Weekend market update: US markets on Friday continued their strong week, with the S&P 500 up another 0.8% and NASDAQ 0.5%, taking US broad gains to 2.7% and a record high in the Easter-shortened week. The S&P/ASX200 put on 2.4% for the highest close since the virus outbreak. Asian markets were weaker but Europe is doing well from the strong US data.

***

There was an important moment on ABC TV's 7.30 programme last week in its 'The Future of Retirement' series hosted by Alan Kohler. As well as interviewing Superannuation Minister Jane Hume, Kohler asked former Treasurer and Prime Minister Paul Keating about the origins and purpose of super:

PK: I designed the system. I used to say to the caucus of the Labor Party, what superannuation is about is personal empowerment. That is you can cut the shape of your life, particularly at the end of your life, without reference to a government agency ... I think people in retirement think in family terms.

AK: Let's be clear about what you intended back in 1992. Did you intend that some of the superannuation would be retained and passed on to the kids or not?

PK: Yes, basically, yes, for people to do ... that's the empowerment point, to do what they like with it. I'm not opposed to using some of the capital, but I'm opposed to the state telling you you've got to burn it all.

This is an important debate, as earlier in the programme, Jane Hume said:

"We want to make sure that people have the options available to them to spend their retirement income as efficiently, as effectively as possible so that they have a higher standard of living in retirement, which of course is the aim of the system."

In 2015, I wrote an article called 'My purpose of super is probably not yours' where I quoted evidence that using super as a bequest was a legitimate purpose, and Keating confirms again that it was always his intention. So we are republishing this article because government policy is heading in the direction of reducing the ability to pass superannuation to the next generation.

Jon Kalkman adds a powerful article to the debate, showing how long your money will last based on differences in spending and earning rates. For example, 1% more in spending each year could reduce the time your money lasts by five years. In the context of long lives, more people will end up on a pension than expected at the time of their retirement.

Continuing our powerhouse of experts on superannuation and retirement changes (in the last two weeks, Bernard Salt, Deborah Ralston and David Knox), David Bell presented this week to the Senate Economics Committee on the proposed Your Future, Your Super legislation. David summarises his findings on the performance test which he believes will drive unwelcome changes, such as super funds hugging the average. The worry is the commencement date of 1 July 2021 is only three months away and the bill has not been drafted, never mind passed.

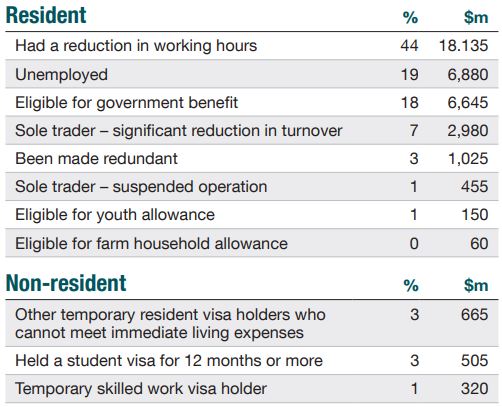

This week, the ATO issued a final report on the early access to super scheme which permitted withdrawal of up to $20,000 per person. It shows that many people will drain their super if they can, with 4.8 million applications for $39 billion received. The ATO approved 4.6 million applications for 3 million people citing the following reasons:

Demonstrating how SMSFs hold larger balances with members who do not want to withdraw early, only 40,000 of the applications worth $395 million came from SMSFs. This is only about 1% of the total amount withdrawn although SMSFs hold over 25% of super balances.

Moving on from superannuation and retirement ...

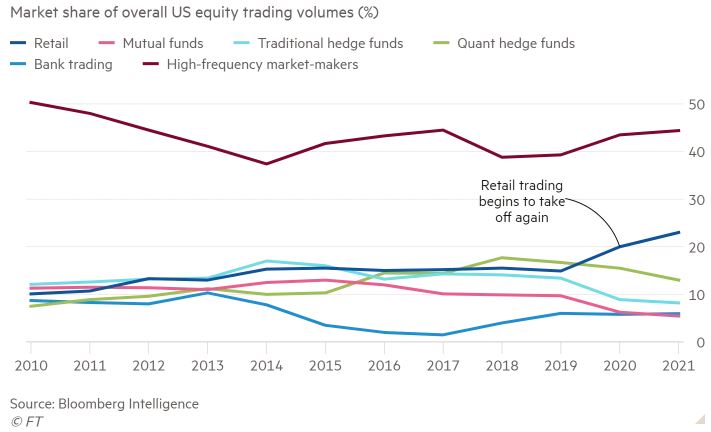

A major new trend of 2020 which is kicking on in 2021 is retail investors investing directly in the share market. It is difficult to obtain good data on the Australian market, although charts like the one below from the US show retail is now trading more than hedge funds and mutual funds (unit trusts) combined, with all dwarfed by high-frequency traders. US research suggests new retail demand is driving up stock prices, but the big question is whether it will continue if the market falls.

So it's pleasing to receive solid Australian data from Dr Shane Miller and Howie Zhang of Chi-X, including how much of our exchange activity is retail and the types of brokers dominating trades.

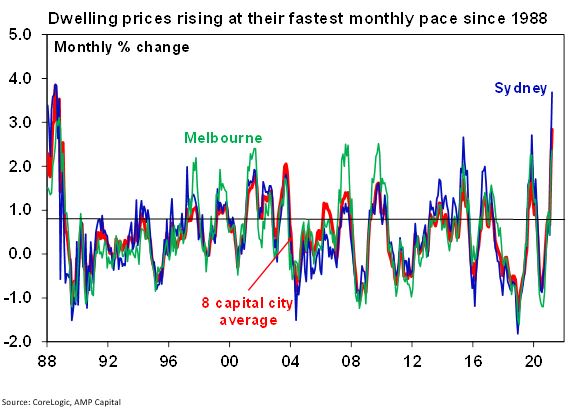

With residential property prices booming, as shown below, it's as much an anguish for those left behind as it might be pleasure for those who have borrowed heavily. In many asset classes, there is a listed version which facilitates easier access to the asset in smaller amounts but Hugh Dive explains why this is not the case in residential property. Hugh shows why the only real way to gain exposure is to buy a residence, but it's competitive out there ...

In casting the net wider for investment opportunities, Victor Kohn and his colleagues focus on emerging market equities, which were left behind in the tech-driven frenzy of the 2020 rise in US markets. He gives five reasons why EM is worth another look for 2021.

Finally, a lighter note with Thomas Rice, who gives his regular run through of exciting disruptions and new technologies. Anyone who thinks we are near a peak in innovation does not realise the billions flowing into new ideas on a scale that capitalism has never produced before. This week, Canva founders Melanie Perkins and Cliff Obrecht, entered the list of the 10 wealthiest Australians at $3.4 billion each after their software company reached a valuation of almost $20 billion. Yes, billion with a 'B'.

For the final time before the offer closes on 12 April, don't forget the great price offered by Morningstar to celebrate the Firstlinks 400th Edition published just before Easter. At only $1 a day for Morningstar Premium's research on thousands of companies and funds, plus the portfolio software of Sharesight, it's a good way to stay on top of your investing. Click here for details.

This week's White Paper by Shane Oliver of AMP Capital is a Q&A on the big issues of global recovery, vaccines, the end of JobKeeper, inflation, the risk of a share crash and house prices.

And for our Comment of the Week, back to Paul Keating and this from Michael:

"When watching the 7.30 programme's Future of Retirement, was it just me or was Keating jumping on something that wasn't how I remember it?

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website