[Editor's Note: Peter Thornhill is a respected author and financial markets commentator, and a lecturer at the Centre for Continuing Education at Sydney University. He has been part of a lively conversation in our comments section as a result of Ashley Owen's article on dividends, and sent in the following additional comment which requires more space].

Much as I admire Warren Buffett I have never invested in Berkshire Hathaway (BRK).

I, perhaps shortsightedly, chose to invest in dividend-paying shares.

This happens to suit our circumstances as, at this time, income is paramount and I do not want the hassle of trying to time my exits from shareholdings trying to produce cash flow from capital.

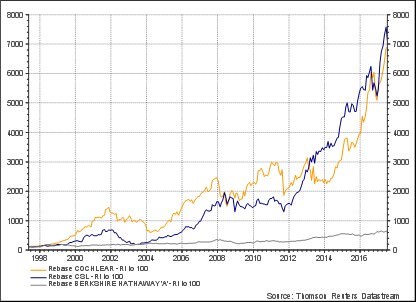

I take some comfort from the chart below as, despite comments to the contrary, we don’t appear to have missed out on much. We still have the capital and the dividend growth has been awesome.

Thornhill