Quick market update: The S&P/ASX200 closed last week up 1.6% delivering the seventh rise in eight weeks, with tech stocks especially strong. Afterpay keeps on running and finished over $58. The market overlooked the release of weak job numbers and some poor coronavirus outbreaks around the world. In the US, the S&P500 was flat over Thursday and Friday, waiting for the next direction.

***

The biggest policy issue facing the Government over the next few months is how to phase out JobKeeper and reduce JobSeeker. Stock markets continue to ride a mood of optimism, but a September withdrawal of support would create a rapid rise in unemployment with consequences for business loans, mortgages and home prices. Prime Minister Scott Morrison said this week:

"We cannot say to Australians that government or anyone else, ultimately, will be in a position to ensure that every job can be saved, and every business can be saved. That is unrealistic ... I'm not going to make false promises to the Australian people. We have cushioned the blow but we cannot prevent the blow." He said keeping JobKeeper and JobSeeker, "would dull the dynamism of the economy and slow the recovery".

Businesses and individuals exposed to lower economic activity need to plan how to survive for the long term, including recommencing loan payments. The Australian Bankers Association releases data on loan deferrals, now totalling almost $240 billion from 800,000 borrowers. This is not interest forgiveness, it is deferral. Payments may hit exactly as welfare support is removed and let's hope deferrals do not become impairments.

One of the other stimulus measures, the relaxation of access to super, has now seen two million people apply for $15 billion of what was supposed to be retirement savings. A new official rhetoric tells people it is their money to spend however they wish. Previously, its sole purpose was to finance retirement. Senator Jane Hume, the Assistant Minister for Superannuation, Financial Services and Financial Technology, said this week:

“The Government isn’t in the business of telling people how to spend their own money. We don’t do that. In the same way we still pay a JobSeeker to a person who might spend it on cigarettes and beer. If people choose to take their own money and spend it on something that isn’t particularly helpful, that’s their business.”

Whoever thought the money in our cherished retirement system, tied up in more rules and regulations than operating a nuclear power plant, would be blown on ciggies and beer.

Meanwhile, the market is totally confused by US Fed Chairman, Jerome Powell. He threw a brick through the recovery window when asked how many Americans would never return to their old jobs. Powell said, “Well, into the millions.” Wall Street fell 6.5%.

Then a few days later, he announced that the Fed would go into the market and buy corporate bonds. Not Treasury bonds but corporate bonds rated as low as one notch above junk on 22 March. In the US, an estimated 20% of companies are 'zombies', where debt serving costs exceed profits, and they survive by borrowing more. Poor companies with compromised business models should be allowed to fail. Famous US brands such as JC Penny, Hertz, Victoria's Secret, Diesel, Antler and Nieman Marcus are no longer viable, just as Amazon destroyed Blockbuster and Borders, and Apple and Samsung undermined Blackberry and Nokia. It's sad for the victims but it's not the Fed's job to bail out weak companies.

So Australia has made it into Wall Street lexicon, as we now have bull markets, bear markets and kangaroo markets, jumping all over the place. Fame at last!

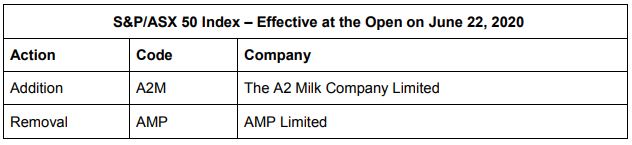

And in a sign of the times in Australia, the rebalancing of the local indexes by Standard & Poor's sees a local fallen icon, AMP, replaced by a milk company in the ASX50. We used to complain that our indexes were dominated by financial stocks, and at least the CSLs and A2Milks are diversifying the index.

In this week's edition ...

We look inside a remarkable change in the market that is influencing price behaviour. The so-called corona generation, or in the US, Robinhood traders, may be at the margin, but new retail investors are having a growing impact as their numbers increase rapidly. Will it be sustained?

(A tragic update on the vulnerabilities came on Friday when Forbes reported that a 20-year-old had committed suicide when his balance on Robinhood was reported as negative US$730,000, said to be the result of the timing of some complex option trades).

We turn to Warren Buffett's advice during the tech wreck of 2000 when people were saying he was out-of-touch and did not understand these amazing innovative companies. Twenty years later, people are asking if Buffett's methods are outdated, especially his ability to reposition his portfolio quickly.

Then Marcus Padley give 10 hints not only on how to look for capital losses to reduce your FY20 tax bill, but the best ways to clean up your portfolio rather than hanging on to the bugs that make a mess of your spreadsheet.

When markets are so uncertain, Kate Howitt falls back on three baseline factors to decide her next step, but there's one overriding influence for the coming storm.

If there is one part of retirement planning where advice is essential, it must be aged care planning. Jemma Briscoe explains a change coming on 1 July 2020 which advisers and their clients should understand despite the complexity.

Brendan Coates makes the case for the vital role of owning a home in retirement and policy solutions for renters. Any analysis of retirement needs to allow for home ownership in the planning.

Population growth has driven economic activity for centuries, but it has also come with a downside of environmental impacts. Michael Collins shows that for the first time, the world is experiencing population declines with profound implications.

This week's sponsor White Paper delves into the investment strategies of Dr Allan Gray, who set up his epynomious asset management business in 1973 and a sister company, Orbis, in 1989. He died at the age of 81 in November 2019 and his former colleagues describe his investing legacy.

Footnote. If you missed a fantastic 4 Corners programme on AI on ABCTV this week, take a look on iview. Scary stuff, far more advanced than I expected.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website