Weekend market update: Both the S&P500 and NASDAQ in the US rose again on Friday at the end of a strong week, with the Fed announcing a more relaxed attitude to inflation targeting. They will aim for a 2% inflation rate 'over time', which means they may not increase rates in anticipation of a stronger economy. It reinforces the 'lower for longer' rate outlook. The Australian market fell a subdued 0.5% over the week, and the $A run up towards US$0.74 means global equity returns are hitting a currency headwind for Australians.

***

With hindsight, we are all excellent 'shoulda' investors. Looking back during the pandemic, many investments that we 'shoulda' done look obvious. Retail investors who rely on professional fund managers must hope that late March presented a once-a-decade moment for investment teams to stop watching screens and reading broker reports and contemplate a new future. Did the analysts and portfolio managers hold special meetings beyond the daily grind?

'OK, everything is sold off, this is our opportunity. People will be working from home, improving their equipment and shopping online. So that's Kogan, JB Hi Fi, Harvey Norman, Officeworks. Woolies and Coles will do well as people cook more. Forget shopping malls but distribution centres are fine. Brazil is in trouble so buy Fortescue and BHP on the back of iron ore prices. Barber shops will close, that's Shaver Shop for home cuts. Check who's got a great online store, anything to do with e-commerce. Super Retail for camping and fixing cars. And everyone will be on social media and searching for stuff, so that's Apple, Google, Facebook.' Etc, etc.

Is that realistic or only hindsight? It is times like these when talented managers with imagination and knowledge of businesses and trends should earn their fees, plus participate in cheap capital raisings. The 2020 performance of fund managers will show who grasped the opportunities.

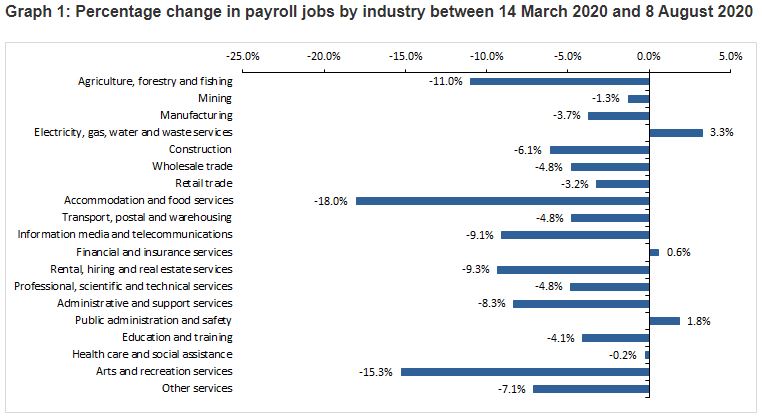

The latest ABS jobs data shows winners and losers by industries. Accommodation and food services down 18.0%, arts and recreation decreased by 15.3%. These jobs and companies will not recover quickly.

On the other side, one big call into e-commerce stocks, as illustrated for the US below, is all it takes for market outperformance.

So with COVID-19 dominating our news, investments and personal actions, has the national and international response to closing borders and businesses been correct? Phil Ruthven's article will either impress or annoy, as he notes that 52 million people die of other causes every year, so why bring economies to a standstill and lose millions of jobs for another pandemic?

We have also extracted a fascinating interview by Geraldine Doogue on ABC Radio with two expert virologists who describe how vaccines are actually produced, and whether Australia has the capabilities.

Every investor is managing the tradeoff between the desire for income and capital preservation. In an interview, Will Baylis describes his approach to the attraction of equity returns of 6% with franking versus equity volatility.

Despite the market rally leaving many stocks fully-priced, Ned Bell sees strong opportunities in small and mid cap (SMID) stocks, where investors have not jumped on the bandwagon of the big names.

Deana Mitchell then explains why many companies have issued new capital during the pandemic, and she gives examples of three issues that have delivered strong rewards and why she participated.

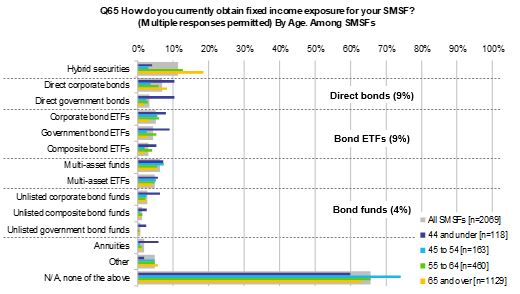

Bond markets are many times bigger than stock markets, yet receive a fraction of the retail investor focus. All a bit boring? The chart below from Investment Trends/Vanguard shows even SMSFs, which are used by an older cohort, hold relatively little in fixed interest, and much of that is in the form of hybrids. Bond markets have become distorted as central banks manipulate rates. There is no 'free market price' for government bonds and no genuine risk assessment. This distorts other market prices as many assets price off the risk-free rate, and it helps equities as investors look elsewhere for returns.

With the importance of bonds in mind, Jonathan Gregory asks whether prices are heading for a Big Bang, a Big Crunch or a Steady State, with the possibility that rates may be very low for multiple investment cycles.

On to big picture changes, Damien Klassen looks at the investment implications of solar, especially when solar+battery rewrite the energy cost curve. It's new-world technology versus old-world digging up stuff.

This week's White Paper is the letter sent by Martin Currie to their major investee companies, as discussed in the Will Baylis interview, emphasising the importance of paying dividends where possible.

And as Afterpay soars above $90, those who read my article six weeks ago (now viewed 20,000 times) may be wondering what I did with my investment. Motivated by little more than FOMO, I participated in the $66 SPP, and now Morgan Stanley has its target price to $106. Spare a thought for those who sold at $8 on 23 March. Ouch!

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website