Weekend market update: The surging US tech index, NASDAQ, took a breather from its all-time high on Friday, falling 0.9%, but the S&P500 held steady to deliver a strong 2.5% rise for the week. Amazingly, it is only 1% below its February high on the back of better economic data and vaccine news. Australian stock markets were up about 1.3% for the week despite the dire conditions in Victoria. The Government announced a relaxation of JobKeeper eligibility taking the cost to over $100 billion.

***

Imagine you had perfect foresight about COVID-19 at the start of the year, when the S&P/ASX200 opened at about 6,700. You correctly foresaw that by August 2020, the global pandemic with no vaccine on the horizon would kill over 700,000 people among 20 million infections. In Australia, borders would close, cities would be locked down with nighttime curfews, loan deferrals would reach $270 billion, most mortgagors would be on income support and companies would be allowed to trade while insolvent. Thousands of businesses would never recover. The expected budget surplus would become a $200 billion deficit in 2020/21, government debt would head to $1 trillion and the effective unemployment rate would reach 14%.

What would be your prediction of the level of the S&P/ASX200? Down 30%? Down 40%? It is a little over 6,000, a fall of about 10%. In fact, the index falls historically by 10% or more at some stage in every couple of years, so the correction is normal. What happened to the 'unprecedented pandemic'?

We don't know the economic impact. Australian Treasury forecasts were outdated as soon as Victoria shut down. The fiscal cliff has been kicked down the road to 31 March 2021 but thousands of people and businesses will no longer qualify for support, or go onto reduced payments, from September 2020.

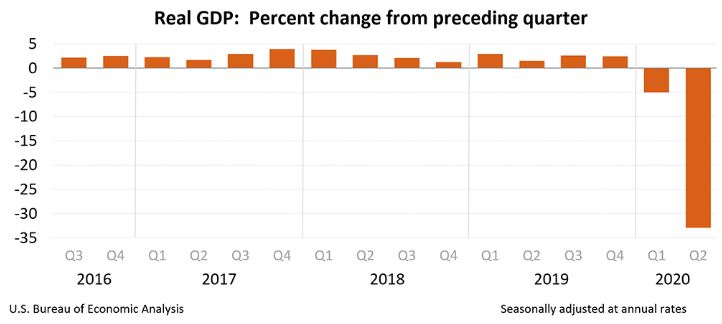

In the US, the June quarterly fall in GDP of 9.5% is annualised in the official data releases, creating a headline-grabbing 32.9% decrease.

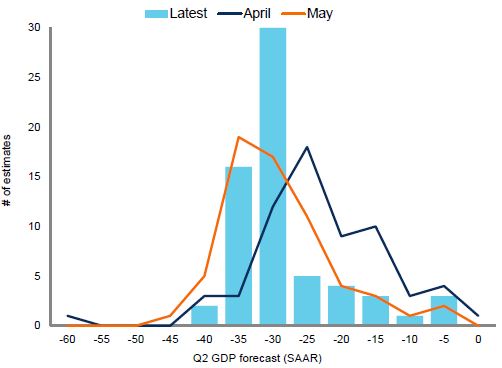

Before last week's release, the consensus forecasts from professional analysts had a massive 40% range, as shown below, changing significantly month by month. These are all experts at analysing economic data. Michael Metcalfe of Macro Strategy said:

“US second-quarter GDP will provide the most comprehensive measure yet on the depth of the recession. Monthly data has swung wildly during the quarter, prompting first a lurch to a more negative distribution of forecasts, before correcting again. The median - or what used to be known as the consensus estimate - is around negative 30%. However, the fact that the range of forecasts is a full 40% says all that needs to be said on the uncertainty surrounding the release.”

Source: State Street Global Markets, Bloomberg

This week, Marcus Padley explains how to handle this uncertainty in the coming profit (or loss) company reporting season. Marcus correctly predicted the buying opportunity in March and his fund is currently 100% in cash. How will he handle investing in the coming months?

Far less uncertain is Emanuel Datt with his view on Afterpay. Although other analysts have a massive range of forecasts on this company, Emanuel sees a bright future for a brilliant business mode.

Similarly, Andy Budden sees excellent opportunities in the rollout of 5G. This week's ABC TV 4 Corners focussed on different opinions on 5G, but the groundbreaking technology will change our lives. Is it investable?

Then Steve Bennett dives into the subject on many minds, about whether work in office buildings will ever be the same. What are the advantages of working together versus WFH?

Geoff Parrish shows why quality investment grade bonds played a strong role in a diversified portfolio during the recent sell off.

With such close attention on the impact of COVID-19 on residential property prices, Chris Rands breaks the debate into two pieces: while he's relatively sanguine about the short-term impact, he sees more clouds in the medium to long-term bigger picture. Maybe housing is not the usual safe place to hide.

This week's White Paper is Brandywine Global's study of what the post-Covid-19 recovery may look like based on a selection of charts.

Thanks for the lively debates last week with around 100 comments across most articles. Firstlinks is a community where your views add to our knowledge.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website