Look up into the night sky and the space between the stars and planets appears completely dark. But view that same sky through a radio telescope and instead see a pale background glow that fills your view. What you are seeing is in fact faint background radiation or the so-called Cosmic Microwave Background (CMB), filling all space.

The discovery of this leftover, or remnant, radiation in 1964 was crucial evidence for the 'Big Bang' creation of the universe. The Big Bang theory itself was partially derived from the discovery that the farther away galaxies are, the faster they are moving away from the earth. Imagining this cosmic expansion running backwards in time leads to the dense and hot very early universe that is the plausible source of the CMB.

Just as the Big Bang theory is a credible hypothesis for the start of the universe, the 'Big Crunch' is the symmetric view of its ultimate fate. The density of the universe is enough to ultimately stop its expansion, triggering a collapse right back to a dimensionless 'singularity' where space and time have no meaning.

Debt is in its own expanding universe

For better or for worse, markets too go through their own versions of the 'Big Bang' and 'Big Crunch' with a profound impact on asset returns. Successful investing is, in part, about forming views around plausible versions of the future, based on observable data today.

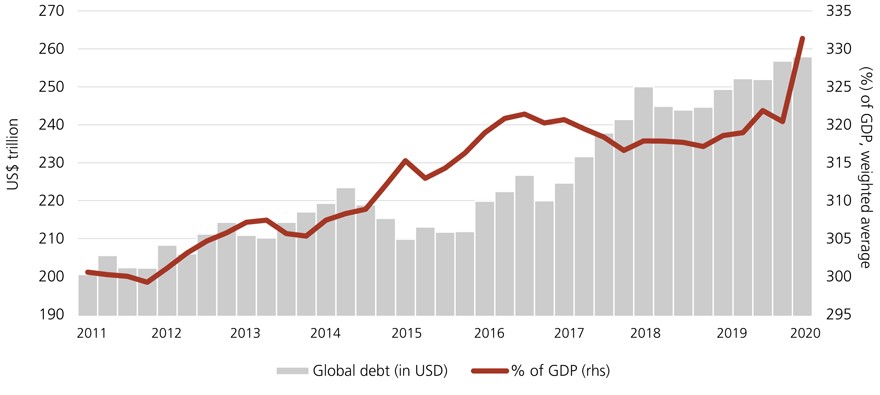

We certainly have our own expanding galaxy of debt on which to hypothesise. Chart 1 shows that debt levels globally hit a record high of US$258 trillion (or 331% of global GDP) in Q1 2020.

Chart 1 – Global debt from 2011 to 2020

Source: IIF, BIS, IMF, National sources, as at 31 March 2020

Clearly, the impact of COVID-19 and the early fiscal response have had a big effect, and all the subsequent data shows this pace has accelerated since then.

But the chart reveals that the trend was already well established. Debt levels have been going up and up over time. What is also apparent is that total debt is increasing at a faster rate than growth in the global economy, so overall leverage (in this case debt relative to global output) is increasing. For a long time now, adding debt to the global economy has not been of obvious benefit to the overall growth rate.

Part of the reason is simply that, all else being equal, more debt means more spent on debt service, which itself can be a drag on growth. Certainly higher overall systemic leverage has been a factor in central banks' need to keep policy rates low.

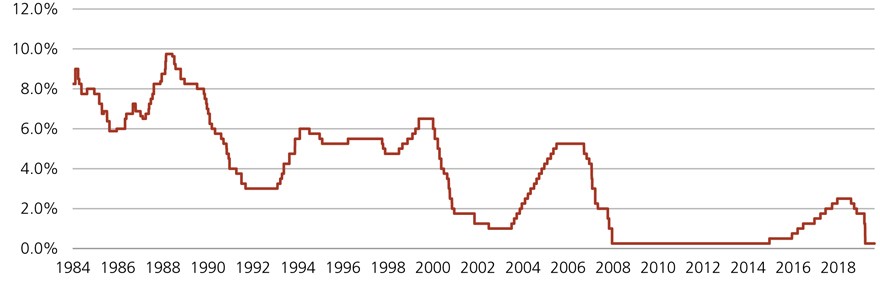

Chart 2 shows the path of the US Federal Reserve's target rate over time. It is noticeable that, as global debt levels have risen, not only is the overall trend sharply lower, but each peak in rates is lower than the last.

Chart 2 – Federal Funds Target Rate 1984 to 2020

Source: Bloomberg, as at 13 August 2020

Low yields have a major impact on future returns

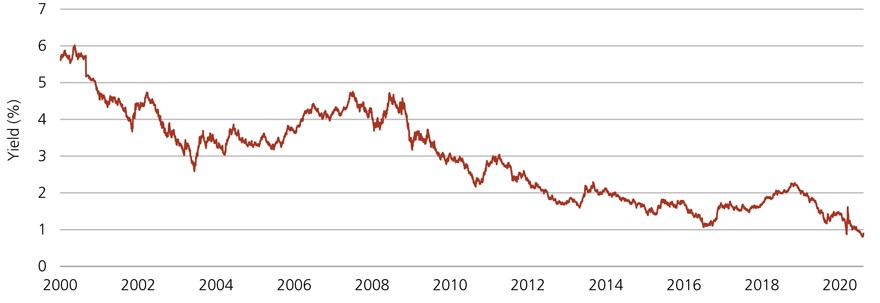

Policy rates are the 'background radiation' that permeate the pricing of every asset class. As a consequence, exactly the same effects are observable in broader bond market yields. Chart 3 shows the yield on the Global Aggregate Bond Index (a broad global bond universe tracked by many investors) which 20 years ago yielded nearly 5.6% but at the beginning of August 2020 this year reached a record low of just 0.8%.

This falling yield has important implications for future returns. Between 2000 and the end of July 2020 the Global Aggregate Bond Index produced an annual average total return of 4.6%. Almost 85% of this return came from income (remember, the starting yield was about 5.6%). Now think again about that 0.8% yield on the bond universe today. We can see that the prospect for future broad-market bond returns over the next 20 years seems rather lower than the past 20.

Chart 3 – Global aggregate bond yield 2000 to 2020

Source: Bloomberg Barclays, Bloomberg Barclays Global Aggregate Index as at 13 August 2020

That said, it seems extremely unlikely that the trend in yields will reverse anytime soon. Many governments need rates to stay low if the positive impact of the massive fiscal expansion is not to be eroded, and central banks are more than willing to assist via asset purchases and policy rates nailed to the floor.

The key point for bond investors today is that, while overall broad market returns are likely to be lower than in the past, different sectors of the market will offer quite different risk-reward characteristics over time. So the diminishing prospective return of a passive allocation to the broad market should alert investors to the need for active styles that embrace the widest possible opportunity set.

Three possible outcomes

What outcomes might today's world of low growth, high debt and low yields foreshadow? Broadly, at least three paths seem conceivable:

1. The 'Big Crunch'. Today's very low levels of growth, coupled with ever more borrowing, eventually ends in a debt deflation spiral. Low inflation or even deflation leads to high real costs of debt servicing causing companies and consumers to default on loans and mortgages which have become too large to manage. This in turn leads to pressure on the banking sector, leading to less lending and more insolvency in a downward spiral. In this environment cash and high-quality government bonds probably outperform credit.

2. The 'Big Bang'. A continued expansion of government spending might lead to inflation which destroys the value of debt in real terms but crushes the value of savings with it. This scenario isn't likely over at least the next year or so as the deflationary effects of COVID-19 predominate. It will become a much bigger risk if capacity constraints arise in economies where massive fiscal spending creates excess demand that ultimately forces up prices. Inflation-protected securities could do relatively well here.

3. The 'Steady State'. We could see policymakers prefer a 'steady state' outcome. Here the trends of the past 30 years go into reverse; global growth rates exceed the rate of expansion of global debt, real growth rates accelerate and inflation goes up, but not too much. It's perfectly possible, but it would mark a break in some very well-established trends. That said, credit and emerging market bonds would be likely winners.

As momentous as it will be, our best estimates for the end of the universe still place it billions of years away. The end of the bond bull market is probably rather nearer, even though today it might seem as enduring as time itself.

Exactly how and when it will unfold is still extremely uncertain. So investors should critically appraise their bond holdings now to ensure they have the diversification and flexibility to thrive in what will be a very challenging world!

Jonathan Gregory is Head of Fixed Income at UBS Asset Management in the UK and the lead Portfolio Manager on all Global Aggregate, Global Credit and UK Fixed Income Strategies. UBS is a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

More articles and papers from UBS can be found here.