Weekend market update: For the first time in a month, Wall Street lost ground last week on fears of technology stocks underperforming earnings estimates and escalations in COVID-19 statistics. The S&P/ASX200 lost 1.1% on Friday while the S&P500 shed 0.6%. Gold rose above US$1,900 for the first time since 2011, and the Australian dollar remained firm at US$0.71.

***

There is a similarity between the current health crisis and economic crises of the past. For COVID-19, record amounts of biotech funding from government agencies and private companies are looking for a vaccine. Likewise, central banks once struggled treating recessions but the 'vaccine' now is record amounts of financial stimulus to ensure liquidity. While the world awaits a COVID treatment, markets are purring along, at least until side effects hit.

In what is now considered a major economic policy mistake, during the Great Depression from 1930 to 1933, the US Fed shrank the supply of cash quickly, leaving less money in circulation and reducing liquidity for people to buy goods, services and assets. A potentially mild recession became severe with a quarter of Americans out of work. Disposable incomes fell by almost 30%.

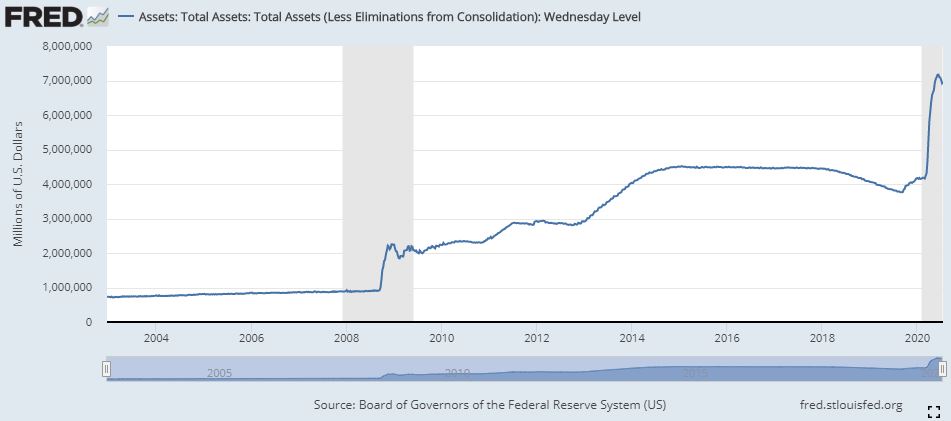

Learning how to treat that disease, central banks now throw unlimited 'whatever it takes' liquidity at the market, the latest iteration being the US Fed buying corporate bonds. The chart below shows the total assets of the US Fed, currently US$7 trillion, with the 2020 expansion making the GFC look like a blip.

In the background, we have Modern Monetary Theory (MMT) saying governments have no practical constraints on their spending, so they can just go hard when there are no inflationary consequences. Next, solve world poverty?

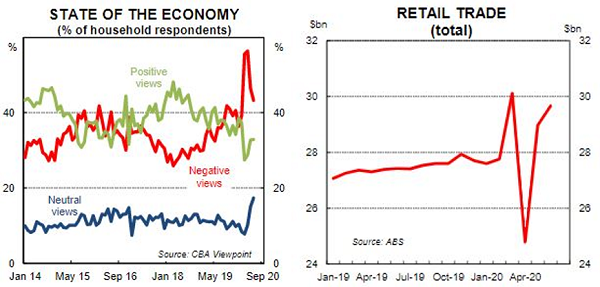

In Australia, gross government debt has reached about $850 billion and where previously a budget surplus in 2019/20 was forecast, a $90 billion deficit is now expected. The spending has a purpose and Reserve Bank Governor, Philip Lowe, is relaxed on the amount. The combination of JobKeeper, JobSeeker, super early release and business loans has helped retail trade, as shown below from ABS data and CBA Economics.

Individuals and the economy are benefitting. The heavy retail fall in April was followed by strength in May and June, such that Q2 2020 was only 2% lower than Q1 2020, an extraordinary result given the job losses and lockups. Negative views on the state of the economy have fallen quickly. So far, that's the economic cure, although we have yet to see the reality of poor corporate earnings in the coming season.

As with a vaccine, it remains to be seen whether there are unacceptable side effects from burgeoning government debt, but after a dozen years of liquidity injections in the US, there are few signs of inflation or limits to the size of the Fed balance sheet.

Where are we on the other cure, the vaccine? The stock market has drawn considerable enthusiasm from potential breakthroughs by US company Moderna and the UK's AstraZeneca working with Oxford University. China's Sinovac, Australia's CSL, big US players such as Johnson & Johnson and Merck, and German firms CureVac and BioNtech are among the leaders.

However, there is a reality check on vaccines which the market is ignoring. Rod Skellet reports on the company with most recent vaccine success, Merck, saying it takes much longer to develop safely than the market recognises. After approval, will governments hang on to supplies for their own people?

Next up, two of Australia's highest-profile fund managers identify stocks they like in the current market. Matt Williams shows the value of clever capital allocation is vital for company success, and Paul Xiradis reveals his favourites.

Then Raewyn Williams describes the conditions under which value stocks can recover lost ground versus the growth momentum, while Christine Benz interviews retirement expert, Wade Pfau, on the 4% 'safe withdrawal' rule, which has long been an industry standard for not running out of money in retirement.

In these uncertain times, Noel Whittaker describes new ways a portfolio can be hedged against stock market falls, and Amit Lodha says his reading has informed his long-term thinking more than ever during the pandemic lockdown.

This week's White Paper from Fidelity International focusses on the rapid growth of waste, and the investment opportunities from avoiding a devastating impact on our lives and the planet.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter (June 2020 update)

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website