The recent release of VicSuper’s new non-account based pension (NABP) products for retirees signalled the first of a number of innovative solutions in the retirement income space. More importantly, we have evolved the philosophy and process we follow to help members achieve income security in retirement.

Our previous retirement planning approach

Until recently, VicSuper financial planners used a managed payout approach. In the main, they would recommend a strategy incorporating our account based pension (ABP) with an investment portfolio mix based on the member’s risk profile. The higher the member’s capacity for risk, the more aggressive the investment portfolio and a higher total return would be assumed. We would factor in other forms of income available to the member including the age pension, defined benefit pension and investment income, in preparing our advice. We were aiming to deliver a real level of income that was sustainable, with minimal volatility, which provided members with the flexibility to access capital as needed. Cash flow projections were based on a constant rate of expected return.

There were significant advantages to this approach: the member’s control of investment capital was fully maintained, any returns above expectations could increase the income available, and it was easily implemented by risk profiling a member and investing into the ABP.

The evolution of our methods

However, there were also some weaknesses to this approach:

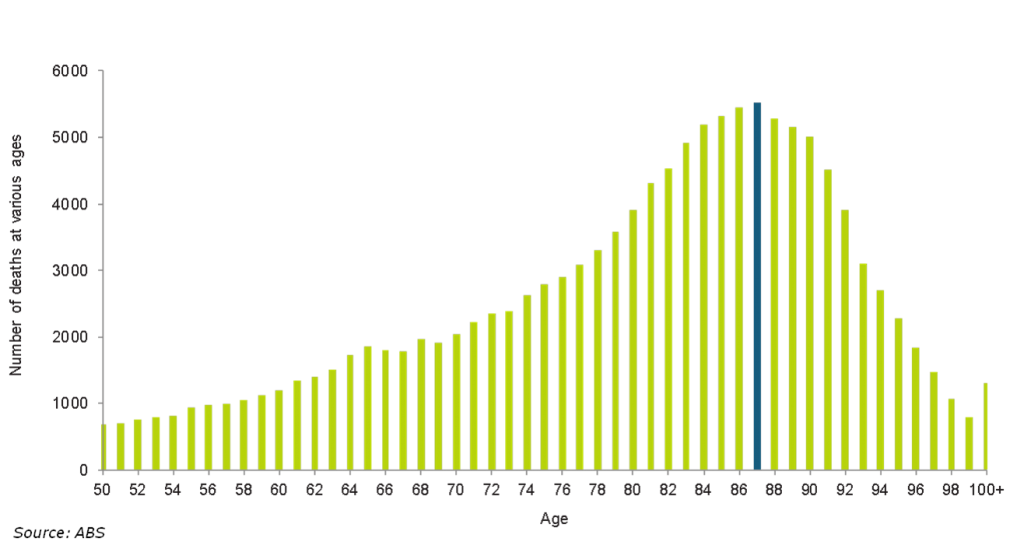

1. Firstly there was no protection for members against outliving their savings. By basing the analysis on average life expectancies, the approach did not fully address longevity risk by basing the analysis on average life expectancies. This can be relevant to a significant cohort of members (see numbers to the right of the blue line in the diagram below).

.

2. The managed payout approach doesn’t effectively mitigate against sequencing risk where the order and timing of returns could materially impact a member’s income in drawdown phase. Historically, members responded to market volatility by taking less income and the 50% reduction in the minimum drawdown following the GFC allowed for this. However, taking a hypothetical 65-year-old member with $600,000 in their pension account, we felt that an income based on a minimum drawdown that was halved from $30,000 to $15,000 would not be a desirable outcome.

3. Much of the risk in retirement (inflation, longevity and market risk) was also borne by the member. This was traded off against the prospect or possibility of higher returns, however it differed from our approach in accumulation which is to provide default life and income protection insurance to members, and specific needs-based tailored insurance if the member saw a VicSuper financial planner..

4. Lastly, there was no direct asset-liability matching for the member in retirement. So if the member had a need for essential income, with anything below that being unacceptable, our approach in pension phase did not directly manage it. We actively manage this risk in accumulation by providing advice to the member (where appropriate) to use income protection and death and disability insurance to provide needs-based protection.

The probability of outliving savings is real

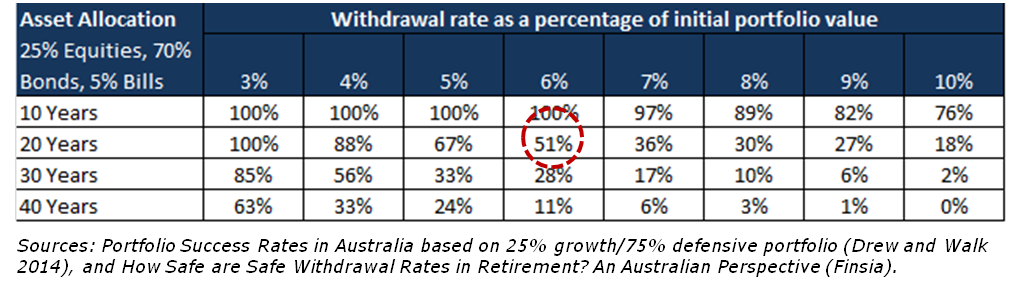

The ABP minimum drawdown requirements for a 65-year-old starts at a higher point (5%) than much of the recent research on safe withdrawal rates suggests is appropriate to provide a sustainable, indexed income stream with a minimal chance of failure.

This research based on Australian data suggests there is an almost even chance that a typical conservative 25% growth/75% defensive portfolio would be exhausted over a retirement period of 20 years assuming a 6% pa drawdown rate, adjusted for inflation (see table below).

As part of a retirement strategy review we looked carefully at the approach outlined above to determine if there was a better way of achieving our members’ goals.

Our new approach – income layering

Recent research from Investment Trends supports the idea that guarantees and protection (associated with income that lasts for life, guaranteed minimum income payments, protection against market falls and indexed against inflation) become stronger drivers than high returns when retirees are considering retirement income products.

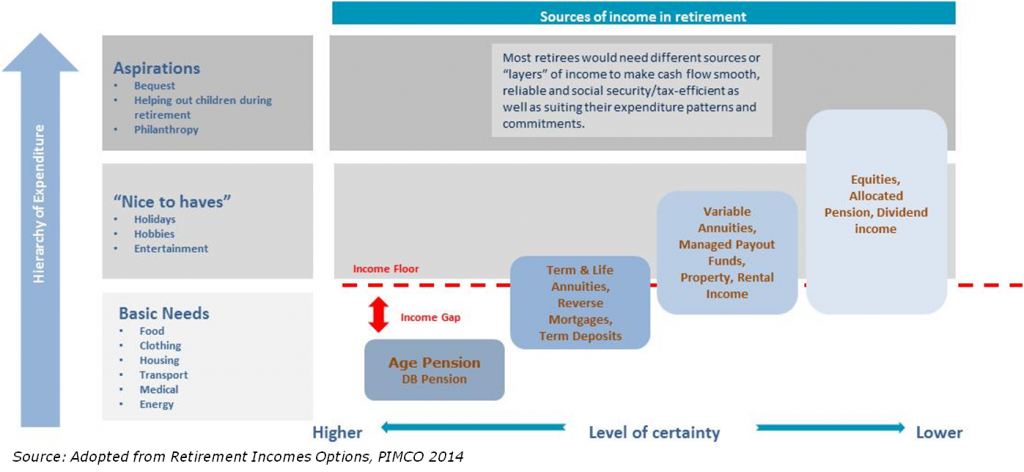

We began looking at different ways we could help our members achieve their goals and meet our best interest duty. One way to deliver this was to develop an objectives-based approach that used an asset-liability matching framework to generate retirement income. Since a member having insufficient income to meet their essential expenses was an outcome to be avoided at all costs, it was perhaps better to not target a strategy that will perform best if we guessed correctly about future market returns, so we took a member’s worst case scenario off the table. One way of doing this was by implementing an income-layering strategy, defined as:

Income layering is a strategy that locks in a secure stream of retirement income before investing any remaining retirement savings in market-based products. It is based on the belief that securing income to meet the essential or basic needs should be of primary importance to the member.

Income-layering starts with detailed budgeting (as much as possible) for the amount of income a member requires each year in retirement, and splitting up this income into essential income and income that can be considered discretionary. ‘Essential’ income should cover the must-have basic expenses like food, clothing and shelter and also those items that define a member’s lifestyle. That is, those things that are non-negotiable because they represent the essence of the member’s life. The discretionary income covers lifestyle requirements that members would be willing to do without if their retirement savings take a turn for the worst.

We’ve now implemented a new advice process that takes into account a member’s health, expected longevity, liquidity needs and balances security with flexibility via internal business rules which guide an appropriate allocation between our various product solutions.

The income-layering approach has protection against longevity risk, and offers upside potential to improve a member’s standard of living. As a priority, essential income is then secured over an appropriate timeframe by a combination of the age pension, any defined benefit pension entitlements, and our VicSuper NABP products. Of critical importance, however, is that the floor income provides as much protection as possible against inflation, longevity and market risk.

Other superannuation money can be invested in the ABP, in a portfolio that aligns with a member’s risk profile. The capital allocated to meeting these two priorities is balanced against other factors, for example if a member has a particular liquidity need requiring significant capital to be available at short notice.

There’s no single silver bullet solution

Whilst investing a member’s entire super into an ABP may (or may not) result in a superior outcome, this depends on investment returns and the sequencing of those returns. The income-layering approach recognises that there is no one ‘silver bullet’ solution in that it uses both guaranteed income streams and an ABP to deliver an appropriate outcome for the member. It provides the member with peace of mind, flexibility, and the opportunity of a growing income in retirement if investment returns are good.

Michael Dundon is the Chief Executive Officer of VicSuper.