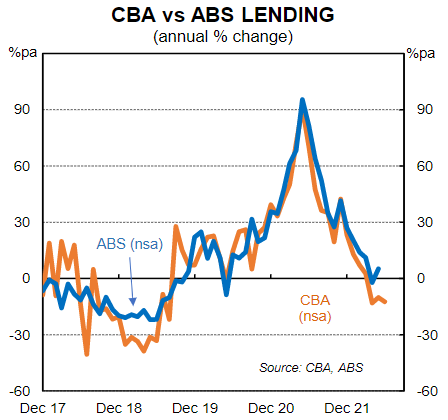

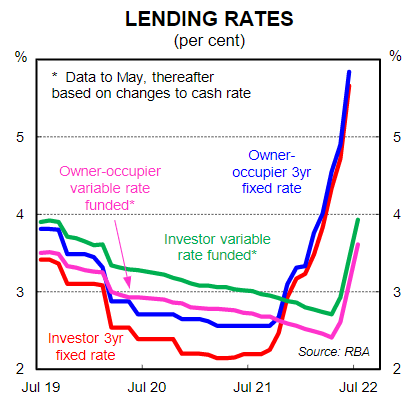

Lending data for June 2022 show that annual growth in new housing lending remained negative, approaching levels not seen since the restricted lending period around 2019. Reflecting the recent rise in interest rates, both fixed and variable lending rates are well above their pre pandemic levels. However, consumer lending for holiday finance and car finance increased.

Housing lending and rates

Annual growth in new housing lending remained negative with the weakness led by lending to owner-occupiers and also lending for the purchase of existing dwellings.

Borrowing costs for both owner-occupiers and investors have risen sharply in recent months. Both fixed and variable rates are now well above their pre-pandemic levels.

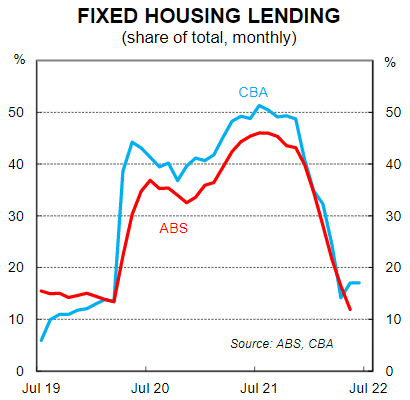

The fixed share of new lending was little changed in June. It remains around its pre-pandemic levels, having fallen sharply as fixed lending rates have risen rapidly.

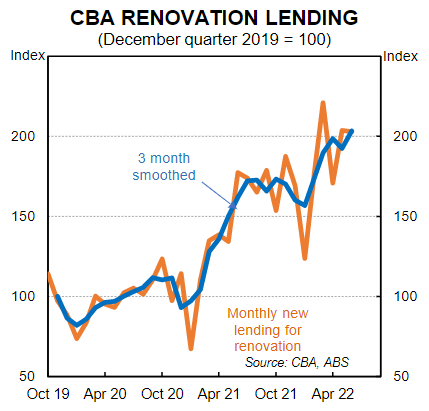

New lending for alterations and additions was unchanged in the month at a high level. On a smoothed basis, renovation lending appears to be at or close to a peak.

Consumer and business lending

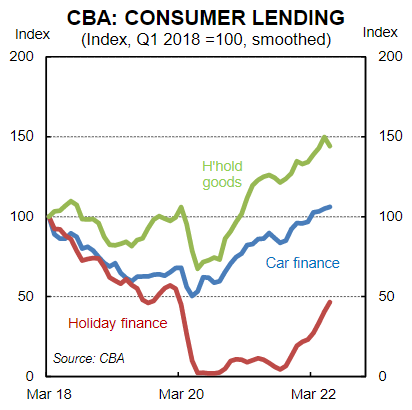

On a smoothed basis, consumer lending for both holiday finance and car finance increased but there was a tick down in household goods finance.

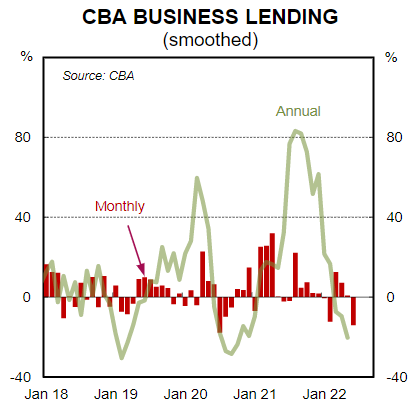

Business lending tends to be quite volatile, but on a smoothed basis, there are signs of a softening in new business lending.

Stephen Wu is an Economist for Global Economic & Markets Research at Commonwealth Bank of Australia. This report is for informational purposes only and is not to be relied upon for any investment purposes, as it has been prepared without taking into account your objectives, financial situation (including your capacity to bear loss), knowledge, experience or needs.