Released by US film producer Mike Moore, the documentary Planet of the Humans tells how renewable sources of energy are flawed solutions to mitigate the dangers of climate change.

About halfway through the documentary, a scientist laments that the environment’s biggest problem is that “there are too many human beings using too much, too fast”. The warning here and elsewhere in the documentary is that only a reduction in the world’s population can save the planet.

Declining birth rates

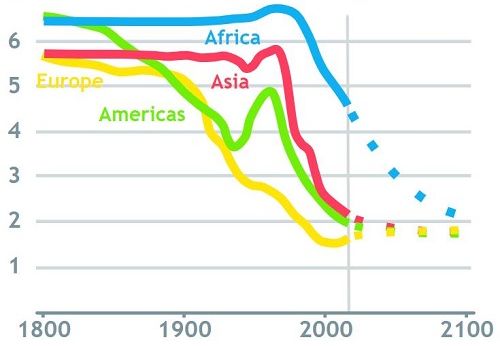

Well, in that case, the battle against climate change is winnable because the populations of many countries are shrinking. The OECD says that only three (Israel, Mexico and Turkey) of its 37 members have fertility rates above the replacement rate of 2.1 children per woman.

Babies per woman (Total Fertility Rate)

Source: Free teaching material from www.gapminder.org. Period from 1950 to 2100. Data from UN’s Population Division’s publication World Population Prospects 2017.

The UN reports the reproduction rates of all European countries are below replenishment levels. The EU forecasts that the populations of 12 of its 27 member countries will shrink in coming decades as only immigration props up numbers in the others. The World Bank predicts China’s population will decline by 100 million people by 2050, that East Asia’s will shrink from the 2030s and Brazil’s will contract from the late 2040s by when India’s population growth will be static.

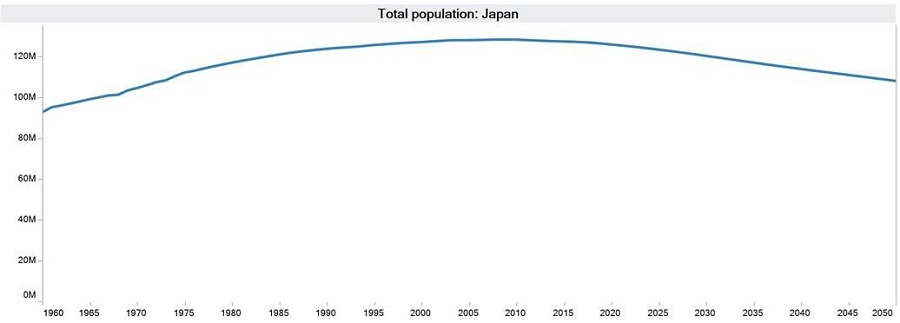

Already dwindling are the populations of Russia (since 1992), Japan (first in 2008 and uninterrupted since 2010, see below) and Italy (since 2014). But for immigration, many Anglo countries with declining birth rates including Australia and the US would be shrinking population-wise too.

Many demographers say, if anything, the global bodies are underestimating the declines in population numbers. Social and economic forces that lowered birth rates in advanced countries are now universal across the emerging world. These factors include expectations of low infant mortality, rising female education, better career prospects for women, and urbanisation.

Fewer births in the emerging world, these demographers say, will see the world’s population diminish from a peak of between eight and nine billion people from around the middle of this century, whereas the UN forecasts the world’s population to increase another three billion to 10.9 billion by 2100.

The economic impact

The consequences of declining populations could be significant and mostly grim, any environmental benefits aside. Fewer births reduce what is probably the biggest motivational force in society; young parents seeking a better life for their children. In economic terms, declining populations are a bigger challenge than ageing populations because the former herald a lasting shortfall in private demand that points to lower output, even if GDP per capita might rise. Businesses will invest less if fewer people are consuming less. Such outcomes hint at the ‘Japanification’ of economies; deflation and almost permanent recessions for economies that prove impervious to stimulus.

Government finances face difficulties as the shrinking and ageing of populations accelerates because a smaller working-age cohort must support more elderly people who cost more health-wise. A stretched bunch of fewer workers could lead to reduced innovation and productivity gains. Government policy, especially with regards to taxation and social-security spending, could become skewed towards the elderly rather than productivity should older voters form a voting bloc.

For the countries affected, a drop in population numbers might undermine their global power, and any rejigging of the world order rarely happens without friction. To sustain population numbers, rich countries might rely more on immigration but that risks social and political strains (including in source countries), especially if long-dominant ethnic groups become minorities.

These outcomes indicate the biggest threat raised by shrinking populations; that the unprecedented change is a shock. Capitalist societies are geared for growing populations, as happened over the 19th and 20th centuries when the world’s population increased eightfold from one billion around 1800. Over that time, all aspects of societies were designed to accommodate more people, a trend that engenders much optimism and dynamism.

Much might need to be adjusted as fewer people mean less of everything. Policymakers could no longer assume positive economic growth as a given. Companies could no longer reflexively plan to expand. Investors could no longer presume higher revenue by default. Town planning might be about shrinking social infrastructure. And so on.

Time to stop ignoring this change

In 1937, UK economist John Maynard Keynes foresaw the problem and cautioned that “a change-over from an increasing to a declining population may be very disastrous”. At the very least, as many urge, it’s time that society stops ignoring what might be an unrelenting challenge of the upcoming age.

To be clear, demographic projections largely extend trends, and birth rates could rebound at any time to make mockeries of such forecasting techniques. It barely needs to be said that a rising population is no guarantee of economic success and that younger populations come with bespoke challenges too. Declining populations could come with benefits. These could include reduced environmental damage, fewer clashes over the world’s resources and reduced inequality if labour shortages boost wages. Perhaps changes might be less disruptive than expected because populations only shrink slowly.

Such musings reinforce how much is speculation when it comes to analysing a sustained decline in populations because the world has never undergone a voluntary mass depopulation. There’s no guarantee either of the supposed benefits such as the better environment that Planet of the Humans assumes.

Michael Collins is an Investment Specialist at Magellan Asset Management, a sponsor of Firstlinks. This article is for general information purposes only, not investment advice. For the full version of this article and to view sources, go to: https://www.magellangroup.com.au/insights/.

For more articles and papers from Magellan, please click here.