Energy prices. The environment. Climate change. Saving the planet. These issues seem to be increasingly topical, but many of the discussions are not grounded in fact. Let's look at the current state of play in energy usage in Australia and consider the path forward.

Australians do not use energy sustainably

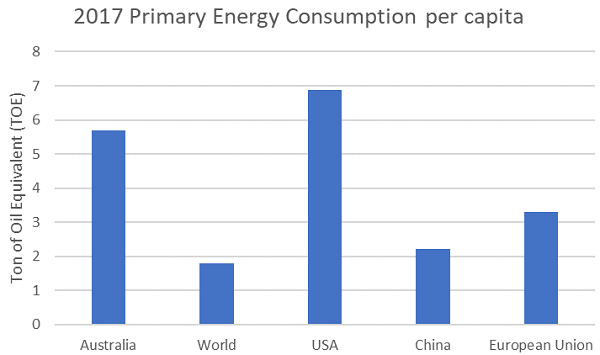

Each Australian annually uses energy corresponding to 5.7 tonnes of oil. This is in the same range as the US (6.9 tonnes) but much more than the rest of the world including China and Europe. There is a lot of room for Australians to use less energy with more efficient materials and machines or making lifestyle changes.

Australia's energy problems

Source: BP and the UN

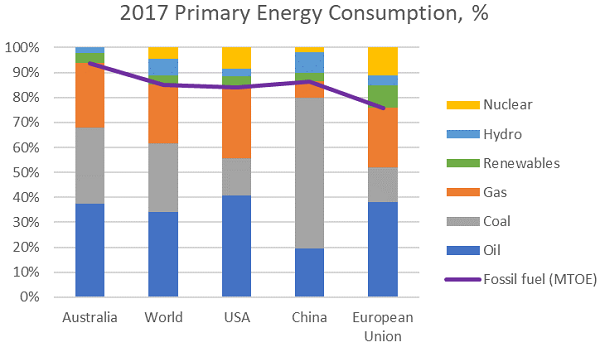

Australians rely on fossil fuel for about 94% of their total energy needs. The only countries that rely more on fossil fuel are either oil producers (such as countries in the Middle East, North Africa, or the former Soviet Bloc), coal producers (such as Poland) or countries with limited resources (such as Trinidad).

Comparing Australia to other large economies, we rely more on fossil fuel than oil, gas and coal producers (such as the US, China) and materially more than countries that have made fighting climate change a priority (such as those in the EU).

Source: BP

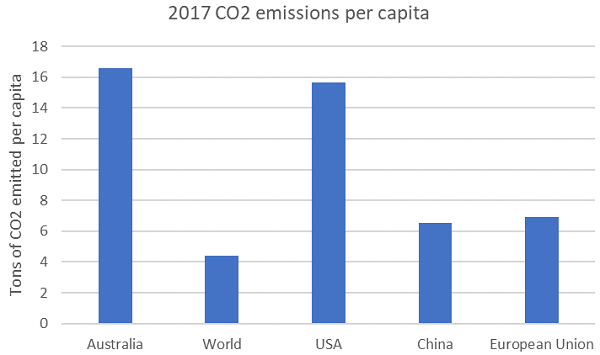

The consequence of this intensive use of fossil fuel is that Australia, with less than 25 million inhabitants, emits about 400 million tonnes of CO2 annually.

This is comparable to what is emitted by the 66 million residents of the United Kingdom (410 million tonnes) or the 80 million residents of Turkey (398 million tonnes).

Looking at per capita emissions, each Australian emits about 16 tonnes of CO2 every year. That is about four times as much as the world average and two and a half times as much as developed economies in Europe.

Source: BP and The UN

Political intervention triggered by higher bills

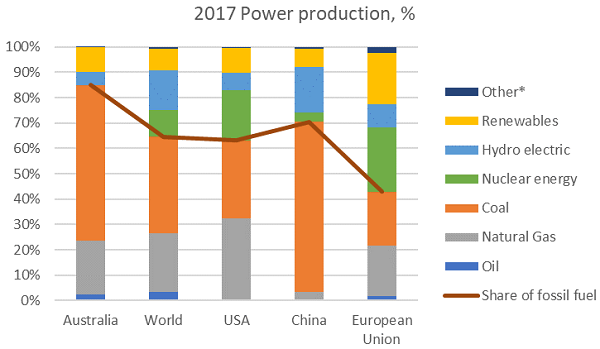

Coal is the king of Australian power production with a 61% share of the mix. The only countries that rely more on coal are South Africa, Poland, China, India and Kazakhstan. Australia’s use of wind and solar is comparable to the rest of the world but it has very limited hydropower. As a result, Australia relies on fossil fuels produced locally for about 85% of its power production.

Source: BP

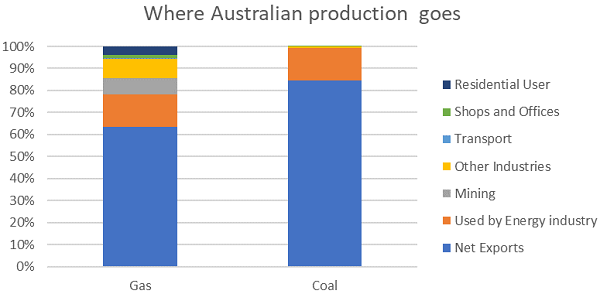

Australia is the world’s top liquified natural gas (LNG) exporter and the world’s top coal exporter. It exports more than two-thirds of its gas and about 85 per cent of its coal.

There is limited appetite for additional coal-fired power plants due to the amount of pollution they produce and gas plants are hurt by the cost of gas.

Australian gas is becoming more expensive as recently-built assets are geared to export, and Australians have the unpalatable choice to either compete with Asian buyers or source gas from ageing fields whose operating costs increases year after year.

Source: ABS

Renewable energy has helped reduce the dependency on coal and gas in other countries. Investment in wind and solar is supported across Australia by subsidies, at both the federal and state level. Most of those subsidies are funded by customers, rather than general taxation.

Today, renewable subsidies represent 4% to 8% of the typical consumer bill. This varies by state depending on the growth of renewables and the layer of support given besides federal programs.

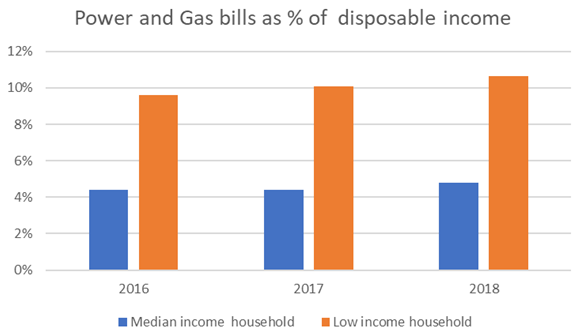

The rise in coal and gas prices, and to a lesser extent the bill surcharges to fund renewables, have added to the combined power and gas bills. In aggregate, Australians of median income now pay about 4.8% of disposable income for power and gas, whereas they only paid 4.4% in 2016.

As for lower income households, they now pay about 10.6% of their disposable income for power and gas, whereas two years ago they paid 9.6%. These increases would have been higher if the allowed return for power and gas networks had not been cut by the regulator.

Source: Australian Energy Regulator

The pressure on disposable income is also faced by industrial companies, triggering the following political and regulatory interventions:

- Regulators are forcing greater transparency on networks, and besides cutting allowed returns have generally toughened regulation, and

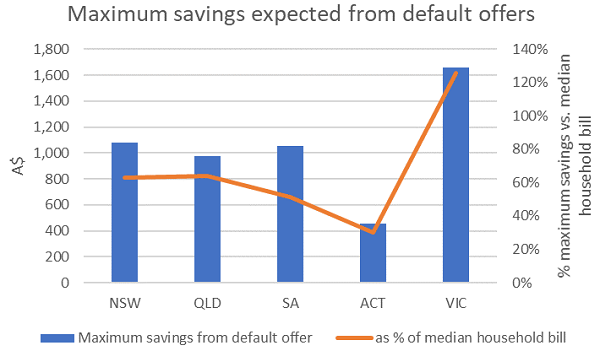

- From July 2019, Australians will benefit from automatic switching to a ‘default offer’ regulated by the Australian Energy Regulator. Customers on expensive tariffs will automatically be switched to this lower offer. For people on the higher tariffs, this could save hundreds of dollars.

Source: Australian Energy Regulator and Canstar Blue

The way forward: the cheapest and cleanest energy is that which you do not use

AMP Capital has decades of experience investing globally in power and gas assets. As long-term investors, we are called upon to fund new investments or support companies during times of transition. In our experience, energy policy has the following pillars:

- Safety of supply: the nation has access to energy, and if possible that energy is domestic or from friendly countries;

- Affordability: residents and business only need a modest share of their income to pay their bills; and

- Environment: environmental damage is avoided or remediated.

These three objectives each cost money and are often divergent (for instance, coal is great for safety of supply and affordability, but is a high pollutant). This means that energy policy is about priorities and investment.

In Australia, the introduction of renewables can help in two ways:

- If the renewables are commercially contracted over the long term, it will reduce Australia’s dependency on coal and gas, and thus reduce the exposure of ordinary Australians to fluctuations in international energy markets.

- As renewables are intermittent (the strength of the wind and sunshine changes during the day), they need to be backed up by power plants that can react quickly. These so-called peak plants do not need to be built - Australia can, for a limited amount, convert and subsidise existing assets that are largely amortised. This would help ensure safety of supply and protect jobs in those plants.

However we believe the real way forward is for Australia to commit to the cheapest, safest and cleanest form of energy: the energy that is not used. Australia should invest much more in energy efficiency and thus cut bills and pollution materially.

While there are upfront costs (upgrading buildings, replacing vehicles, changing machinery) the long-term savings offer a return and the short-term effort creates and supports many jobs and can dramatically improve the living conditions of the less fortunate Australians.

Michel Debs is a London-based Portfolio Manager and Analyst with the Global Listed Infrastructure team at AMP Capital, a sponsor of Cuffelinks. This article is for general information only and does not consider the circumstances of any investor.

For more articles and papers from AMP Capital, please click here.