The Weekend Edition is updated to include an end-of-week market summary, plus Morningstar adds free links to two of its most popular articles from the week.

When we surveyed our readers, 72% said they would like to read more articles on stock picks either regularly or occasionally, so the weekend selections will usually include new stock-specific ideas. It's also a chance for a weekend catch up on articles you may have missed. Previous editions are here and contributors are here.

***

Weekend market update

From the AAP Netdesk: Australia's share market had a downbeat finish to a rewarding April for investors, as attention turns to big banks' earnings next week. The benchmark S&P/ASX200 index on Friday closed lower by 56 points, or 0.8%, to 7025.8. The market's drop was the biggest of April. Investors may have reacted to the ASX200 on Thursday closing at its highest level since the start of the coronavirus crash in February last year. However, April proved pleasant for those with money in the market. The ASX200 gained 3.5%, its biggest rise since November's record of almost 10%.

From US sources: On Friday, the S&P 500 lost 0.7% and NASDAQ gave up 0.9% as stocks surrendered some of the gains made over the strong April rally. For the month, the S&P 500 was up over 5%, which like Australia, was the biggest one-month gain since November. The Dow Jones rose 2.7% and the NASDAQ 5.4%. A trading highlight was Twitter falling 15% on falling usage. Over the week, Asian indexes fell on manufacturing shortages due to logistic and microchip problems.

***

According to music scholars, Beethoven became more original and brilliant as his hearing deteriorated late in his life. He could not hear the music of either himself or others, and so became less influenced by the external 'noise'. The clarity and creativity of his music formed inside his head, and he no longer listened to and relied on the soundtrack of others.

Good investing is similar. Each person needs to establish a portfolio that suits their circumstances and goals, and most would benefit from drowning out the noise. Set up a diversified mix with quality assets and let them perform over time, rather than reacting to the daily news. Warren Buffett made a clear distinction between investing and speculating, and it helps him remain calm when others are panicking. He said:

“All investment is, is laying out some money now to get more money back in the future. Now, there’s two ways of looking at the getting the money back. One is from what the asset itself will produce. That’s investment. One is from what somebody else will pay you for it later on, irrespective of what the asset produces, and I call that speculation. So, if you are looking to the asset itself, you don’t care about the quote because the asset is going to produce the money for you.”

We start this week with David Booth, who founded Dimensional on the investment principles of Nobel laureates. He describes the five main lessons he has learned from many decades in investing, with especially good advice on living with uncertainty.

Andrew Mitchell also says investors must look at the long term when selecting fund managers, and he provides evidence that all top-performing managers over 10 years have periods of underperformance. Don't bail out at the wrong moment.

Roger Montgomery reveals the major themes attracting his attention for further stockmarket gains, as he expects equities to perform well in 2021.

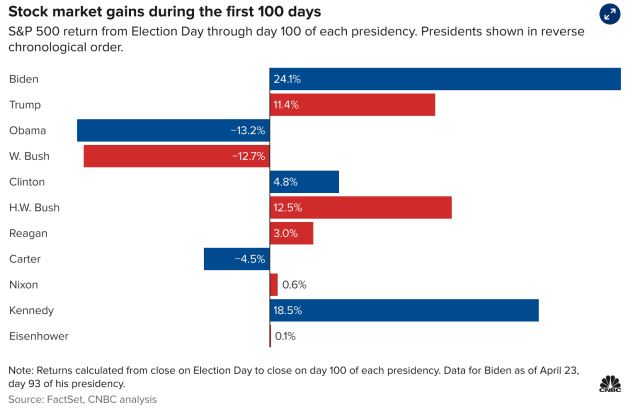

Which is what has happened in the early days of President Joe Biden. Among many claims and untruths that Donald Trump uttered during his presidency, he told his followers during the Presidential Debate that (pointing to Biden): "If he's elected, the stockmarket will crash." Well, we now know the market has loved the trillions Biden has spent, even in the face of possible higher taxes. Here are the first 100 days of the S&P 500 of each recent President.

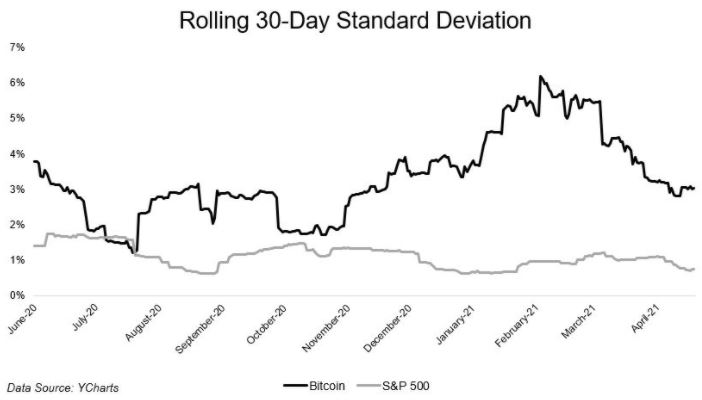

Several readers have asked why we do not publish more articles on cryptocurrencies and Bitcoin. It's partly because I don't believe such a volatile and hard-to-value asset is suitable for the portfolios of most of our readers, but maybe that's living in the past. I have never watched Married at First Sight, the most popular television programme in Australia, or posted on TikTok, so maybe I'm a dinosaur. We asked Citibank as a global house to provide its view, and Rich Welby and Sandy Kaul obliged with 10 quick observations. This level of monthly (not annual) volatility sits uncomfortably for most people.

One threat to the rising stockmarket is inflation, although the latest CPI issued yesterday rose only 0.6% in Q1 2021. It was below consensus expectations giving an annual rate of headline inflation of 1.1%. However, Chris Joye of Coolabah wrote this week:

"Our key conclusion is that a material jump in inflation expectations would result in sharply higher interest rates and a large fall in stock prices. The process starts with tighter monetary policy to bring inflation under control, with the Fed’s cash rate climbing by almost 2.5% (from near-zero today). Persistence in sticky inflation expectations and tighter monetary policy settings drives a big, 1.5% rise in the 10 year government bond yield. Higher discount rates hurt stock prices, which decline by about 15% over the next 3 to 4 years in real, or inflation-adjusted, terms."

Chris has a solid track record, especially his recent calls on residential property prices, so his warning is worth noting.

Stephen Miller takes a wider view, critical that we expect the RBA to do so much of the heavy-lifting through monetary policy and interest rates, when a range of micreconomic reforms are ignored.

Finally, a change of pace with a look at the European Super League, which received extensive media coverage in Australia last week, including in the financial press. Yet there is a serious lack of coverage of the A-League despite the high-quality product. You don't need Messi and Ronaldo for a great football experience, so why are the local crowds so poor?

Briefly on superannuation, the Treasurer Josh Frydenberg has announced changes to the Your Future Your Super (YFYS) regulations and a new consultation period. Two criticisms have been addressed:

"Administration fees will be included in the performance test, ensuring that the test focuses on the final member outcome and is consistent with information presented to consumers on the online YourSuper comparison tool.

The Government has also added Australian unlisted infrastructure and unlisted property as specific asset classes covered by the performance test."

***

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Energy analyst Mark Taylor explains why Woodside Petroleum is set to benefit from future gas demand. And several tech titans are undervalued following a monster week in US earnings writes James Gard.

***

Many gems in reader comments last week, especially on the Buffett and Ralston articles. The Comment of the Week comes from Kevin:

"I'm in the long term buy and hold camp too. The compounding is amazing. Mine is mainly the banks for decades. The dividends now after using DRP plans for decades are very high and produce an excellent income. Throw in Wesfarmers held for around 22 years now and things are great. For some reason people seem to have great difficulty doing nothing at all, just leave things alone to grow. The volatility is a price to pay. I have always thought the very small number of shares that change hands every day are taken too seriously. Have a look at prices once or twice a year."

This week's White Paper from First Sentier Investors looks at the case for making a structural allocation to high quality credit within a diversified investment portfolio.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website