(Thanks for your interest in this Reader Survey, which is now closed with about 800 responses).

It is many years since we found out more about our readers and what they like and don't like about Firstlinks. We have received hundreds of responses to our Reader Survey, but we will leave it open for a few more days to maximise the sample size.

We promise we read and take onboard every one of the thousands of comments received. It is appreciated to hear so many of you look forward to receiving our newsletter.

Your feedback across a dozen quick questions will help to improve our content and it should take only a few minutes. The survey can be accessed via this link, or using the embedded form below.

The responses have been both insightful and surprising. Many have pointed to our independence and breadth of articles as strengths, and subcribers enjoy reading the comments attached to articles.

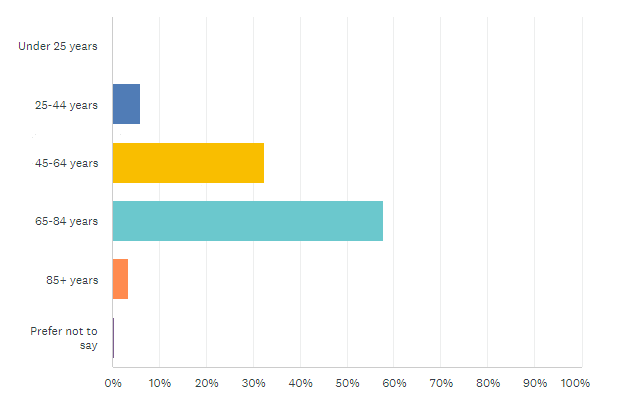

Age and SMSFs

One surprise has been the age of our subscribers, as the chart below reveals. We're sure there are more younger readers than shown here! Where are all the Gen X and Y?

Reflecting this age distribution, most respondents are members of an SMSF, and a high proportion are retired. This is far higher than in previous surveys, and probably shows who is willing to put the time into responding rather than representing our audience.

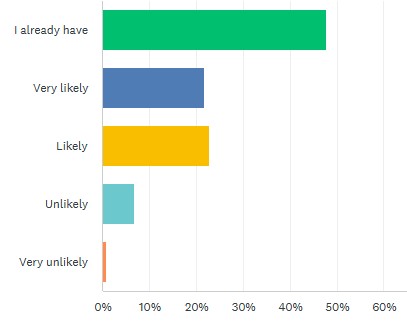

Passing to a friend or colleague

Firstlinks does not play the clickbait game of many newsletters, nor have we ever bought a mailing list, and we rely on our readers to refer the newsletter to friends and colleagues. We are grateful that 93% of respondents have either already referred, or are very likely or likely to, with some reasonable explanations of why they do not:

- Most of my friends are not interested, simply pay and have others do it

- I never refer or recommend anything to anybody

- Most of my friends are dead already

- I recommend to nobody. A problem with you becomes a problem with me

- Most folk don't want to know and invest in term deposits and are too afraid to seek paid advice.

How likely are you to refer a friend or colleague to Firstlinks?

It's also useful for us to learn more about the subjects you would like Firstlinks to cover.

It's also useful for us to learn more about the subjects you would like Firstlinks to cover.

What part of your investing do you want most help with?

So thanks again to all the respondents and please jump aboard if you have yet to share your views.