Although it’s only days until the end of the financial year, there is still time to establish a tax deduction by establishing a sub-fund within a public ancillary fund, such as the Australian Philanthropic Services Foundation. Unlike a private ancillary fund (PAF), there is no requirement to establish a new trust or trustee company, so a sub-fund within a public ancillary fund can be established immediately, and there’s no set-up cost to do this.

(Declaration of interest: I am the pro bono Chairman and Founder of Australian Philanthropic Services (APS), a not-for-profit organisation which sets up and administers private ancillary funds and public ancillary funds as well as providing grantmaking advice. See this link for more details).

What is a public ancillary fund?

A public ancillary fund is a philanthropic structure that allows a planned approach to charitable giving. Amounts donated by you to your own sub-fund within a public ancillary fund are immediately tax deductible, while donations to eligible charities from your sub-fund can occur over many years.

The ATO has a fact sheet for public ancillary funds here.

The benefits of public ancillary funds include:

- Simple – the fund has the administration, investment and governance activities as the trustee, leaving donors solely to think about the charities they would like to support.

- Taxation benefits – the money donated into a sub-fund is tax deductible in the year of the donation and the fund is a tax exempt structure, so the philanthropic dollar goes further.

- Portability – in certain circumstances, it’s possible to transfer assets from a public ancillary fund into a private ancillary fund, or PAF.

- Naming – the sub-fund can have a specific name, such as a family name, and grants to charities from the sub-fund will refer to this name. Anonymous grants are also possible.

Public and private ancillary funds are growing rapidly and becoming the preferred philanthropic structure for wealthier Australians.

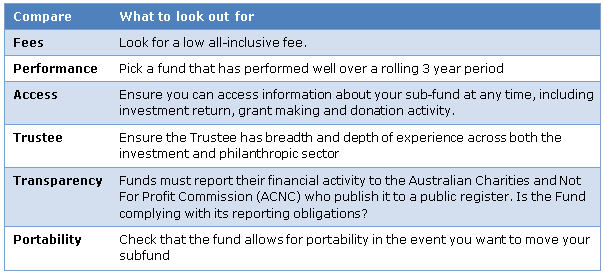

There are a few things to consider when comparing public ancillary funds:

Grantmaking and choosing a charity

Last year, APS surveyed clients about the challenges and satisfaction they experience in giving away money. The responses and needs identified were varied, reflecting the diverse and personal nature of private philanthropy. The biggest challenge identified across the board however, was deciding which charities to fund.

Charities supported from a public ancillary fund must have DGR Item 1 status, of which there are around 25,000 in Australia.

In choosing a charity, many clients want to know that their donation makes a real difference.

It is important to note that there is no right or wrong way when it comes to giving. While some will approach it more scientifically, for others it’s the act of giving itself that is important. For most, grantmaking is a journey that evolves and changes over time.

Here are a few key things to consider:

- Work out what you want to achieve. The more specific you are, the easier it is to work out whether you’ve made any progress. Who do you want to help? Where? What kind of approach resonates most with you?

- Less is more. You can’t solve all the problems of the world. Choose whichever issue you feel most connected to, and leave the rest to others.

- Make sure that the organisation you want to support has clear goals defined, and is measuring their progress towards achieving these goals.

- Ask yourself is it more important to you to reach a certain, sizable number of beneficiaries, or hear individual stories and know that you’ve made a tangible difference in the lives of a few?

- Decide whether you are okay with a change of plan and lessons learned from the process, or would you consider the project a failure if it didn’t achieve the outcomes as planned?

- Keep in mind that building the capacity of a charity may be another valuable way to support a charity: measuring impact (evaluation), fundraising, and effective management (administration) also cost money.

APS offers services to assist clients with grantmaking, but obviously for this financial year, anyone interested will need to move quickly. For next financial year, the best results come from getting started early to identify your philanthropic goals and learn about your areas of interest and the charities you might want to support.

Chris Cuffe is co-founder of Cuffelinks and Chairman and Founder of Australian Philanthropic Services. This article is for general education purposes and does not address the specific circumstances of any individual investor.

For more details, contact [email protected].