpetual change of human affairs, was most descriptive of their real tendency, he engraved on it the words: "And this, too, shall pass away."

FitzGerald retold it thus:

“It is said an Eastern monarch once charged his wise men to invent him a sentence, to be ever in view, and which should be true and appropriate in all times and situations. They presented him the words: "And this, too, shall pass away." How much it expresses! How chastening in the hour of pride! How consoling in the depths of affliction!”

When considering how deeply the world might be afflicted by Covid-19 it is worth remembering that we will not even be talking about it in five years’ time. Acknowledging the tragedy that the outbreak has already wrought on families all over the world is important. Notwithstanding, humans are resilient and adaptable and a solution will be found. When we look back, the virus will have been contained, a vaccine developed, and the world will move forward.

The viral and financial market contagions that could occur in the interim, and which have been demonstrated already, are worth considering, if only to try and anticipate when it might be best to venture a purchase of shares at prices that may not be revisited for a decade.

We care about the answers to this question deeply if only because, like Berkshire Hathaway, we also approach the crisis with about 30% of our portfolios in cash.

The success story in South Korea

We have been tracking the data daily, including the number of tests being conducted. This is important because you only find something when you are looking for it.

South Korea has published 183 updates since the start of the outbreak. This may be a function of their level of concern, which itself is a function of the country’s proximity to China. Regardless, at some point they realised they had a problem and began testing in earnest. As at the time of writing, South Korea has conducted 4,000 tests per one million head of population, or 210,000 tests in 10 days.

As a result of the tests, South Korea has produced a detection rate of 3.58% (obviously the infection rate is higher because not everyone is being tested and many are quarantining themselves at home).

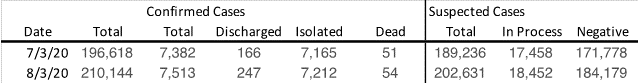

Table 1. South Korea

Source: Montgomery Small Companies Fund

As the data in Table 1 reveals, of the 210,000 tests, 7,513 have been confirmed with Covid-19 (3.58%). Of the 7,513 confirmed cases, 54 people (0.7%) have died, 96% have been quarantined and 3.3% have been discharged. Given that testing is continuing and that there is a large cohort who have been quarantined and are therefore unresolved the fatality rate of 0.7% is likely to go up.

But South Korea’s story is one of relative success, being able to isolate the outbreak to a death cult, and thye rapidly ramped up their testing.

The challenge in Italy

Italy, by contrast, is a basket case and the poster child of the consequences of a poor response.

As we write this note, Italy is experiencing the first economically and socially significant outbreak outside of China and South Korea. Italy is also the first liberal democracy to enforce a country-wide lockdown. Until today, the country had implemented a haphazard approach to lockdowns, confined to the Lombardy region. I say ‘haphazard’ because eyewitnesses at the sieve-like boarder control roadblocks reported cyclists and vehicles moving through the checkpoints unimpeded.

Italians turned up late to admitting there was a problem and consequently we have seen their numbers explode.

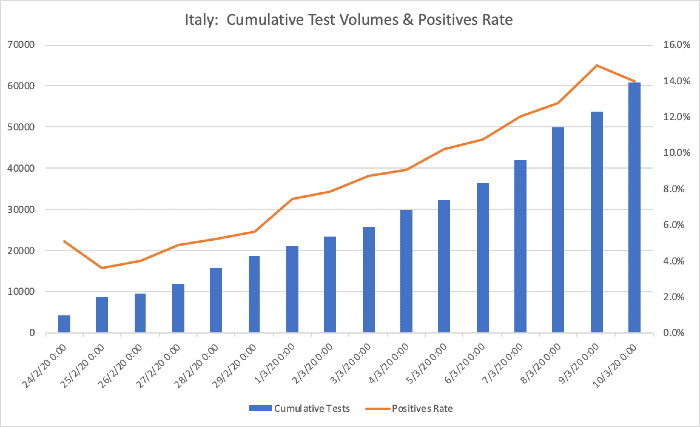

Italy today has only conducted a quarter of the number of tests per million (1000 tests/million population) that South Korea has conducted. And because those tests commenced late, they have been shocked to discover a detection rate of 16.7%. Italy only really started testing on 24 February with 4324 tests, but the number then fell away and it was not until 7 March that testing numbers again exceeded those earlier numbers.

As at today (10 March), the Italians have only tested 0.1% of their population and already they have experienced almost 12 times the number of deaths (631) as South Korea. As Figure 1 illustrates, this is the result of commencing and then scaling testing late.

Figure 1. Italian cumulative tests and positive results.

Source: Montgomery Small Companies Fund

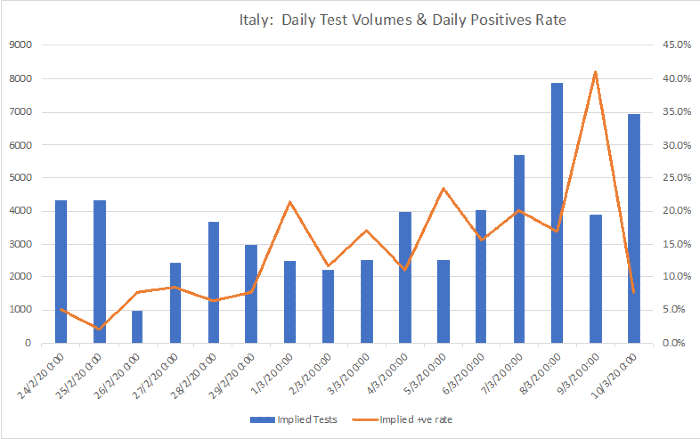

Figure 2 makes an observation that should be troubling for the US and therefore for the markets. As the rate of testing goes up in a country that is late to commence, the number of confirmed cases understandably surprises.

Figure 2. Italian daily tests and confirmations

US is slow to move

To show how late the United States is to respond to the outbreak, the CDC (Centers for Disease Control and Prevention) has thus far reported only 26 tests have been conducted per million population. The US CDC spotted coronavirus in January but left it to public sector laboratories to develop a test. It has obviously taken some time because by the end of February, the US had averaged 92 tests per day in a country of 340 million people! Today, the testing is beginning to scale and 810 tests were conducted on 6 March 2020.

If they scale effectively, what will the US find? They will report a high detection rate, much higher than the 7.5% detection rate as of 10 March 2020. Of the 647 confirmed cases, 4.3% have died. This number will rise too. Italy appears to be offering a road map.

A limiting factor is that Amercians do not kiss each other as a greeting, the US population is younger and the frequency of smokers is lower. However, a large number of people could die.

Short-term implications for equity markets

So, is it time to start buying the dips in shares again? The answer is probably not. Of course, there will be companies that are affected by the virus directly and if their share prices overreact negatively at any time, investors should ask whether the company’s ills are being treated as permanent. If the market is treating the issue as permanent, but it proves to be temporary, an opportunity could be presented. Keep that in mind.

The US could soon experience a parabolic jump in the number of confirmed cases as they scale up their testing. This means broad-based value may yet be just around the corner.

Roger Montgomery is Chairman and Chief Investment Officer at Montgomery Investment Management. This article is for general information only and does not consider the circumstances of any individual.