Donald Rumsfeld, US Secretary of Defence from 2001-06 during the War on Terror, separated risks into known unknowns and unknown unknowns. He was ridiculed at the time, but we can now see the point he was making. He is suggesting there are regular risks that we can plan and manage for, and there are some risks that are off the charts and difficult to prepare for. Some people also call this second group, 'black swan' events, after the Nassim Taleb book of the same name. The Covid-19 pandemic fits in this second group.

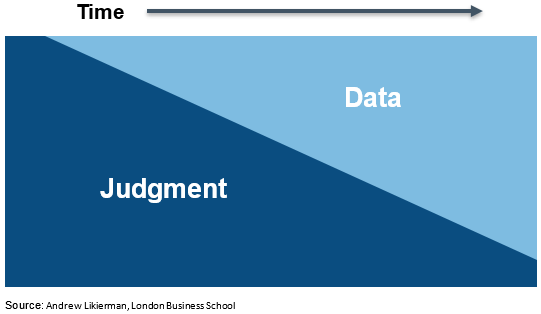

The difficult issue in dealing with black swan events is that you are dealing with little and imperfect data. At the start we have very little data and need to exercise a huge amount of judgement. As time goes by, we get more and more data and analysis and judgement is required less. Andrew Likierman from London Business School (LBS) represented this relationship graphically below:

The 'rule of thumb' influencing the market

In periods when data is scarce and huge amounts of judgment are required, people tend to use heuristics, or rules of thumb. These heuristics represent our knowledge of history and what tends to work best in these situations.

A key market heuristic in periods of crisis is to watch the second derivative. The second derivative is simply the rate of change or the acceleration or deceleration of whatever is causing the crisis. I think the market focuses on the point when the second derivative changes from acceleration to flattening or deceleration as it often represents the point of maximum pain and destruction.

In the case of Covid-19, that change in the second derivative may represent a heightened point of community concern and also the point of most aggressive government action. Markets are forward-looking and typically bottom nine months to a year before the economy bottoms. As the second derivative changes and governments increasingly talk about a six-month period, markets can now start to see the light at the end of the tunnel.

The second derivative is now changing in most parts of the world. We are seeing a deceleration of new infections in Australia as well as most of Europe, parts of the US and the majority of Asia. On cue, markets are responding to this change in second derivative and are now starting to improve. This does not mean that market volatility will end but rather we can see the light at the end of the tunnel and some relief is entering markets.

Building bridges in a social experiment

Governments in recent weeks have used analogies of bridge-building and hibernation. They have viewed this crisis as a giant ravine where we need to build a bridge over that ravine, or a sudden frozen snap where we need to go into hibernation to survive to the other side.

I do agree that this crisis is fundamentally one-off in nature and it is all about surviving to the other side. While I believe it is a one-off event and should be viewed as a 1x per event and not a 15x per event, it is important to note that life will be different on the other side of the Covid-19 crisis. There have been major disruptions throughout human history and while things get back on track eventually after that disruption, there can be many business, educational and community practices that change forever after the disruption.

For each major disruption, we effectively go through a huge social experiment. Under this social experiment we try new things, and some work, some don’t. The experiments that work we adopt forever. During WWII, as men went off to war, women entered the workforce to perform their jobs. At the end of the war as life resumed and men returned to their jobs, the workforce and its structure had been changed forever. WWII was the catalyst for women to enter the workforce and this increase in the participation rate has been one of the largest contributors to GDP growth globally for the past 80 years. A change occurred during this disruption, women never looked back and our economy and community had been changed forever.

There are other examples, like the birth and acceleration of the Indian IT industry post the Y2K bug, which demonstrate that changes that occur during major disruptions can change business, education and community practices forever.

Vijay Govindarajan and Arup Srivastava, writing in the Harvard Business Review, have used these historical examples as to why they think higher education will change forever post the Covid-19 crisis.

Focus on changes that survive the crisis

Thinking through these sorts of changes post the Covid-19 crisis is where I am spending most of my time at the moment. These changes may include an acceleration of existing trends like ecommerce, digital delivery of food and beverage, working from home, technology solutions for better communications, smaller office design and deglobalisation. All of these would create winners and losers in markets.

In terms of the Fidelity Australian Equity Fund, I remain very comfortable with the portfolio. The Fund is invested in large, blue-chip companies, which themselves are liquid in nature, and I look to selectively invest in sectors like technology, resources and travel as opportunities arise.

The Fund will remain well positioned through the current Covid-19 crisis. I have 100% of my superannuation allocated to my fund. I believe this is the right approach for alignment and taking the ups and downs with every investor.

Stay safe and invest well!

Paul Taylor is a Portfolio Manager of the Fidelity Australian Equities Fund. Fidelity International is a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2019 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited. FD18634.