The impact of central bank activity on stock and bond markets is so pervasive that 'don't fight the Fed' has become a cliché. In fact, clichés are thriving in the coronavirus pandemic. We hear 'the cure is worse than the disease', events are 'unprecedented' and 'black swans', hotels and ships are 'Petri dishes', while 'we're all in this together' but it's 'the worst since the Great Depression' before we 'come out on the other side'. And yes, yes, yes, we know 'when the tide goes out, we can see who's been swimming naked', although 'it's the end of the beginning'.

'Don't fight the Fed' is advice to invest in alignment with the actions of the US Federal Reserve, which is doing 'whatever it takes'. It's a risky strategy. It's apparently safe to invest in equities when the Fed is lowering rates and pumping money into the economy. Confidence has even returned to high-yield (which we used to call junk) bond markets because the Fed is buying, despite the fact that many companies will not survive the downturn. Poorly-run companies which have leveraged their balance sheets by borrowing for share buybacks (and thereby enhancing executive bonuses) instead of building reserves should be allowed to fail. Risk should have a price.

For many years, since it ran out of monetary policy ammunition, the Bank of Japan has been buying trillions of yen of equities a year to stablilise the market, and the Fed is not far behind.

But while the Fed can print an apparently unlimited amount of money, 26 million Americans who have lost their jobs in the last five weeks will not spend it. Millions of companies facing lockdown will not invest it in new equipment. Most people are home-bound, hunkering down and protecting cash. And as restrictions are lifted, will people resume their pre-coronavirus lives? Incomes are falling, rents are not paid, and for a long time, we will be wary at sporting events, in restaurants, at shopping centres. Then what happens when governments shut off the life supports?

In Australia, 800,000 jobs have gone in three weeks. The Grattan Institute estimates that up to 26% of Australian workers could be out of work as a direct result of the shutdown, with "an enduring impact on jobs and the economy for years to come."

Nassim Taleb (he of 'black swan' fame) in his book Antifragile: Things That Gain from Disorder, says:

"Indeed, our bodies discover probabilities in a very sophisticated manner and assess risks much better than our intellects do. To take one example, risk management professionals look in the past for information on the so-called worst-case scenario and use it to estimate future risks - this method is called 'stress testing'. They take the worst historical recession, the worst war, the worst historical move in interest rates, or the worst point in unemployment as an exact estimate for the worst future outcome. But they never notice the following inconsistency: this so-called worst-case event, when it happened, exceeded the worst case at the time."

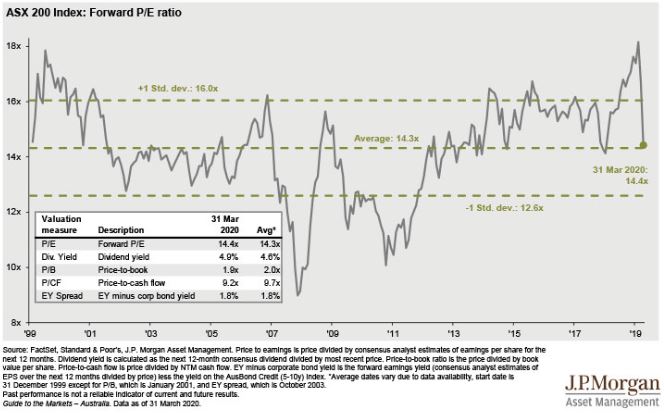

If the crisis is indeed 'unprecedented', we are not overly worried when, since the heavy falls to 23 March, stock markets have rallied strongly. That's 'don't fight the Fed'. We are now back above the average price/earnings ratio for the S&P/ASX200 since 1999 despite the prospect of massive corporate earnings collapses. The chart below is to 31 March 2020 and the market is up since then. Look what happened in 2008 during the GFC.

And while Australia can take comfort from its impressive control of coronavirus, in the 'Land of the Free', armed protesters are taking to the streets to campaign against the lockdowns, actively encouraged by their President.

We lead with a comprehensive review by three authors from consulting and actuarial firm Rice Warner, contrasting decisions taken by different countries. They plot an exit strategy, comparing the 'go too early' versus 'stay out longer'.

Duncan Lamont checks 11 bear markets since 1871 for investing lessons, notably warning that hiding in cash and not reinvesting misses the inevitable market recoveries. Paul Taylor identifies a rule-of-thumb the market is using, and looks at business activities which will survive the downturn.

Chris Manuell warns of further falls as economic conditions deteriorate, and the oil price crash shows widespread problems caused by lack of demand.

While it's accepted that there is little potential for inflation while output is so weak, we complete the third part in our series asking experts to opine on the consequences of massive borrowing programmes. A trillion here, a trillion there, and soon we're talking serious money. Chris Brightman worries that governments have lost all semblance of fiscal restraint when money printing seems so easy.

Raewyn Williams sees an opportunity due to the market fall not only to seek stock bargains, but to do a portfolio makeover without a capital gains tax bill, while Aidan Geysen says loss of dividends can be managed by taking a 'total return' approach to spending needs.

In this week's White Paper, Shane Oliver lists the good news and the bad news to see if there is a light at the end of the tunnel.

David Knox addresses whether superannuation taxes unfairly benefit wealthy people, and Morningstar's Adam Fleck runs his ruler over Magellan and Platinum as investment opportunities.

Plus articles by Nick Griffin on avoiding FOMO's market spell and Randall Jenneke on managing a portfolio in these extraordinary circumstances.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review for March 2020 from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website