The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

It’s 1979 and Conrad Hilton, found of the Hilton chain of hotels, dies. His will leaves much of his wealth to his foundation. It’s contested by family members, as lawsuits fly left and right. And there are plenty of colourful characters duking it out.

There’s Francesca Hilton, the daughter to Conrad and his second wife, Hungarian-American actress Zsa Zsa Gabor. She fought her father’s will and lost, though received US$100,000. Francesca ended impoverished and living in her car, before dying in 2015.

There’s Barron Hilton, Conrad’s son, who spent much of his career building Hilton Hotels. He reached a settlement where he received a significant number of shares in the hotel company.

There’s Zsa Zsa herself, the beautiful socialite, who married Conrad during World War Two and divorced soon after, and who later wrote in 1991 that Francesca was born because Conrad had raped her.

In court in 1979, Zsa Zsa said of Conrad Hilton:

“Conrad Hilton was not an easy man to understand. So religious. Always with the nuns, the church. Every day going to the church or praying on his knees in the bedroom to a shrine. In some ways, I think it’s the reason why we are here today. He would rather the nuns have his money than his own family. I don’t think he would disagree with my saying it, either.”

She was probably right. Conrad Hilton came from humble beginnings to buy his first hotel in Dallas in 1919, before going on to build a worldwide empire. He did it through sheer will and unwavering faith. He tried to raise his children to have his work ethic rather than relying on money, though it was only partially successful.

One of his other sons, Conrad Junior, the first of eight husbands to movie star, Elizabeth Taylor, became an alcoholic and drug addict, and died aged 42. Bizarrely, Gabor alleged Conrad Junior had an affair with her at one time.

Problems have followed the Hilton clan through the generations. So much so that Paris Hilton, famous for an explicit video tape and not much else, is regarded as one of the more ‘normal’ Hiltons left.

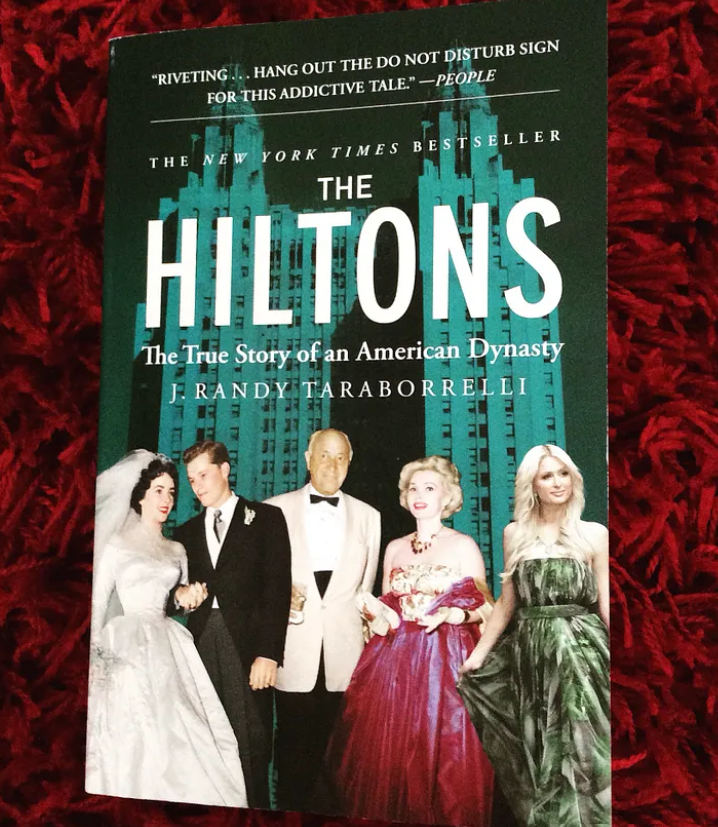

The Hiltons story, well depicted in J. Randy Taraborelli’s book, The Hiltons: The True Story of an American Dynasty, is akin to that of the Succession television series, albeit a true and arguably better one.

It can be read as an all-American tale of rags to riches or a cautionary one of how that journey may not bring happiness.

More broadly, it has some great lessons about what wealth can give us and what it can’t.

What wealth can buy

Let’s first look at what money can provide us:

It can buy goods. Money can be used to buy everything from basics such as food and clothing, to houses and cars, and more elaborate purchases such as boats, holiday homes etc. In Conrad Hilton’s case, it allowed him to buy a preposterously expensive and elaborate house in Bel Air, Los Angeles. Recently, the house listed with an asking price of US$250 million.

It can buy better health. Money provides better access to doctors and healthcare, and leads to increased quality of life and longevity, according to many scientific studies.

It can buy a social network. Having money can connect you with other people with money. This can lead to job and other opportunities that you may not have had otherwise.

It can buy time. Money can provide for an early retirement and give you the time to do what you like.

What wealth can’t buy

Here’s what money can’t give us:

It can’t buy social connections. Recent psychology studies point to three pillars of life satisfaction in retirement: health, money, and relationships. On the last pillar, the single biggest predictor of happiness is your relationship with your spouse or partner. Close behind is having a social network – that is, plenty of friends who you catch up with on a regular basis. Money can’t buy these social connections.

It can’t buy wisdom. Human beings have two types of intelligence. One is called fluid intelligence which is our ability to think abstractly and deal with complex information. It peaks early in life, at around the age of 20. The other is called crystallised intelligence, which is where we age and gain more experience of the world, and that helps us to make better decisions. Money can’t buy either of the two intelligences.

It can’t buy happiness. As the Hiltons demonstrate, wealth has a way of bringing as much misery as it does happiness. Put another way, it can bring out the best and worst in people.

It can’t buy freedom. A common refrain is that money can give you freedom. It can certainly provide financial freedom. It can alleviate concerns about getting food, shelter, and other things.

As for freedom more broadly, I’m not so sure. In my view, real freedom comes from not being dependent on money or anything else. By this definition, none of the Hiltons were free as all of them were dependent on wealth, as well as the source of that wealth, Conrad Hilton. I’d argue that generations of Hiltons have been trapped rather than freed by wealth.

Buddhists may have it right. They say that attachment (or dependency) is the root of all suffering. That letting go of all attachments is the key to contentment.

As investors, we’re in the game of building wealth to secure our financial futures. The tale of the Hilton family is a nice reminder that wealth can serve us, or we can serve it. And that we get to choose.

James Gruber

In this week's edition...

It's been accepted wisdom in markets for decades that investors focus more on limiting losses than making gains - the so-called 'loss aversion' theory. Yet new research outlined by Don Ezra shows that as we age, the reverse may be true. If right, it could have broad implications for the investment industry.

We have several articles advocating investors to go where few are willing to tread. First, Emma Fisher and Matt Williams at Airlie think fears about consumer discretionary spending are putting several quality retailers on sale. They especially like Nick Scali and Premier Investments at current prices.

Next, James Gruber looks at how value stocks have again been left for dead in 2023, after a bounce last year. He believes the 16-year bull market in growth stocks is showing many signs of excess that could result in a sharp and enduring bounce in value-based investments.

And, in this week's Wealth of Experience podcast, Andrew Parsons of Resolution Capital, argues the extraordinary negativity around commercial property appears overdone, and that segments such as retail property look like a sound, contrarian bet. The podcast also features Graham Hand on home ownership versus super, and Peter Warnes on the interest rate outlook.

Tribeca's Jun Bei Liu previews the ASX reporting season. She expects earnings downgrades aplenty, yet the rebasing of company earning forecasts should result in a more realistic outlook and possible buying opportunities.

Chinese demographic problems are far worse than most think, according to geopolitical expert, Peter Zeihan. In fact, he says that this is going to be the final decade that China exists as a nation-state.

The World Gold Council says SMSF investors continue to face inflationary pressure not seen in decades, and it could influence investment performance if the potential effects are not considered. It provides a guide on how to inflation-proof your portfolio.

Two extra articles from Morningstar for the weekend. Mark LaMonica looks at whether the market is underestimating the potential of an ASX healthcare heavyweight and assesses earnings results from two US tech giants.

This week's whitepaper comes from the World Gold Council and it examines the mid-year outlook for gold after a positive first half of the year.

***

Weekend market update

On Friday in the US, stocks rebounded as soft inflation data boosted investor sentiment and shares of big tech companies powered the indexes higher. The S&P 500 rose 1%. The Dow Jones Industrial Average added about 177 points, or 0.5%, and the Nasdaq Composite jumped 1.9%. The benchmark 10-year U.S. Treasury yield dipped to 3.968%, from 4.011% on Thursday. Meanwhile, Brent crude rose 0.85% to US$83.54, and gold ended up 0.76% at US$1,959.

From AAP Netdesk:

In Australia, the local bourse retreated from its almost six-month high, as the Bank of Japan loosened its attempts to control bond yields. The benchmark S&P/ASX200 index on Friday finished 52.3 points lower, down 0.7% to 7,403.6, while the broader All Ordinaries fell 56.5 points, or 0.74%, to 7,616.1.

Every ASX sector fell on Friday except for utilities, which gained 0.1%, and energy and utilities, which were flat.

The property sector was the biggest loser, falling 2%. Vicinity Centres dropped 2.7% and Scentre Group fell 1.8%.

The heavyweight mining sector dropped 1.2%, with Fortescue plummeting 5.4% to $21.68 a day after releasing a quarterly production update. BHP retreated 0.8% at $45.80, Rio TInto was 1% lower at $116.62, and Newcrest dropped 1.8% to $26.41.

All of the four Big Four banks were lower, with CBA down 1% to $105.50, ANZ edging 0.1% to $25.76 and Westpac and NAB both falling 0.3%, to $22.28 and $28.38, respectively.

In technology, SiteMinder soared 21.5% to a near six-month high of $4.29 after the hotel commerce platform reported it expects to be profitable by the second half of 2023/24 following strong growth over the past year.

From Shane Oliver, AMP:

- Global shares rose over the last week being buoyed by increasing confidence that central bank interest rates are at or close to the top and solid US earnings reports, despite a brief setback with the BoJ moving to loosen its yield curve control. For the week, US shares rose 1%, Eurozone shares rose 1.4%, Japanese shares rose 1.4% despite a brief dip following the BoJ move, and Chinese shares gained 4.5% on Chinese stimulus hopes. Despite a fall on Friday not helped by weaker than expected retail sales and the BoJ move, Australian shares were boosted by news of lower-than-expected inflation and rose 1.2% for the week with gains led by energy, telco, IT and consumer discretionary stocks. Bond yields generally rose on the back of stronger economic data in the US and the BoJ move. Oil prices continued to rise with tight supplies and metal prices also rose, but the iron ore price fell slightly. The $A fell as the $US rose.

- Despite lower-than-expected inflation readings, the Fed and ECB continued to raise interest rates over the last week but the better inflation backdrop means they are at or close to the top:

- The Fed raised its Fed Funds rate by 0.25% to 5.25-5.5% as expected. On the one hand it upgraded its assessment of economic growth from “modest” to “moderate”, it noted that the labour market remains tight and it retained its tightening bias. However, it tightening bias has softened as it acknowledged the fall in inflation, with Fed Chair Powell non-committal on whether it will raise rates again in September with the outcome being data dependent. The money market is only attaching a 20% probability to another hike. We think the Fed has finished hiking, but the main risk in the US is if there is a resurgence in growth which curtails the cooling in the jobs market.

- Similarly the ECB hiked by another 0.25%, taking its deposit rate to 3.75% and its main refinancing rate (which is more comparable to the RBA cash rate) to 4.25%, but it dropped its tightening bias in favour of full data dependence with ECB President Lagarde no longer saying there is more ground to cover, leaving the door open to another hike but will approach the next meeting in September with an “open mind” as to whether to hike or hold. Money markets are attaching around a 28% probability to another hike.

- The BOJ weakened its “yield curve control” – but don’t expect a big impact on global markets in the near term. The BoJ left its short-term policy rate at -0.1% and kept its 10-year bond yield target at zero but appears to be now tolerating a rise in 10-year bond yields to 1%, beyond the cap of 0.5%. This appears to be designed to allow the BoJ to retain other aspects of its ultra easy monetary policy for now, but with various inflation measures above its 2% target it is a move in the direction of tightening, albeit a very mild one, but with more likely to come over time. Since Japan is a large holder of foreign bonds allowing Japanese bond yields to rise further will put some upwards pressure on global bond yields. But with JGBs still set to offer much lower yields than in other markets for some time yet the impact is likely to be minor as was the case after the BoJ raised the yield cap from 0.25% to 0.5% last December, at least until the BoJ pushes further down the tightening path.

- Australian inflation is also moving down with global inflation. From its peak around 8%yoy, the quarterly CPI inflation rate has now fallen to 6%yoy. Just as we lagged the US on the way up by about six months (as we were slower to reopen our economy and the global energy price crisis took longer to hit Australia) we are lagging it on the way down by about six months.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Quarterly ETFInvestor (ETF Market Data) from Morningstar

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website