One of the few positive, simplification measures that came with the 2017 major changes to superannuation was the ability for all fund members to claim a tax deduction for contributions made to super. Prior to 1 July 2017, only substantially self-employed individuals were eligible to claim a tax deduction.

Salaried employees may have been (and may still be) eligible to participate in salary-sacrifice arrangements with their employer, which has the same effect as claiming a tax deduction. However, many employers don’t offer salary-sacrifice. Also, some employers only contribute deducted amounts quarterly when superannuation guarantee contributions are made, even though deductions from the member’s salary occurs weekly or fortnightly.

The change has resulted in hundreds of thousands of additional members being eligible to claim a tax deduction and although the rules for claiming have not changed, there are aspects of the rules that are commonly misunderstood.

Notice of intent to claim

Claiming a tax deduction for personal contributions requires a member to submit a valid notice of intent to claim a tax deduction to the trustee of the fund. The notice is often known as a section 290-170 notice after the section of the tax law that covers deductible contributions.

Conditions for claiming a tax deduction for personal contributions include:

- the individual is still a member of the super fund at the time of lodging the notice

- the relevant contributions are still retained within the fund (such as before partial/full withdrawal or rollover from the fund)

- the trustee has not begun to pay a pension based in whole or part of these contributions

- the member has not supplied a super splitting notice to the fund in respect of the same financial year

- no part of the contribution/s are covered by an earlier notice

- the member has received a notice of acknowledgement from the trustee of the superannuation fund.

The notice of intent to claim a tax deduction must be submitted on or before the first of the following dates:

- the date the client submitted their tax return

- 30 June of the following financial year after the client made the contributions.

Impact of partial withdrawals

Where a member makes a partial withdrawal during the year, part of the withdrawal is defined as including contributions made before the withdrawal. This means that unless a notice of intent to claim a tax deduction is received prior to a withdrawal, the member will not be able to claim a tax deduction for the whole personal contributions made that year.

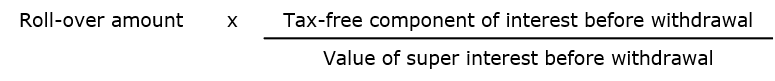

A valid deduction notice will be limited to a proportion of the tax-free component of the superannuation interest that remains after the roll over or withdrawal. The proportion is the value of the relevant contribution divided by the tax-free component of the superannuation interest immediately before the partial withdrawal. The amount that can be claimed is calculated according to the following formula:

Step 1 – Calculate the tax-free amount of the withdrawal

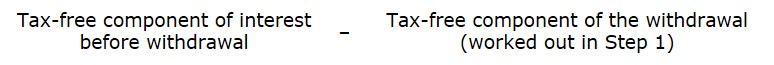

Step 2 – Calculate the tax-free component of the remaining interest

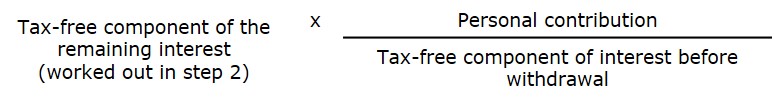

Step 3 – Calculate the remaining amount of the personal contribution

The law allows members to lodge a notice of intent to claim a tax deduction at any time during the year however some funds have specific product rules that only allow notices to be lodged as an annual process. Accordingly, it is best to check with the fund before rolling over.

Regular rollovers to fund insurance premiums are an example of a situation where members are not fully aware of the impact on their ability to claim a tax deduction.

Case study

Brian contributes $2,000 per month to his super fund and intends to claim $24,000 as a tax deduction. On 31 December he rolled over $3,000 to pay for his insurance premiums in an insurance-only super fund. Brian does not provide his super fund with a notice of intent to claim a tax deduction before the rollover.

As at 31 December, Brian’s super balance is $50,000 and the tax-free component in his super fund (so far) is $12,000 (the contributions for which a notice of intent to claim a tax deduction has not been received by the fund). The portion of the $12,000 that remains in the fund is calculated as follows:

Step 1 – Calculate the tax-free amount of the withdrawal

Roll-over amount x (Tax-free component of interest before withdrawal / Value of super interest before withdrawal)

$3,000 x ($12,000 / $50,00) = $720

Step 2 – Calculate the tax-free component of the remaining interest

Tax-free component of interest before withdrawal - Tax-free component of the withdrawal (from Step 1)

$12,000 - $720 = $11,280

Step 3 – Calculate the remaining amount of the personal contribution

Tax-free component of the remaining interest (from step 2) x (Personal contribution / Tax-free component of interest before withdrawal)

$11,280 x ($12,000 / $12,000) = $11,280

Brian makes a further $12,000 of contributions before the next 30 June. Brian then lodges a notice with the intention to claim a deduction for the $24,000 contribution. The notice is not valid as the super only holds $11,280 of the first half of the year’s personal contribution. Brian can only lodge a valid deduction notice for an amount up to $23,280.

If Brian made a further rollover on 30 June to fund insurance premiums the process would be repeated and the amount available to claim reduced further.

Brian could claim the whole $24,000 by lodging a notice of intent to claim a tax deduction before the rollover occurs.

Conclusion

Understanding the rules in relation to the eligibility requirements for claiming a tax deduction for personal contributions will enable members to maximise their tax deductions.

Julie Steed is Senior Technical Services Manager a Australian Executor Trustees. This article is in the nature of general information and does not consider the circumstances of any individual.