Weekend market update: the US market moved little on Friday, although the NASDAQ rose to another all-time high, holding well above 10,000. The US was up a solid 4% for the week, while Europe rose 2.8% and Australia 2.6%. All this against a backdrop of rising virus cases, stalled reopenings and the Victorian outbreak locally.

Australian shares had their biggest annual loss (down 11% in price or 7% with dividends) for eight years in FY20 while Wall Street just had its best quarter (up 20%) since 1987. Whatever happens from here, we will look back in a couple of years and say the outcome was obvious. We will either say, "Of course markets rose as governments injected unlimited liquidity, medical science improved treatments and the economy rebounded quickly" or "Of course markets fell as businesses collapsed, millions of jobs were lost forever, the virus was resilient and consumers changed forever." Which side are you on? I'm in the latter camp but forecasting markets is not my strong suit.

Similarly, many people are annoyed they missed the low of 23 March, and are thinking "Just give me another chance to invest at 30% less." But this is more a reaction to knowing the market has risen. If it actually fell heavily again, the majority of people would do nothing as it always looks as if the market will go further. Shares are not like bananas - we usually don't buy more when they are cheaper.

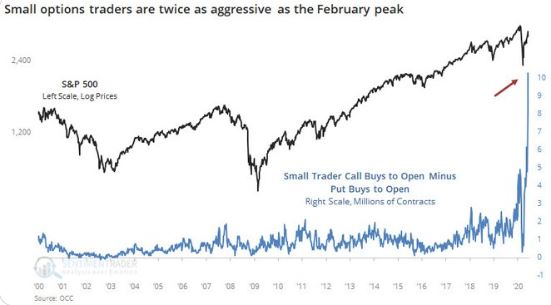

So it's good to read an update from Howard Marks including his views on market psychology. He points to the impact of Fed liquidity and new traders playing the market like a game, noting the volume of 'small trader calls' (where people pay for the right to buy the market at a certain level) is through the roof, as shown below.

Note that there is not much evidence of this speculative type of new activity in Australia, where retail investors are more focussed on traditional quality stocks.

Two COVID-19 milestones this week, reaching over 10 million cases and over half a million deaths, gave the market the wobbles on one day but a 'nothing to see here' the next, so we are none the wiser on the next trend.

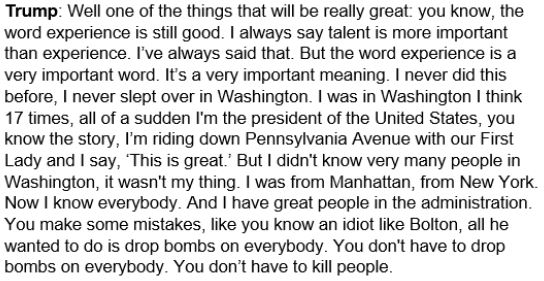

There are few signs that The White House is worried but Donald Trump should be. Consider the response in this interview (watch from 36.45) when asked for his top priorities for a second term:

Ask yourself, if you were on the board of a company interviewing a CEO, how would you interpret that set of strategic priorities?

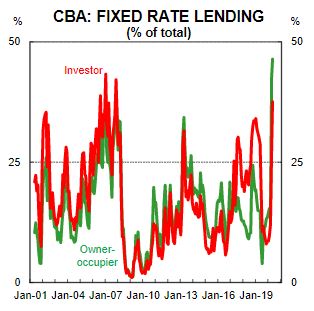

Meanwhile, in Australia, one way borrowers are coping is to switch to fixed rate loans, as shown below in the CBA statistics. The variable rate is at least 0.5% higher than two-year fixed, and owner-occupiers are at the highest level ever for fixed rate borrowing. Well worth considering with rates around 2% to 2.3%, although RBA Deputy Governor Guy Debelle said this week that a rise in the cash rate is "some years away". Good to have a clear central bank forecast.

In this week's edition ...

In this week's edition ...

Another industry veteran, Don Stammer, gives his take on whether 'this time it's different' has much meaning to someone who has seen multiple market cycles.

Franco Morelli continues his look at SMSFs, this time checking how contributions have changed and the differences between accumulation and pension stages.

Among the most vulnerable in society are older women who have been unable build a super balance due to family circumstances. Erica Hall says the pandemic has made their plight worse.

APRA's attempts to rate large super funds based on their performance was always a tall order, and David Carruthers does the numbers to show the best funds in a strong market often struggle in a downturn.

Matt Rady reports on research with people near or in retirement and the profound impact COVID-19 is having on retirement plans. The same thing happened in the GFC. People lose faith in their ability to withstand a downturn, especially when generating income requires taking more risk.

Finally, back to practicalities with Julie Steed's explanation of death benefit pensions. Anyone with a family member drawing a super pension should check this.

This week's Sponsor White Paper from Martin Currie looks at opportunities where Emerging Markets (EM) companies are being especially innovative and disruptive. It's a part of the market most investors ignore.

Graham Hand, Managing Editor

Attached here is a full PDF version of this week’s newsletter articles.