It is boom time once again for global ‘high yield’ debt. It’s great for borrowers wanting cheap debt with few conditions but bad for long-term investors. Both investment grade and high yield debt carry more leverage than 10 years ago but interest servicing costs are lower. In effect, lower interest rates have allowed corporates to borrow more without having to pay more in interest.

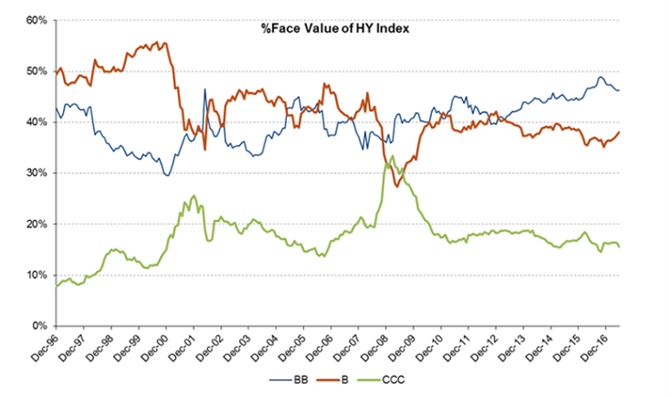

The first graph from Bloomberg on US high yield shows the breakdown of US high yield bonds into rating categories. Compared to a decade ago, the higher quality BB’s make up a greater portion of the index, with B’s much less than 20 years ago, and CCC’s shrinking since the days of the GFC. That’s a good thing, though it needs to be considered alongside two other factors that aren’t so positive.

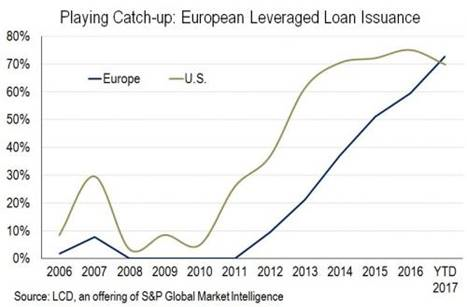

The bad news for high yield investors is that covenant quality is worse than it has ever been. The graph below tracks the proportion of US and European sub-investment grade loans that have minimal or no covenant protection. Asia isn’t faring any better, covenant-light bonds are at 61% of issuance in Singapore and 72% in Hong Kong. Fewer covenants mean that sick companies are allowed to operate unchecked for longer. A lack of covenants increases the proportion of debt that suffers monetary defaults and reduces the recovery rate.

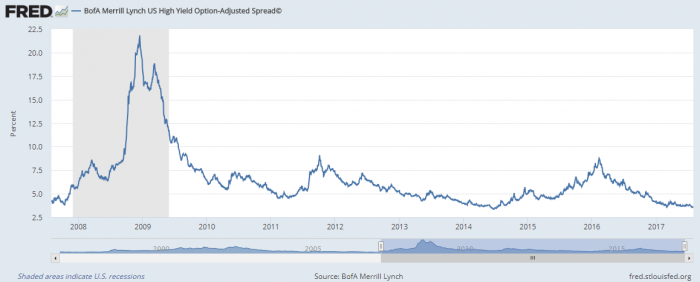

The last key characteristic to note is that spreads over base rates are near the lowest in the last 10 years. US High Yield bond spreads are shown below, but the story for European debt and leveraged loans is the same. There’s been a wave of loans being repriced in the US and Europe this year; situations where borrowers reduce the spread they pay, usually without providing any offsetting risk reduction. Borrowers clearly have the whip hand over lenders.

Spreads are now at the level where the B and CCC rated segments are barely positive if historical average losses are subtracted. Not surprisingly, many are saying that now is the time to be a contrarian and sell high yield. Edward Altman sees high yield conditions as bad as 2007 and Howard Marks similarly warned about conditions in his latest memo. The initial yields on offer may look comparatively high, but that’s no guarantee of high returns in coming years.

Jonathan Rochford is Portfolio Manager at Narrow Road Capital. This article has been prepared for educational purposes and is not a substitute for tailored financial advice. Narrow Road Capital advises on and invests in a wide range of securities.