Weekend market update

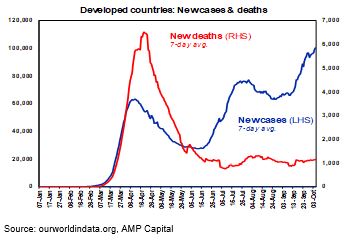

US shares continued their strong week on Friday with the S&P500 up another 0.9% to give a five-day gain of 3.8% on hopes of new fiscal injections. Other global markets also did well with the S&P/ASX200 rising 5.4%, the best weekly increase since April, on the back of a stimulatory Budget. The Australian index is just over 6,100 but it has struggled to push through 6,200 recently. To date, the markets are looking past the strong rise in new cases as deaths are flat, but the northern winter may cause a refocus.

***

***

Budgets are forecasts, and more than most, Josh Frydenberg and Treasury waved a wet finger in the air in compiling the 2020 version. How many companies will now employ a new apprentice for $100 a week subsidy? Which back-of-the-envelope showed 3.5 million businesses would use the instant asset write off and the 1 million loss carry-back? At a time when, to use the Treasurer's words, "Our cherished way of life has been put on hold”, these estimates are understandable. But the $17.9 billion for superannuation savings based on the new YourSuper proposal is wishful thinking.

Exploring YourSuper is our main Budget focus this week. For a broader analysis, see Shane Oliver's summary in the White Paper section. Given the adverse changes in recent years, we should be grateful there were no meaningful announcements on superannuation and SMSFs, including nothing on the next stage of the Superannuation Guarantee.

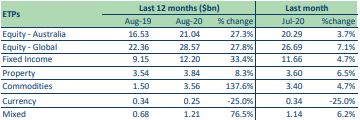

We noted last week the strong fund flow into global investments, but the biggest surprise package is the support for fixed interest products with rates at all-time lows. The first two tables below from BetaShares show flows in August 2020, and the third table from the ASX is total balances as at August 2020. It shows $12.2 billion invested in fixed interest in Exchange Traded Products, up from $9.1 billion a year ago, and the trend is the same overseas.

On to tips to guide your asset allocation ...

Damien Klassen examines the cherished 60/40 portfolio, the 60% equities/40% bonds exposure used by millions of Australians. When investing, the past is irrelevant, as all earnings are in the future. Does 60/40 still work?

My interview with Vivek Bommi of Neuberger Bermann shows how fixed interest and stock markets bailed out companies facing the pandemic, and how high yield bonds are attracting flows in the current market.

Damon Shinnick and Jonathan Baird explain how an active bond fund is able to achieve returns not directly available for retail investors. Unlike the stock market where anyone can buy anything, the vast majority of opportunities in fixed interest are not available to the public other than via funds.

There is a crucial problem for active equity managers when they become too big for their market. Andrew Mitchell explores why this temptation to grow causes underperformance.

Some industries have benefitted greatly from COVID-19, and Josh Gilbert asks whether the boost to food delivery and related services will be sustained in the long run, or is the happy meal over?

And back to basics on managing an SMSF, Julie Steed warns that claiming a tax deduction for contributions needs to follow a process to ensure a favourable tax treatment.

Now, off to check the YourSuper comparison tool and get my share of the $17.9 billion.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website