It is easy to see why people have been calling for the inclusion of the family home in the pension assets test. Why should someone who lives in a $2 million home receive the full pension? Changes to the age pension asset test taper are designed to reduce the entitlement of many part-pensioners, but they will also hit ‘downsizers’ and people moving into aged care, and the family home exemption has a major impact.

Under the current asset test a person (or a couple) lose $1.50 per fortnight of age pension for every $1,000 of assets they have in excess of the asset test threshold. The proposed changes will increase the maximum amount of pension (expected to be $30 per fortnight for a single) and the asset test threshold before their pension starts to reduce. There will also be an increase to the rate at which the pension reduces, from $1.50 per fortnight to $3 per fortnight. If you think you are suffering déjà vu that’s because prior to the asset test changes in 2007, the asset test taper was $3 per $1,000 of assets per fortnight – yes, back to the future!

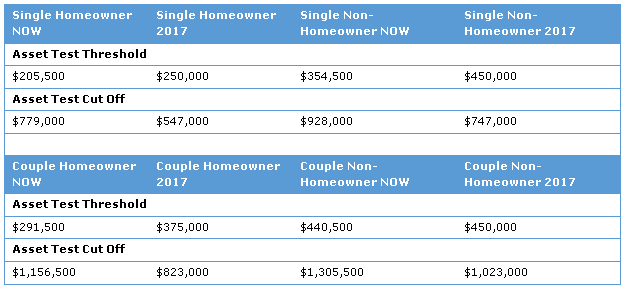

Here’s a snapshot of the changes to the asset test thresholds:

Watch the income test as well

The government estimates that 230,000 pensioners will lose some or all of their pension while 170,000 pensioners will receive more. Of course, the pension paid is based on both an asset test and an income test, with the test that produces the lowest amount of pension being the amount paid. Little attention is being given to the income test, to which my warning to pensioners would be ignore it at your peril! The income test often bites people before the asset test does, especially when the majority of someone’s assets is held in financial investments such as bank accounts, term deposits and shares and not holiday homes, boats, caravans or cars.

A single pensioner with $240,000 in the bank and a car and personal effects worth $10,000 may be entitled to the full pension under the new asset test, but under the income test their pension would still be reduced by $55 per fortnight.

For those who benefit from the changes, the joy may be short-lived if they choose to downsize to a retirement village or need to move to an aged care facility. This is because most people pay less than the value of their home. Under these changes they may be better off paying an amount that is equal to or greater than the value of their current home.

In a retirement community this may be a lot simpler. Some retirement communities will allow you to pay a higher amount going in and pay a lower amount as an exit fee. For people moving into aged care it is not so simple. The aged care reforms that were introduced on 1 July last year mean that residents cannot pay more than the market price. Adding to the complexity, downsizers who move to an Over 55’s community rather than a retirement village may find that it is more affordable due to the ability to access rent assistance and the fact that exit fees often don’t apply.

Let’s look at an example. Betty is a part pensioner who is considering moving from her family home to a retirement village. Her home is worth $650,000 and the unit in the retirement village is $400,000. Betty has $100,000 in the bank, $150,000 in term deposits and $10,000 worth of personal effects including her car.

Critical impact of the exemption of the family home

Betty currently receives $778 per fortnight (pfn) of age pension. If she remains at home the changes would increase Betty’s pension to around $860 pfn under the asset test but under the income test Betty would only be entitled to $829 pfn.

If Betty moves to a retirement village, and pays $400,000 for her unit, the extra $250,000 in assets will reduce her pension to only $110 pfn. Put simply, she loses $780 pfn of pension.

If Betty purchased a unit in an Over 55’s community for the same amount, her pension would still be $110 pfn but she could receive rent assistance of up to $128 pfn. This is because in an Over 55’s community, you own the home but rent the land.

Conversely, if Betty chose a more expensive retirement community, say $700,000, she would be $40,000 below the new asset threshold and entitled to $890 pfn. But her pension would only increase to around $860 pfn due to the income test. If the unit was in an Over 55’s community her pension would be $860 pfn and she could receive up to $128 pfn of rent assistance.

If instead Betty moves to an aged care facility and pays $400,000 her pension would be $710 pfn because she has the benefit of the non-homeowner asset threshold. If she chose a facility with a market price of $700,000, her pension would be $860pfn again due to the income test.

Downsizers have more choices around the price they pay and when they move. People needing aged care are limited by the market price arrangements introduced in July 2014 as well as the need to access care. Placing such a disincentive on downsizers and people who need care does not serve senior Australians or the young people who miss out on the opportunity to buy a home.

Rachel Lane is the Principal of Aged Care Gurus and oversees a national network of financial advisers specialising in aged care. Read more about aged care facilities in the book ‘Aged Care, Who Cares; Where, How and How Much’ by Rachel Lane and Noel Whittaker. This article is for general educational purposes and does not address anyone’s specific needs.