The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

When I started working in global capital markets at CBA in the early 1980s, my first Eurobond issue was arranged by Credit Suisse First Boston (CSFB). It was the bluest of bluechip names, among the most prestigious of investment banks. When we visited London, CSFB hosted dinner in a castle and brought out Lord and Lady Suchandsuch to regale guests with stories of royalty and courts in an extravagant meal finished with 50-year-old cognac. I was 25-years-old and rapidly learning how top society lived and worked.

Then CBA generously seconded me to Swiss Bank Corporation (SBC) to learn more about capital markets and my wife and I lived in Basle for six months. It was an incredible work environment of wood-panelled walls and floor-to-ceiling bookcases, lawyers sitting in dark offices dominated by massive partners' desks, and Bircher muesli each morning.

The Head of CBA Treasury, Campbell Ker, came over to Europe for a transaction roadshow, and we travelled around Switzerland and Luxembourg, six meetings a day, including an unforgettable flight on a small plane which banked around the snow-capped peak of the Matterhorn, so close I felt I could touch it. I still feel goosebumps thinking about it. We visited the offices of Swiss private banks hidden inside stark grey stone buildings, some of them looking like the archetypal Gnomes of Zurich. It was a time when the Swiss held the private wealth of the rich (and the Belgian dentists) protected by strict secrecy laws.

While I was there, SBC led CBA in the largest Australian dollar Eurobond issue ever, stuffing the bearer bonds (what tax?) into the portfolios of thousands of uber-wealthy clients and collecting generous fees along the way. It was civilised and efficient and Swiss-like, managing money as it passed from generation to generation among the elite.

Shortly after, I became Head of New Issues and it was the most wonderful job I ever had (looking back 40 years later). For someone who had only known motels and the back of a plane, the first- and business-class travel and luxury hotels soon became familiar. We raised billions of dollars of cheap, long-term debt all over the world, and Credit Suisse and Swiss Bank and UBS competed for our business. They were rivals for the funds management and investment banking needs of the world's borrowers and investors and it was unthinkable that they would all merge and remove the competition that banking needs.

But in 1998, SBC merged with UBS to create a powerhouse, the largest bank in Europe and the second-largest in the world with more funds under management than any global competitor. The merger was designed to cut costs and improve profits following a failure to adapt to rapidly-increasing competition.

And now, this greatest of banking nations with the world's once-most prestigious names looks like a banana republic. The Swiss Financial Market Supervisory Authority, FINMA, has cobbled together a deal to combine all these banks after a mad panic of a weekend. Credit Suisse has been struggling for years but it still employs about 50,000 staff. The bankers who I worked with in musty and dusty offices in Basle must be shaking their heads in disbelief.

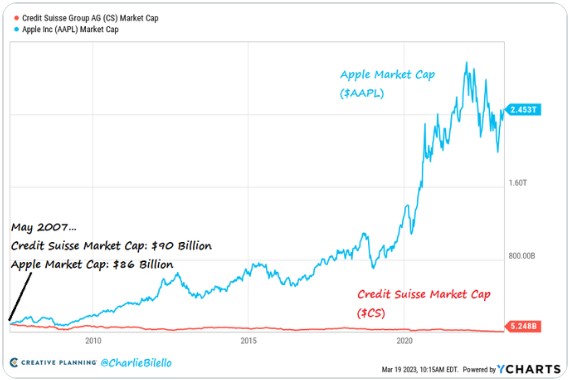

Prior to the GFC, when banking was a more reliable business and markets were riding high, many sensible investors would have preferred exposure to the great Credit Suisse than a technology company such as, say, Apple. In May 2007 when the first iPhone was released, Credit Suisse had a larger market value than Apple but US$90 billion of Swiss pride has been destroyed.

And now UBS has paid only US$3 billion for Credit Suisse, which was a sudden loss of value since last Friday when the market cap was around US$8 billion. The bargaining strength of UBS left Swiss authorities desperate to pull together the deal before Monday's open, but the biggest shock in the terms was the complete write down in the value of US$17 billion of Credit Suisse hybrids. If FINMA wanted to settle the markets, this had the opposite impact, sending shockwaves through bond houses and other bank regulators as the Swiss spread the crisis to US$275 billion of global perpetual bonds.

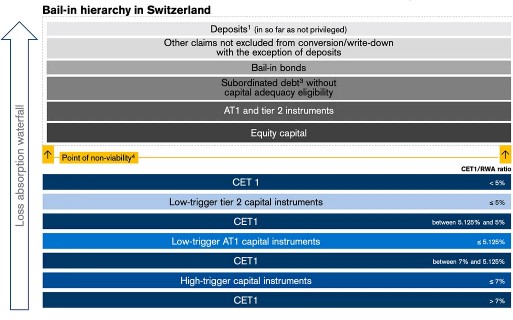

FINMA overturned a general understanding of the hierarchy in bank capital structures. Hybrids or Contingent Convertibles (CoCos) - the Additional Tier (AT1) bonds - were supposedly another buffer above ordinary capital (shareholders) to absorb losses and protect senior bond holders. But critically, markets understood that shareholders ranked last in a crisis and AT1 holders were protected by ordinary equity.

FINMA will argue that AT1 bondholders did not properly read the offer documents. It was easier to assume the Swiss AT1s are the same as any bank preferred shares, but the Swiss bonds had a sting in the tale. The documents say (CSG is Credit Suisse Group):

"Furthermore, any Write-down will be irrevocable and, upon the occurrence of a Write-down, Holders will not receive any shares or other participation rights in CSG or be entitled to any other participation in the upside potential of any equity or debt securities issued by CSG or any other member of the Group ... The Write-down may occur even if existing preference shares, participation certificates and ordinary shares of CSG remain outstanding."

Plenty of bond managers are sweating this week. They need to explain how they misunderstood this, as the meaning seems clear. It says the write-down in AT1 will occur even if ordinary shares of Credit Suisse remain outstanding. The bonds effectively rank behind common stock.

Courtesy of John Hempton, here is the Swiss bank capital structure, unlike anything I have seen in 40 years in the business. As John says, it clearly shows 'common equity capital' (CET1) ranks above the 'low-trigger' AT1 capital instruments in the loss absorption waterfall.

This ability of the Swiss regulators to 'bail-in' the AT1 bonds came at the point of non-viability. Credit Suisse did not fail by becoming insolvent due to bad loans but it was facing a liquidity crisis following withdrawal of deposits. As recently as 31 December 2022, its net tangible assets were US$45 billion. Once the Government stepped in to provide support (US$100 billion of liquidity, US$27 billion for write-downs, billions for losses, litigation and legals), the authorities argue they were required to mark down the hybrids to zero. In contrast, shareholders will receive US$3.25 billion in equity in UBS. Class actions and furious legal teams representing bondholders are challenging the decision.

Regulators from other countries are assuring markets that the Swiss rules do not apply widely. For example, the Bank of England issued a clarification:

"AT1 instruments rank ahead of CET1 and behind T2 in the hierarchy. Holders of such instruments should expect to be exposed to losses in resolution or insolvency in the order of their positions in this hierarchy."

Over the last couple of days, AT1 prices have rebounded as some level of confidence returns. For example, the ASX-listed VanEck Bentham Global Capital Securities Fund (ASX:GCAP) fell from $9 at the end of last week to a low of $7 on Tuesday and closed above $8 on Wednesday.

Investors considering the opportunity to buy into the turmoil don't know whether the financial system will face further problems. Liquidity levels at Credit Suisse looked high but no bank can withstand a massive loss of depositor support without government intervention. Banking is all about trust and this was a classic loss of confidence. Any investor jumping in should confine activity to the big Australian banks.

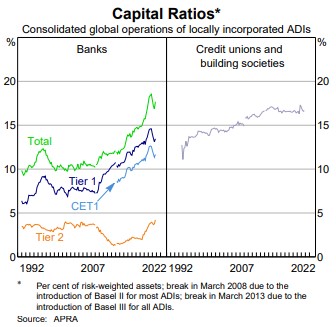

Why is Australia different? The first major point is the quality of our banks, which are making healthy profits, unlike Credit Suisse. Our hybrids documentation is also materially different. Whereas the Swiss can write off the hybrids in an intervention, it is common here for the documentation to say:

"XYZ Bank must convert these notes (to shares) if the common equity capital ratio of the XYZ Bank as prescribed by APRA falls to or below 5.125% or if a non-viability event occurs."

While there are variations in the documentation for Australian issuers, there are no known circumstances where hybrids would be subordinated to common equity. In the absence of an extreme black swan event, the hybrid should be converted to shares in the bank in a crisis. And here are the latest capital ratios for Australian banks provided by the Reserve Bank and APRA, showing how much work has been done raising capital since the GFC.

One consequence of greater uncertainty is the impact on the Reserve Bank's plans to control inflation. The futures market for cash is now a full 1% lower at the end of the year than it was a few months ago. The 10-year bond rate is down to about 3.2%. Cash is currently 3.6%, futures is about 3.2% by August and not long ago it was at 4.2%. Then to 3% a year later, although this week's Reserve Bank Board minutes suggest optimism is a little early for embattled borrowers.

“Members observed that further tightening of monetary policy would likely be required to ensure that inflation returns to target and that the current period of high inflation is only temporary ... Members noted that the staff’s most recent forecasts were for inflation to return to the 2–3 per cent target only by mid-2025, and this was on the assumption that the cash rate is increased a little further”

Market rates fell due to the following sentence, and economists are increasingly on the side of a pause after 10 consecutive increases:

" ... members agreed to reconsider the case for a pause at the following meeting, recognising that pausing would allow additional time to reassess the outlook for the economy.”

The US Federal Reserve increased rates by 0.25% overnight (Wednesday) but signalled that the banking crisis might end the tightening cycle sooner than previously expected.

***

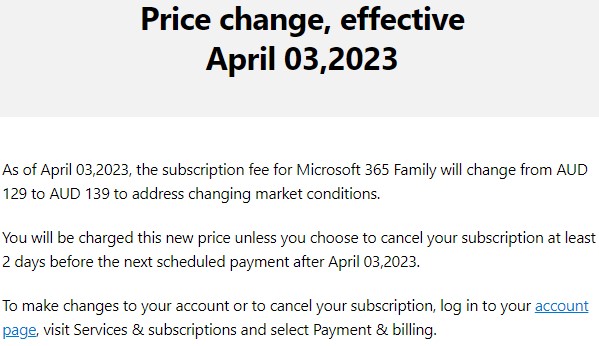

A reminder of how we have accepted price increases with barely a whimper came for everyone who uses Microsoft (and who doesn't?). Nobody will cancel Microsoft due to this increase "To address changing market conditions". Which is a non-attempt to disguise the desire for more profit. Look for a neat rise in revenue for this quality company.

And still on great technology companies, one of Apple's strengths is its pricing power and ability to avoid discounting, as this spectacular 'discount' offer for a new iPhone 14 shows:

As we come to the end of a momentous week for investing, banks and bonds, we have yet another financial chapter which will be be quoted and analysed forever. It was not only the demise of the venerable old Credit Suisse, but the day common equity sat above a bond issue in the payment pyramid. There are few certainties in investing.

***

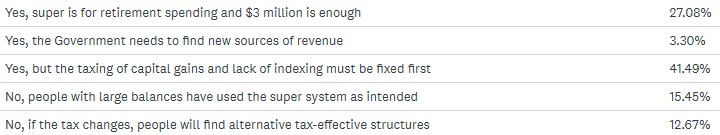

Interest in the $3 million super 'surcharge' or 'tax' or whatever it will be called remains strong, and our Reader Survey showed surprising support for the change despite many of our readers being adversely affected. Perhaps the Government deflected attention away from the $3 million amount with its clumsy unrealised capital gains and lack of indexing in the calculation, and if those things are fixed, many people will be more relaxed.

Here is the voting on the support for the $3 million proposal.

There has been a great response to the Reader Survey but we will leave it open for a few more days to improve the sample size (and financial advisers, we need more of you as it's mainly the SMSF trustees and retirees who have responded).

Graham Hand

Also in this week's edition ...

Romano Sala Tenna of Katana reminds us that regardless of these short periods of turmoil, there is only one long-term trend for the stock market, and that's up. And he presents four of his best charts to prove it. Romano says the real rewards of the market come from being able to ride out the inevitable crises and crashes along the way.

Turning to the current banking fallout, and Damien Klassen suggests that this time really might be different. Normally, credit crunches come before banking crises, but now it might happen the other way around. Damien provides a roadmap for how things may unfold and how investors should play it. Overnight in the US, Fed Chair Jerome Powell said he expects the banking crisis to lead to tighter lending conditions which may help the Fed to restore price stability.

Meanwhile, Morningstar's Dave Sekera advises investors not to panic because this isn't 2008. He reviews what’s different this time around, what to watch for that could make the situation worse, as well as the market and economic impacts. Dave believes there are opportunities to find undervalued stocks unfairly pulled down with the bank carnage.

We've pulled in four experts to clarify misconceptions about the super tax and franking. They suggests that the super tax is a progressive tax not a flat tax, we have many ways of taxing 'income', concessions are overstated and franking has a common value.

Here's a question that concerns most of us: is early retirement an achievable reality for the masses – particularly in the current volatile economic climate – or is it just a pipedream, reserved for the lucky few? Cromwell's Peta Tilse has some good news: it is achievable. And she has some advice on how to do it.

James Gruber reports on one of Australia's oldest listed investment companies that few have heard of (unless you're a regular reader of Firstlinks contributor, Peter Thornhill). Though it likes to keep a low profile, Whitefield took the time to celebrate its 100th birthday in a closing bell ceremony at the ASX last week.

Martin Lau of FSSA is undeterred by China's critics. He says the structural drivers for China's growth remain intact. Namely, rising incomes and wealth, increasing demand for premium goods and services, and burgeoning sophistication in technology and manufacturing. Martin highlights three long-term themes and companies that are likely beneficiaries.

Owen Covick and Kevin Davis provide a cheeky take on Treasurer Jim Chalmers' recent pledge to create "a new sustainable finance architecture, including a new taxonomy to label the climate impact of different investments". They have some helpful, or not-so-helpful, suggestions for Mr Chalmers.

In the weekend update by Morningstar, Josh Peach looks at three ASX stocks that fund managers are buying, while Kongkon Gogoi examines two Aussie ETFs to navigate a possible global recession.

***

Weekend market update

In the US on Friday, the S&P 500 rose 0.1% as big tech climbed and bank stocks trimmed losses despite concerns about a wider banking crisis amid a selloff of Deutsche Bank. The Nasdaq 100 finished marginally lower by 0.3% but remains near year-to-date highs. Treasurys settled down a bit from their recent volatility, as two- and 30-year yields finished at 3.78% and 3.64%, respectively, while WTI crude slipped below $70 a barrel and gold pulled back to $1,979 per ounce. The VIX settled just south of 22.

From AAP Netdesk:

On Friday in Australia, the local share market endured its seventh consecutive losing week as interest rate hikes and fears about the stability of the global banking system weighed on sentiment. The benchmark S&P/ASX200 index did manage to close near the highs of the day on Friday, finishing down 13.4 points, or 0.19%, to 6,955.2, after having been down as much as 0.65% in the first 15 minutes of trading. The broader All Ordinaries finished down 11 points, or 0.15%, to 7,137.6.

The ASX's 11 official sectors were mixed on Friday, with five gaining ground and six losing it.

Financials were the biggest losers, falling 1.1% amid losses for the Big Four banks and Afterpay owner Block, which plunged 18.4% to $88.94 following a scathing report by US short-seller Hindenburg Research. Hindenburg said its two-year investigation had found Jack Dorsey's Cash App business had facilitated fraud against consumers, misled investors with inflated metrics and dressed up "predatory loans and fees as revolutionary technology". Block said it would working with the United States Securities and Exchange Commission and explore its legal options over the "the factually inaccurate and misleading report".

NAB was the biggest loser among the Big Four banks, falling 1.6% to $27.18. CBA dropped 1.2% to $95.84, ANZ retreated 1.1% to $22.52 and Westpac declined 0.6% to $21.20.

Insurance companies lost more ground with Suncorp dropping 1.2% and IAG down 0.9%.

In the heavyweight mining sector, BHP reversed its earlier losses to finish up 0.3% at $43.64. Rio Tinto added 0.2% to $114.43.

Goldminers turned in another solid performance as the price of the precious metal hovered around $US1,990 an ounce, having briefly traded above the $US2,000 mark at time this week. Newcrest climbed 1.8% and Evolution added 2.8%, while Kingsgate soared 11.7% to a 15-month high of $2.01 after announcing the first pour in six years at its recently reopened Chatree goldmine in Thailand.

Aged care operators Estia Health and Regis Healthcare were both up by double digits after Estia confirmed it was considering a tentative takeover offer from Bain Capital for $3 per share, or $775 million. Estia soared 14.1% to $2.67, close to a two-year high, while Regis rose 13.9% to a two-month high of $1.845.

From Shane Oliver, AMP:

- Global share markets had a volatile week with ongoing worries about banking contagion, but managed to rise helped by some settling of concerns in the US and hopes that central banks are near the top on rates. For the week US shares gained 1.4%, Eurozone shares rose 1% (despite a fall in Deutsche Bank shares on Friday), Japanese shares rose 0.2% and Chinese shares rose 1.7%. However, Australian shares remained under pressure falling by 0.6% for the week with falls led by property stocks, banks, IT and industrial shares. Bond yields mostly fell again. Oil and metal prices rose but the iron ore price fell. The $A fell despite a further fall in the $US.

- Bank turmoil is still providing a roller coaster ride for investors. The bad news is that:

- the risk of further contagion remains high in the short term (as evident by the fall in Deutsche Bank shares on Friday) particularly as rate hikes and last year’s surge in bond yields continues to feed through to other sectors of the economy, eg, office property is particularly vulnerable to the negative valuation impact of higher bond yields and reduced space demand from “work from home” which in turn will have an impact on banks;

- the US authorities have contributed to confusion over protection for bank deposits over $US250,000 with Treasury Secretary Yellen providing conflicting messages on this over three days reflecting the problems the US Administration has in extending protection without a backlash from Congressional Republicans;

- central banks have continued to raise interest rates – with multiple moves over the last week from the Fed, Bank of England, Swiss National Bank, Norway, the Philippines and Taiwan. The Fed tightening is unprecedented for a financial crisis. It does seem like central banks are determined to show that they have financial stability measures to deal with financial stability issues and so monetary policy is still free to deal with inflation; and

- the turmoil still implies a hit to growth - as a result of increased bank funding costs and reduced lending which could knock around -0.5% off GDP in the US & Europe - and hence profits.

- However, the good news is that:

- the situation is nowhere near the broad-based bank asset problems that gave rise to the GFC (at least not yet);

- authorities in the US and Switzerland have moved quickly to limit contagion from problems in US regional banks and Credit Suisse;

- while the Swiss National Bank created uncertainty by wiping out the value of hybrid AT1 bail-in bonds issued by Credit Suisse, EU authorities have stated that bail-in bonds would rank ahead of equity in the EU;

- bank borrowing from the Fed has fallen back to around zero suggesting deposit outflows have stabilised;

- major central banks are taking account of the banking turmoils’ dampening impact on lending and hence economic activity and inflation which implies less interest rate hikes than otherwise and that central banks may be at or near the top; and

- so far there is little evidence of a surge in banking sector systemic risks – although it’s still early days.

The bottom line is - so far so good, but history warns that the fallout from the monetary tightening of the last year still has a way to go yet including in terms of the impact on banks so volatility in share markets is likely to remain high for a while yet.

- The Fed is likely nearly done. The Fed raised its key Fed Funds rate by another 0.25% taking it to a range of 4.75-5%, with an acknowledgement of the dampening impact on activity and inflation from the banking turmoil, a downgrade to its tightening guidance and no change to the peak dot which remains at 5-5.25% suggesting just one more hike. Fed Chair Powell’s press conference comments leaned more hawkish though, focussing on still high inflation and warning of more rate hikes and pushing back against market expectations for rate cuts this year. However, the overall impression is that while the Fed does not plan to cut interest rates to deal with banking sector liquidity issues (seeing last week’s banking backstop measures as dealing with that) it is taking account of its impact on the economy and inflation and so has adjusted to a less hawkish stance than was the case before the turmoil began when it was thinking of hiking by 0.5% and raising its peak interest rate guidance. With demand likely to slow further, unemployment likely to rise and inflation expected to fall further our view remains that the Fed is nearing the end of its tightening cycle. While the Fed does not currently see rate cuts this year, in contrast to market expectations, we are allowing for one cut in December.

Curated by James Gruber and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by the weekend.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Funds Report from Cboe Australia

Plus updates and announcements on the Sponsor Noticeboard on our website