The ASX 20 is intriguing, representing 60%+ of the ASX 200 and making Australia one of the world’s most concentrated stock markets. But rather than large blue chip companies compounding earnings and driving up the market (like it is in the US), it comprises mature and cyclical businesses that simply aren’t growing and some of which appear to be broken.

As we know, large companies are typically more macro exposed, with domestic facing businesses today either leveraged to a low growth/low confidence/low investment environment (in my opinion Australia is ‘going sideways slowly’) or China for commodity demand (where growth is slowing and less commodity intensive).

It has been confounding just how well this cohort has performed in recent years, with the ASX 20 up 51% over the last three years (to 30 Sept 2025) despite -19% earnings growth (not a typo!). I suspect the flow of funds (which can be fickle) has overwhelmed the fundamentals (which tend to be more enduring).

A few relevant/inconvenient facts:

- Of the ASX 20, 14 companies are expected to earn significantly less this year than they have in the past. In fact, earnings for 8 of the 20 companies are more than 25% below their prior peak.

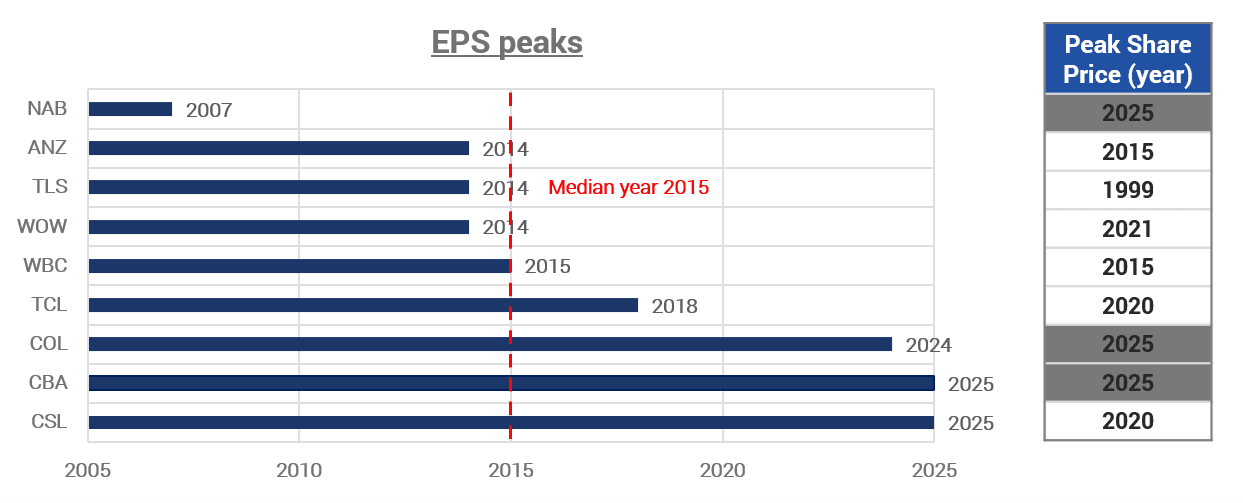

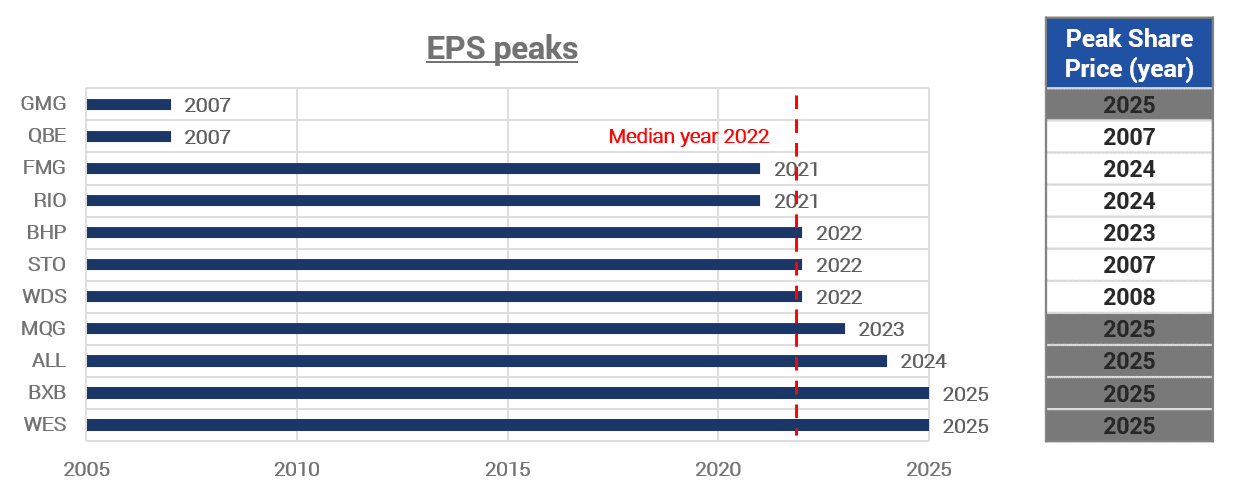

- The weakness is broad-based and not confined to cyclical companies (44% of the ASX 20), where the median company’s earnings peaked three years ago. For their defensive counterparts (56% of the ASX 20), the median company peaked in 2015 (refer charts).

- By way of example, there appears to be very little discussion or scrutiny around the fact that Woolworths’ earnings today are 25% below 2014 levels, Telstra’s are 43% below 2014 and QBE’s earnings are 35% below 2007.

- The entire banking sector had higher earnings in 2016 than are projected for F26, confirming a lost decade for a sector which represents 25% of the market.

Chart 1 – ASX 20 Defensives & Banks (56% of ASX 20)

Source: Bloomberg, Oct 2025.

Chart 2 – ASX 20 Cyclicals (44% of ASX 20)

Source: Bloomberg, Oct 2025.

The lack of earnings growth can explain why some stocks have been dead money for over a decade, it’s hard to believe but you could have sold your WOW holdings for $41 in 2021 (now at $27), Woodside for $66 in 2008 (now $22), or Westpac for $39 in 2015 (now $39)! Back in 1999, when petrol averaged 75-80c/litre and a loaf of bread was under $2, you could have sold Telstra at $8.62 (now $4.90).

The opportunity cost of holding these types of positions is staggering and completely destroys the notion that you can simply hold blue chips forever. It is clear that the ASX 20 today consists of ‘blue chips’ and ‘broken blue chips’, I will leave it for readers to decide the appropriate label for each company.

What is clear, however, is that fundamentals can change significantly: many of these incumbents have wilted and been eroded by intense competition, demand peaking, deregulation and acquisitions that have ranged from questionable to outright stupid.

It stands to reason we want to challenge the consensus/complacent view on our largest companies and their respective futures. It’s worth contemplating the future of competition in banking, the supply outlook for iron ore (large African deposits being commercialised) and even the displacement/competition risk that ranges on everything from blood plasma to slot machines.

Our view is that if you want to invest in the ASX 20—or the ASX 200, of which 65% is that cohort—you need to be hyper-active, paranoid, disloyal and focus on identifying what might be current or future broken blue chips. Life appears to be easier investing in mid and small cap companies which are less mature, less macro exposed and subject to less regulatory scrutiny.

Dion Hershan is Head of Australian Equities at Yarra Capital Management, a sponsor of Firstlinks. This article contains general financial information only. It has been prepared without taking into account your personal objectives, financial situation or particular needs.

For more articles and papers from Yarra Capital, please click here.