The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Vanguard and consultant, Investment Trends, have released their 11th annual SMSF Trustee report, and it gives a comprehensive snapshot of the latest trends in the sector.

Let’s go through them:

By the numbers

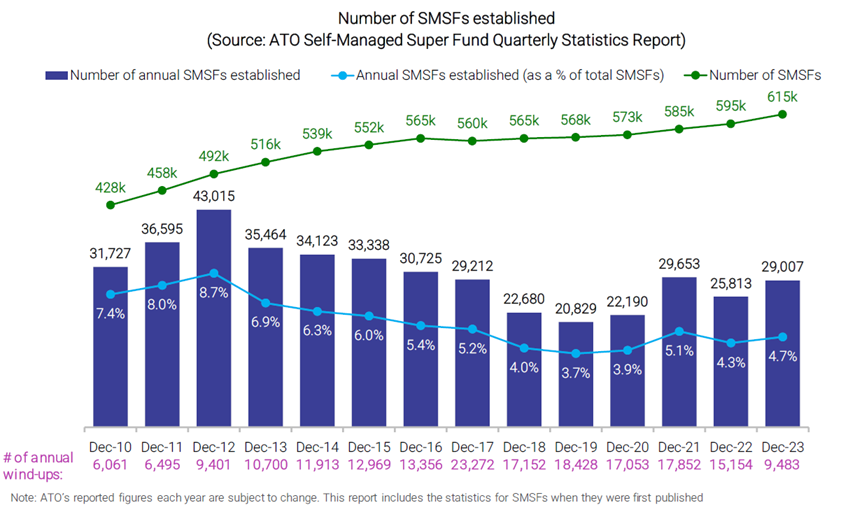

The overall number of SMSFs continues to rise. There are 615,000 SMSFs, after the establishment of more than 29,000 SMSFs in 2023, and only 9,483 closures.

Source: Vanguard/Investment Trends 2024 SMSF Investor Report

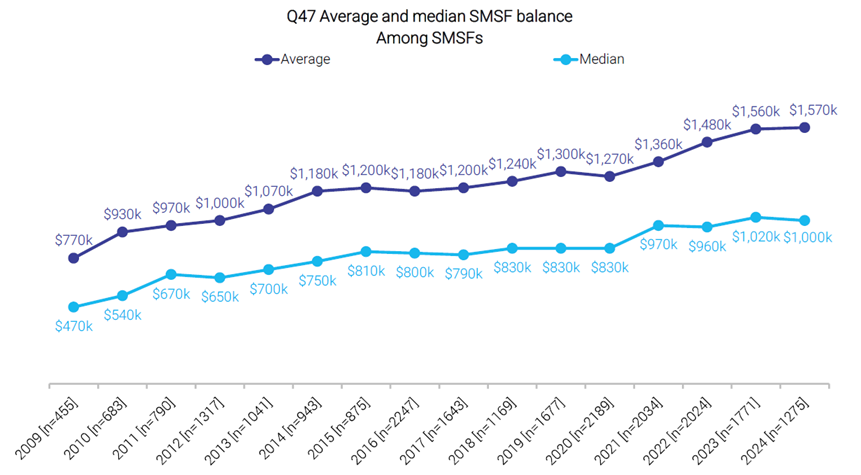

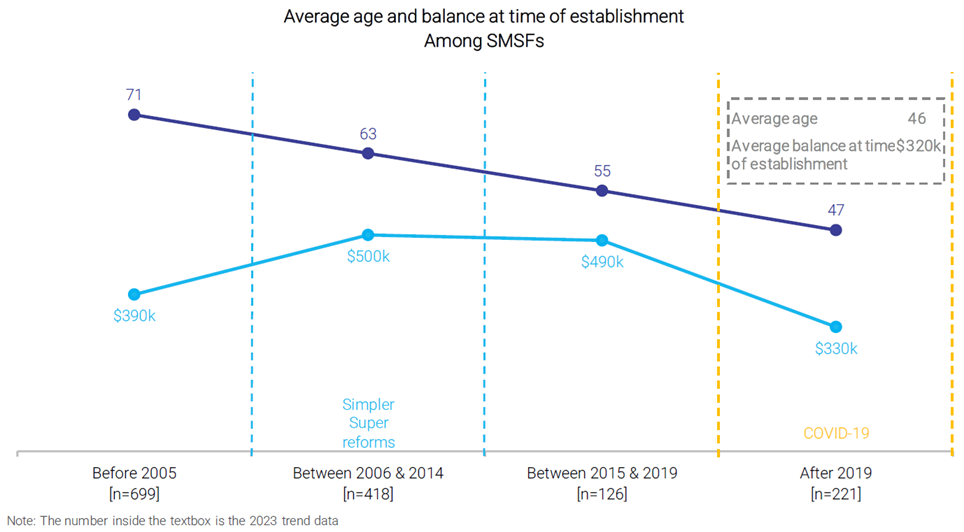

SMSF average balances are at their highest levels at over $1.5 million, almost double what they were 15 years ago. The median balance is $1 million. Of those establishing new funds, they are 47 years old on average, with a balance of $330,000.

Source: Vanguard/Investment Trends 2024 SMSF Investor Report

Source: Vanguard/Investment Trends 2024 SMSF Investor Report

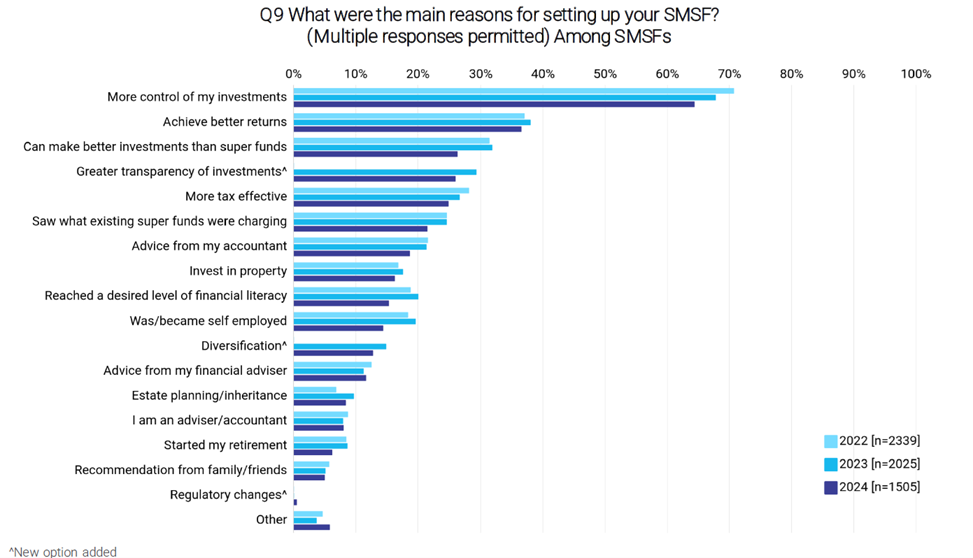

The desire for control over investments continues to be the primary reason for establishing an SMSF.

Source: Vanguard/Investment Trends 2024 SMSF Investor Report

Of the SMSFs surveyed, 36% intend to retire before they reach 60 years of age.

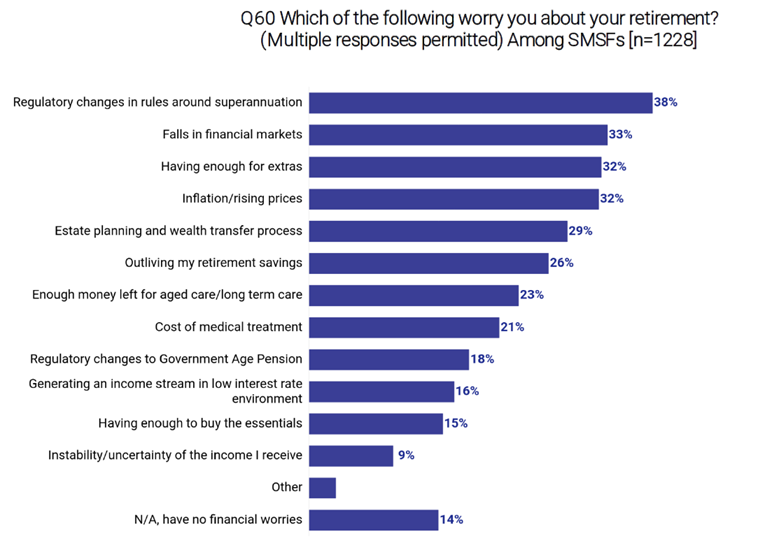

Confidence in retirement

The report finds that SMSF members are far less concerned than those in super funds about the possibility of outliving their retirement savings. In fact, 34% of individuals in SMSFs are not concerned about this at all. Of SMSFs who are already retired, there’s even less concern (47% of retirees vs 24% of non-retirees are not at all concerned). Instead, the biggest worries for SMSFs about retirement are regulatory changes in super rules, falls in markets, inflation, and having enough money for extra expenses.

Source: Vanguard/Investment Trends 2024 SMSF Investor Report

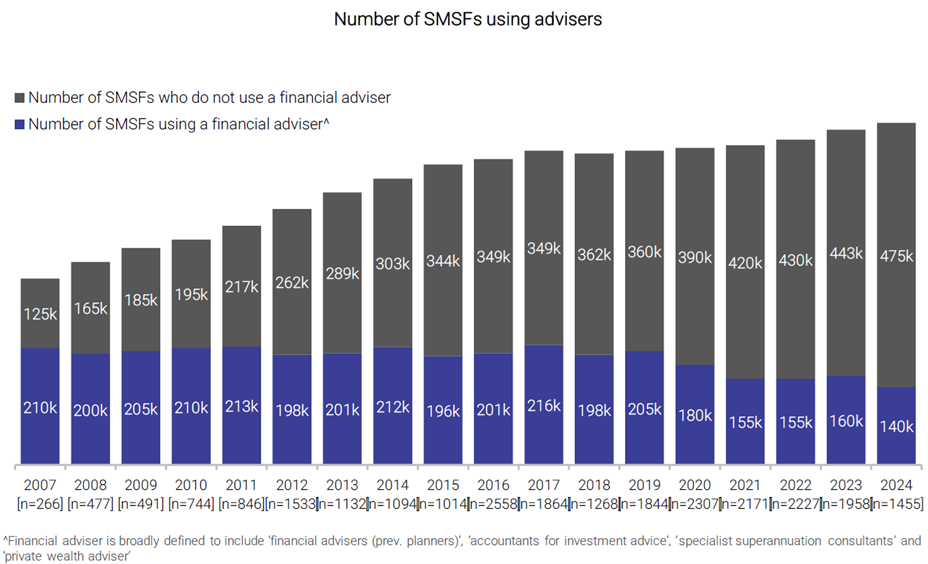

Not keen on financial advisers

Around 77%, or 475,000, of SMSFs do not use a financial adviser. The number using advisers peaked at 216,000 in 2017, but that’s plummeted to just 140,000 today – a 35% drop over seven years. The report finds that newly established SMSFs are less likely to use advisers than established SMSFs.

Source: Vanguard/Investment Trends 2024 SMSF Investor Report

Furthermore, only a quarter of trustees without financial advisers are likely or very likely to seek financial advice in future.

The report says the top four reasons given for not seeking financial advice are:

- The ability to manage their own finances

- The high cost of advisers

- Not current needing advice

- Poor previous experiences with advisers

So, where do SMSFs seek advice if they need it? Accountants remain the go-to advisers for established SMSFs. For new SMSFs, they consult with their SMSF administrators.

In terms of what advice that SMSFs would find helpful, tax and retirement strategies topped the list, followed by pension strategies and inheritance and estate planning.

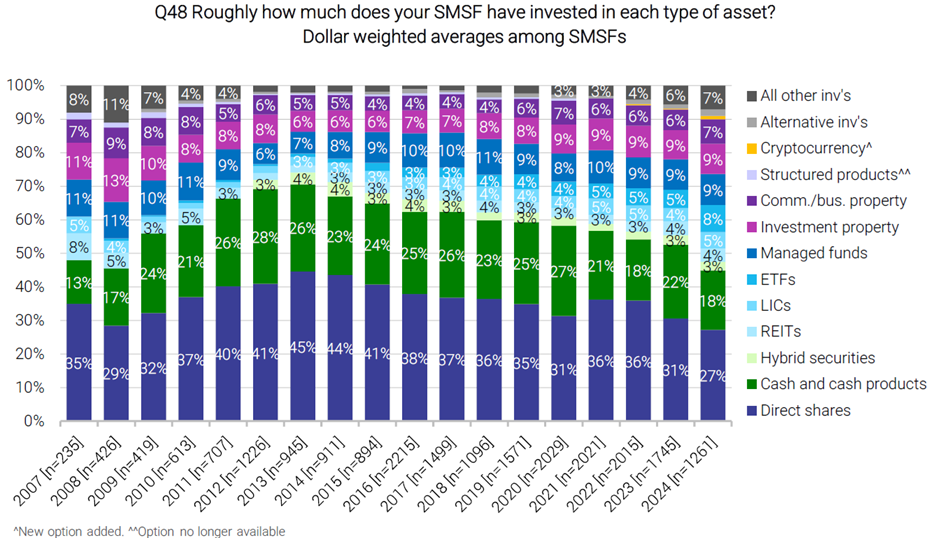

Asset allocation

Last year, SMSFs reduced their cash and direct shareholdings and increased their use of ETFs. The percentage of cash holdings fell from 22% in 2022 down to 18% in 2023. Meanwhile, direct shareholdings decreased to 27% from 31% the prior year. ETFs as a percentage of total assets climbed from 5% to 8% in the 12 months to December last year. SMSFs now account for 13% of ETF investors.

Source: Vanguard/Investment Trends 2024 SMSF Investor Report

Observing longer term trends, direct share and cash holdings have fallen sharply from their peaks in 2013. They’ve been replaced with more ETFs, property, both residential and commercial, as well as Listed Investment Companies (LICs).

Interestingly, SMSFs seem to be using ETFs to both diversify their assets and gain greater exposure to international shares.

SMSF use of managed funds remains high at 9% of total assets. Over one-third of SMSFs have an allocation to managed funds.

Gender differences

For the first time, the report includes gender breakdowns. Female SMSF trustees have lower SMSF balances ($1.3 million vs $1.6 million) and annual incomes ($96,000 vs $122,000) compared to their male counterparts.

SMSF women trustees are more concerned about outliving their retirement savings – 3.3 on a scale of 10, vs 2.8 for men.

Female trustees also feel a greater need to improve their financial literacy and therefore are more likely to seek out education. To do this, they’re primarily approaching accountants and SMSF administrators.

James Gruber

In this week's edition...

Two commonly asked questions are: 'How much do I need to retire' and 'How much can I afford to spend in retirement'? Ashley Owen says precise answers to these questions are difficult, but he provides an easy-to-understand guide to help you come up with your own numbers to suit your goals and needs.

Since the creation of compulsory superannuation in the 1990s, inflation hasn’t been a notable issue, but the past two years has been a stark reminder of the impact inflation can have on the spending power of retirees. With another inflation uptick a risk, what are the best ways for retirees to protect their income from future inflation shocks? Aaron Minney gives his thoughts.

Bonds have had a prolonged bear market and their positive correlation to equities of late means they may not be the diversifier in portfolios that they once were. What are the alternatives to bonds, and where might there be value? Schroders Group CIO Johanna Kyrklund has some suggestions.

A Firstlinks article on April 17 on how public servants were demanding an exemption from the $3 million super tax provoked a lot of debate. It also caused some confusion, given the number of defined benefits schemes and their complexities. Today, we get a different view from John Pauley on how unfunded pension schemes may be treated unfairly compared to their funded counterparts under the new tax.

Investors are pouring into ETFs yet they may not be aware that there are tax advantages to these funds. VanEck's tax guru Michael Brown outlines two tax advantages to having ETF investments, plus a bonus perk if you’re in a fund hedged to the Aussie dollar.

Healthcare is a niche property sector that's about to go mainstream. With ageing demographics set to boost demand for decades to come, institutions are investing a lot of money in the space. Cromwell's Colin Mackay identifies one specific area that is especially attractive.

On a lighter note, did you know you are far more likely to share genes with friends than non-friends? Or that the number of friends you have is correlated to the size of certain parts of your brain? These are the latest findings of psychologist, Robin Dunbar, who's most famous for inventing Dunbar's number, as Joseph Taylor explains.

Two extra articles from Morningstar for the weekend. Shane Ponraj explores whether the market is underestimating ASX pathology shares, while Jospeh Taylor looks into the outlook for the major banks continuing to return capital to shareholders.

Lastly, in this week's whitepaper, Franklin Templeton details recent trends in demographics around the globe and what they may mean for the future.

***

Weekend market update

On Friday in the US, stocks bounced back after Thursday’s stumble, with the S&P 500 pushing higher by two-thirds of a percent to wrap up the week little changed. Treasurys stayed close to home with the long bond ticking lower by one basis point to 4.57% and the two-year note rising to 4.93% from 4.91%, while gold likewise digested its recent selloff at US$2,334 per ounce. WTI crude and bitcoin rebounded towards US$78 a barrel and US$68,900 a token, respectively. Tthe VIX turned lower once more to below 12.

From AAP Netdesk:

The Australian share market on Friday dropped across the board to post its worst losses in more than three weeks as hopes fade for midyear interest rate cuts.The benchmark S&P/ASX200 index on Friday fell 84.2 points, or 1.08%, at 7,727.6, while the broader All Ordinaries dropped 83.9 points, or 1.04%, to 7,999.2.

All of the ASX's 11 sectors finished lower on Friday, with consumer discretionaries down the most, at 2.5%. Wesfarmers slipped 3.8% to a three-month low of $63.82, Tabcorp dropped 3.9% to 62.5c and IDP Education retreated 4.2% to $16.32.

All of the big four banks finished lower, with CBA down 1.5% to $118.87, NAB drooping 1.3% to $33.96, Westpac falling 1.2% to $26.56 and ANZ dipping 1% to $28.11.

In the heavyweight mining sector, BHP fell 0.6% to $44.64 while Fortescue and Rio Tinto each slipped 0.8%, to $26.77 and $132.50, respectively.

Next week, the Australian Bureau of Statistics will report retail sales figures on Tuesday and April monthly consumer price index on Wednesday.

From Shane Oliver, AMP:

- Major share markets were flat to down over the last week as uncertainty returned around the timing of interest rate cuts after hawkish minutes from the Fed’s last meeting, stronger business conditions data and a smaller than expected fall in UK inflation. US shares were flat for the week though, helped by another strong result from Nvidia as the AI boom continues and a rally on Friday on lower-than-expected inflation expectations. However, Eurozone shares fell 0.6% for the week, Japanese shares fell 0.4% and Chinese shares fell 2.1%. The Australian share market fell 1.1% for the week on the back of the weak global lead, hawkish RBA minutes, a pullback in metal prices and some stock specific issues with falls being led by retail, telco, property and material shares. Bond yields reversed some of their recent decline on renewed uncertainty about rate cuts. Oil and metal prices fell, but the iron ore price rose.

- Lots of noise but global inflation is still falling – as evident in April data for Canada, Japan and the UK. This keeps major central banks (excluding the BoJ which has only just started hiking) on track for rate cuts this year albeit it’s a mixed bag as to timing. But it remains a bumpy process. The ECB and Canada look like they might start cutting rates as early as next month. But the UK may now be a laggard with the fall in its inflation rate being less than expected potentially pushing out the start of Bank of England rate cuts till later this year. In the US, the minutes from the last Fed meeting three weeks ago leant hawkish with “various participants willing to tighten further if needed and “a number” noting uncertainty regarding the degree of restrictiveness. However, this followed three hot inflation readings and so now is a bit dated with recent inflation and activity data coming in cooler.

- In Australia, the next move in rates likely remains down. The minutes from the last RBA meeting suggest that while it still retains a tightening bias, its mild and the hurdle for another hike is high requiring upwards revisions to its 2025 and 2026 inflation forecasts. While the near-term risks are probably on the upside if inflation surprises on the upside again, the most likely scenario is that the RBA holds rates ahead of rate cuts starting later this year. The recent US and Australia inflation scare after hot March quarter inflation looks to be receding, Australian economic growth is very weak with the economy going backwards were it not for massive population growth, the labour market is cooling which will result in slower wages growth ahead and Australian mortgage holders have seen far bigger rate hikes in the actual mortgage rates they pay than their counterparts in most other comparable countries. We are allowing for a 0.25% cut in the cash rate to 4.1% in November or December and two cuts next year.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ETF Quarterly Report from Vanguard

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website