After the financial market volatility of 2020, many investors are looking for more reliable sources of income and capital stability. However, with official interest rates at record lows, finding defensive investments that also deliver an attractive return is no easy task.

Australian corporate loans are among the few asset classes that offer both capital preservation and attractive risk-adjusted returns. Traditionally the asset class was only available to wholesale investors. However, in recent years, opportunities have become available to SMSFs and other self-directed investors, such as the MCP Master Income Trust (ASX:MXT), to give investors a way to access this opportunity in a simple listed format.

Let’s take a look at four key benefits of investing in a well-managed portfolio of corporate loans - reliable income, capital stability, diversification and protection against inflation.

1. Attractive, reliable income

Private debt can provide regular income, even during extraordinary times such as we saw in 2020. Interest and fee payments are received from borrowers at specified intervals under the binding terms of their debt contract. A floating base rate, with additional credit margin, ensures total interest income rises in line with upward movements in market interest rates (which may occur as a means of combating inflationary pressure).

This contrasts with dividends that are paid to equity holders at a company’s discretion. Even when equity markets were at their most turbulent in early 2020, and many companies were suspending or reducing dividends, well managed private debt funds continued to deliver consistent monthly income for investors.

The asset class can provide attractive risk-adjusted returns even in a low interest rate environment. More conservative funds can deliver a return around 3% to 4%, an attractive alternative to low-yielding corporate bonds, hybrids, government bonds or even cash deposits. A higher yield fund can deliver a cash distribution around 6% to 8%.

When accessing corporate loan investments through an ASX-listed structure (Listed Investment Trust or LIT), investors benefit from liquidity available via secondary market trading. Investors enjoy the premium income distributions associated with this asset class without having to lock up capital for 3 – 5 years, which is the typical term of the underlying loans. Investors may be able to buy or sell units in the LIT on the ASX daily.

A skilled lender or private debt manager will seek to negotiate appropriate fees and credit margins to ensure investors are generating an appropriate return for risk and for the provision of non-bank debt finance to the borrower.

2. Capital stability

Another key attraction of the asset class is that it can provide capital stability through the economic cycle.

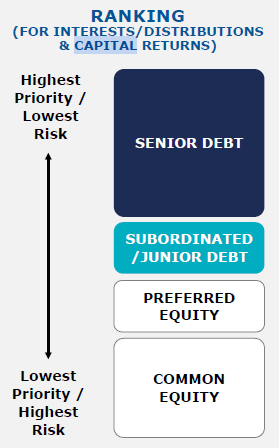

Corporate debt is a lower risk investment than equity because Australian corporate insolvency laws give priority to the interests of creditors in claims over the assets of a business.

In a private market, lenders negotiate directly with borrowers. A skilled lender or private debt manager will seek to negotiate with the borrower appropriate terms and conditions, controls, reporting obligations, covenants, and security to ensure the lender has greater influence on loan terms seeking to mitigate potential risk of loss. Covenants and ongoing borrower reporting obligations are negotiated and provide protection and early warning of changing risks. Security held over the borrower ensures the rights and protection of capital ranks in priority to shareholder equity and any unsecured creditors.

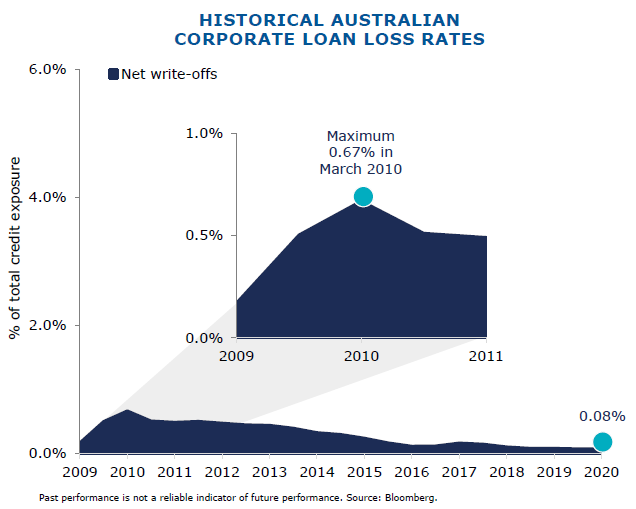

As a result of the protections in place, the corporate loan loss rates for Australian companies have been very low for many years.

However, all borrowers and loans are not created equal. When it comes to investing in corporate loans, it is important to invest with a manager who has the necessary skills and experience to preserve investor capital and negotiate appropriate pricing with the borrower. Here’s what to look for:

- Size and scale: Managers need a sizeable team and breadth of market coverage and borrower relationships to be meaningful to borrowers and better able to negotiate loan terms, recognising the value of the capital available to invest in the borrower.

- Origination capability: Check the manager has direct relationships with borrowers and other market participants to directly negotiate loan terms.

- Risk management capability: A strong focus on risk management and experience in loan restructuring in the event of a default is essential to preserve investor capital.

- Track record of performance: Seek evidence from the manager of capital stability and delivery of regular income payments to investors and that they have been meeting their stated investment targets over time.

- Diversified portfolios: A diversified portfolio helps to spread risk across sectors. Investors should look for portfolios that are diversified across borrowers and ensure the exposure to any one individual borrower doesn’t expose investors capital to inappropriate concentration of credit risk.

- Appropriate terms: When negotiating a transaction with a borrower, the lender must ensure they achieve appropriate terms and conditions and put in place controls to protect investor capital. These controls are designed to put constraints on the borrower to manage risk and therefore protect and preserve investor capital.

Other factors that underpin capital stability include, imposing appropriate reporting obligations and taking security over the company or assets, combined with regular ongoing monitoring of the performance of the borrower.

3. Diversification

During 2020, many fixed income investments failed to deliver the safe haven and downside protection expected. Bonds no longer rise as equities fall, making ‘balanced portfolios’ a lot less stable in times of turmoil.

Corporate loans have a low correlation with other major asset classes, including growth assets such as equities and property, as well as other fixed income products such as bonds, providing excellent diversification opportunities.

Because they deliver reliable income and capital stability throughout the economic cycle, they can be an asset to your portfolio when other markets are volatile.

We believe the best way for investors to access corporate loans is through a low cost and well diversified managed fund, which helps to spread risk by investing in a varied range of sectors, loan types, and borrowers with differing credit quality and maturity profiles.

4. Protection from inflation

The recent spike in US Treasury bond yields is a clear warning that investors globally are again starting to worry about inflation, and the potential impact it could have on monetary policy and financial markets.

Markets are increasingly pricing in a possibility that rising inflation in the US could lead the US Federal Reserve to ease off on its bond buying or even raise official interest rates sooner than expected. Many other countries around the world will face similar risks of rising inflation as their economies recover at varying paces from the COVID-19 recession.

Inflation poses a threat to investors because it chips away at the purchasing power of savings and investment returns. It can be particularly damaging to returns on fixed income investments. Because the interest rate on most bonds and other fixed income investments remains steady until maturity, investors risk missing out on the income boost from higher interest rates as the global economy recovers.

Corporate loans offer protection against inflation because they earn their returns from fees charged to borrowers and interest that is generally charged at a floating rate. The interest on Australian corporate loans is usually structured as an additional margin over the benchmark Bank Bill Swap Rate (BBSW).

The BBSW is essentially the rate at which Australia’s major banks are willing to lend short term money to other banks. It reflects not only the current level of the RBA cash rate but also the expectations the banks have of future cash rate settings.

So if interest rates rise, your income will also rise, which acts to protect the capital of your investment.

Andrew Lockhart is Managing Partner and cofounder of Metrics Credit Partners (MCP), an Australian debt-specialist fund manager, and sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

Metrics Credit Partners was the first fund manager in Australia to launch an ASX-listed corporate loan fund, the MCP Master Income Trust (ASX:MXT), to give investors access to this opportunity in a simple listed format that provides liquidity not previously available in the asset class.