The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two highlights from the week. On Friday in the US, the S&P500 lost another 1.7% and NASDAQ was off 1.8%.

One of the downsides of being a financial newsletter and media junkie is reading the same material over and over again. Each month, fund manager updates describe what central bank chiefs Philip Lowe and Jerome Powell said a few weeks earlier as if we have not heard it a hundred times before. Then the updates take a guess at what the central bankers might do next month suggesting some unique inside knowledge. Do they all subscribe to the same machine learning or AI programme for their reports? C'mon, fundies, you're supposed to be Masters of the Universe and the Smartest People in the Room. Mix it up a bit. Don't let us think your Intelligence (I) is Artificial (A).

These are the same fund managers who implore investors to think long term and ignore short-term performance (especially when the numbers are not so flash). Yet their communications include pages of comments on the very short term like nobody else has covered the cash rate, inflation or daily index moves. Leave that stuff to economists such as Bill Evans, Shane Oliver and Gareth Aird and tell us something original. The Reserve Bank does not even have a track record worth following, with the Governor himself calling their guidance "embarrassing".

For anyone writing a programme using AI for fund managers, here's a template for the opening paragraph:

"Last month, the [Australian index]/[global index] [increased]/[decreased] by [x%] due to the the US Fed making [dovish]/[hawkish] comments on the [better]/[worse] [inflation]/[interest rate] outlook. The [name of fund] [gained]/[lost] by [y%] in [month name], [outperforming]/[underperforming] the index by [z%]. The portfolio benefitted from its exposure to [sector x], especially [company x name], but the position in [sector y] through [company y name] detracted. The outlook for next month is [strong]/[weak] based on expectations of [growth]/[recession] with GDP forecast to [increase]/[decrease] by [a%]. We expect cash rates to [rise]/[fall] by [0.25%][0.5%][0.75%][1%] at the next [Reserve Bank][Federal Reserve] meeting. As we invest through-the-cycle in quality companies, we expect them to perform well over time."

And on it goes. No choices in the last sentence, as every fund manager thinks their investments are the best. Add some charts, update the performance table, send it off, rinse and repeat, across thousands of fund managers all over the world.

In the current climate, many pontifications are out-of-date as analysts hit the send button. The US Fed's Powell upended the market recently at Jackson Hole in a speech that lasted only eight minutes. The Wall Street Journal claimed that prior to the speech, Fed officials were concerned that investors were pushing stocks higher and misreading Fed intentions to control inflation by rising rates aggressively. So Powell changed his original speech to be far more blunt and direct, with the punchline that "the Fed would accept a recession as the price of fighting inflation." The stockmarket in the US dropped 4% immediately, and the optimism of a few hours earlier was completely reversed and updates rewritten.

As they say about sausages, nobody should see how they are made. You don't want to know how quickly an analyst can change their opinion based on one number or one sentence from a government official.

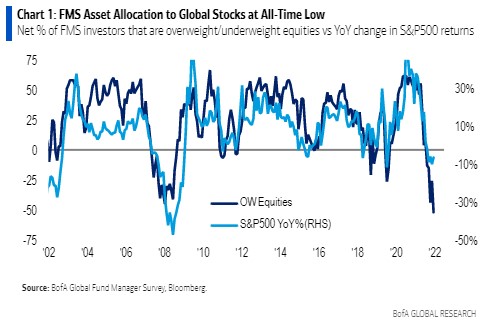

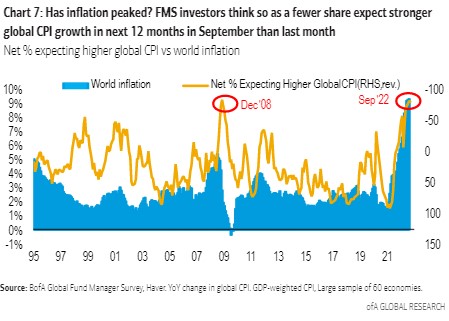

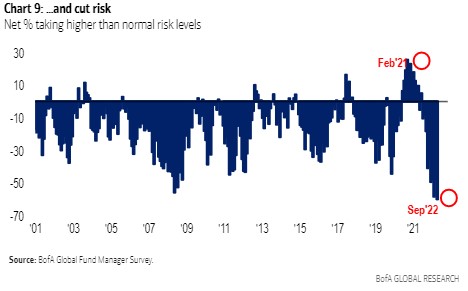

There are exceptions where research provided is genuinely unique. One of my favourites is the Global Fund Manager Survey (FMS) from the BofA Data Analytics team in BofA Securities. The monthly report records the views of about 300 institutional fund managers around the world. Here is a sample of charts showing the current investment activity of global market professionals, and what is especially notable is how many of these indicators are at record levels. The signs are nearly all negative for the market outlook.

First, asset allocations to equities (dark blue line) are at an all-time low.

Second, a record number of investors expect a weaker economy.

Third, 79% of FMS investors expect slower global inflation in next 12 months than today, suggesting that inflation may have peaked last month when inflation rate was 9.3%.

Fourth, a record low share of FMS investors (net -60%) taking higher risk than normal.

(Of course, neither BofA nor Firstlinks takes any responsibility for how these charts may be interpreted and this is only general information).

And while many media outlets have reported on the Deputy Governor, Michelle Bullock, speaking at a Bloomberg event yesterday, describing the $40 billion mark-to-market loss on its bond holdings and inability to pay a dividend to the Government for many years, I took away an important sentence during question time. "The outlook for the world's economy is on a knife's edge."

In this week's edition ...

With well over 800 responses to last week's Reader Survey, we have a strong sample of your opinions on a wide range of policy issues facing the Government as it frames the upcoming Federal Budget. Check the full results with an attached PDF quoting thousands of your comments. Thanks for the exceptional result. We will leave the Survey open for a few more days and publish highlight comments in another article next week.

A few articles this week focus on the impact of inflation in investing. Don Hamson of Plato Investment Management shows how much purchasing power a conservative investor is losing in term deposits, and warns that many more people may end up on an age pension if their assets do not grow. He sees a positive outlook for dividends. And Ashley Owen of Stanford Brown includes two of his fantastic charts to show the dramatic impact of inflation on asset values over time.

Then the analysts at Natixis led by Dave Goodsell dive into the impact of inflation and demographics on the retirement wellbeing of Australians and investors globally, and report on Australia's progress in the Global Retirement Index (GRI). Of the many factors contributing to a good or bad retirement, see how we rate on a global scale.

Will Low of Nikko Asset Management suggests there is a regime change hitting investors and they need new techniques to navigate along a different and bumpier road. Then Robert M. Almeida of MFS Investment Management argues that many analysts do not actually invest money, and that's where the rubber hits the road. He describes changes he has made in his portfolio in the last month, believing we have not yet 'hit the bottom' as there is not enough pain.

And Stephen Dover of Franklin Templeton says the focus on inflation and high employment is missing a major threat, that of stagflation, where low growth is accompanied by low inflation and low interest rates.

In the update for the weekend, Nicola Chand checks the Morningstar Australian database for three companies which carry a 5-star rating due to recent share price falls despite their promising outlooks. Then Jessica Bebel offers seven quick tips for personal financial success, based on a conversation with US author Farnoosh Torabi.

Weekend market update

US market update: Shares fell again in New York on Friday, testing the June 2022 low which drove a bear market rally in July. That optimism has completely gone. The S&P500 lost 1.7% (although it was down 2.5% at one stage) and NASDAQ fell 1.8% as major stocks such as Amazon off 3%, Apple down 1.5% and Tesla losing 4.6% led the falls. All major European markets lost at least 2%. The Australian dollar lost further ground, close to US65 cents.

From AAP Netdesk: After taking a break for the Thursday public holiday, the local share market picked up where it left off - by sinking lower as central bank rate hikes weigh on sentiment. The benchmark S&P/ASX200 index on Friday closed down 125 points, or 1.9% to 6,575. The losses came after the US Federal Reserve issued a hawkish forecast about future interest rate hikes as it raised them by 0.75% for a third consecutive month.

Friday's losses were the fourth losing session the past five, with the ASX200 closing at its lowest level since July 1. The index dropped 2.4% for the week. On Friday, every sector was lower, with the biggest laggards the ones most affected by interest rate hikes. Consumer discretionary and tech both dropped 4.4%, property dropped 3.6% and utilities were down 3%.

All the big retail banks were down with Commonwealth faring worst, dropping 1.9%. Westpac dipped 1.4%, NAB retreated 1.6% and ANZ 0.9%. Macquarie was down 3.1%. The heavyweight mining sector fared the best, dipping 0.5% as the three biggest players gained ground. Coalminers also did particularly well off the back of Russia's 'partial mobilisation' policy to support its invasion of Ukraine, which has badly disrupted energy markets. Whitehaven gained 2.7% to an all-time closing high of $9.20 and New Hope added 2.8% to a similar peak of $6.33.

From Shane Oliver, AMP, (as at 3pm Friday): Share markets fell sharply again over the last week in response to another round of hawkish rate hikes pushing up bond yields and adding to recession fears and with a threatened intensification of the war in Ukraine adding to worries. Reflecting the poor global lead Australian shares fell, led by interest sensitive IT, property, utility and retail shares. Bond yields rose as ever higher short-term interest rates for longer were factored in. Oil, metal and iron ore prices fell on the back of ongoing recession fears.

Shares are likely to see more downside in the short term as central banks remain hawkish, recession risks are high and rising, the conflict in Ukraine looks likely to escalate, we remain in a seasonally weak period of the year for shares out to mid-October and earnings expectations are still being revised down. While investor confidence is very negative, we have yet to see the sort of spike in put/call ratios or VIX that signals major market bottoms.

However, the combination of Australian households being far more vulnerable and hence responsive to rising rates than US households, lower inflation pressures in Australia and a desire to avoid overtightening means that RBA should not raise rates as aggressively as the Fed.

***

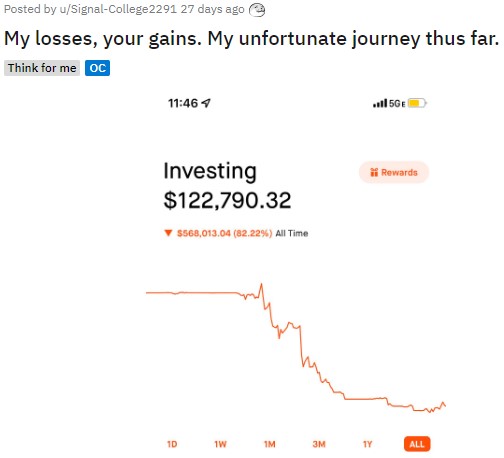

Finally, remember all the talk a year or two ago about meme stocks on Reddit and first-time traders making a killing on the Robinhood trading app in the US? We don't hear much about it these days, but the beauty of social media like Reddit (extract below) is people can post their results anonymously. In the meme mania, some people leveraged into options without knowing what they were doing, and that's how US$700,000 was turned into US$122,000. These 'diamond hands' usually only talk about their wins, making it seem as if everyone is doing well. They're not. (Example courtesy of MyMoneyBlog).

Graham Hand

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Funds Report from Cboe Australia

Plus updates and announcements on the Sponsor Noticeboard on our website